Babylon is a Bitcoin staking protocol designed to bring the security of Bitcoin’s Proof of Work to other blockchain networks, particularly Proof of Stake (PoS) systems. By enabling BTC holders to stake their assets, Babylon leverages Bitcoin’s unmatched security properties to enhance the safety and resilience of participating chains. It introduces a novel approach where Bitcoin is locked in a multi-signature setup, allowing decentralised governance and cross-chain security to flourish.

You might be interested in these articles:

- What is Babylon Network?

- Babylon Staking Guide: How to Stake BABY

- Babylon: Improving PoS Security with Bitcoin Staking

- Babylon Staking APR

- BABY Staking

To achieve cross-chain security, Babylon embeds cryptographic checkpoints in Bitocin’s chain, anchoring its state to Bitcoin’s PoW security. Therefore, ensuring that Babylon’s history becomes as immutable and costly to alter as Bitcoin’s own. Post anchoring, key events on the Bitcoin blockchain are recorded via timestamping, to produce verifiable and tamper-proof timestamps that guarantee the integrity of historical data.

Overall, Babylon’s mechanism opens up a new utility for BTC, expanding its role beyond simple value storage into a broader security framework for the decentralised ecosystem.

For more information on Babylon and its testnets, be sure to visit our crypto news section, where we have previously published articles ranging from Babylon’s architecture to Early Testnet and Testnet-4.

Stick with us as we explore Testnet-4’s objectives, its impact on Mainnet Phase 1, and the next steps in Babylon’s development.

Overview of Testnet-4

Babylon’s Testnet-4 was launched on May 28, aiming to build on the previous testnet iterations by refining core functionalities and testing new features in preparation for its eventual Mainnet launch. Specifically, the testnet was designed to enhance the security, scalability, and usability of the protocol, with an emphasis on stress-testing BTC deposits and exploring optimal mechanisms for securing Proof of Stake (PoS) chains using Bitcoin as collateral.

The testnet was not incentivised, and a staking cap feature was introduced at 5 sBTC (Signet Bitcoin). The staking cap was introduced to control Signet Bitcoin ingress while testing the system through security audits and public security campaigns.

Additionally, the testnet tested for a simplified user interaction, where Bitcoin stakes could stake, unbond, and withdraw by submitting the corresponding transactions to BTC Signet test network via the staking web dapp.

The goal was to achieve greater decentralisation by encouraging more participants to deposit Bitcoin, thereby bolstering the security model of PoS networks that Babylon integrates with. To this end, Babylon also introduced finality provider registration where finality providers deposited a sBTC and submitted their public records to a dedicated Github registry repo before the testnet launch.

Testnet 4 Achievements

Babylon’s Testnet-4 delivered several key achievements, demonstrating the robustness and scalability of Babylon’s design. The initial sBTC cap (standing at 5 sBTC) filled in under 20 minutes, showcasing strong demand and community engagement. Over 70 finality providers were onboarded to fortify the network’s security, ensuring robust support for future phases. Additionally, six wallet providers such as Bitget, OKX and Binance wallets have integrated Babylon from the start, further demonstrating ecosystem growth.

Talking about Binance and crypto purchases, you can use our exclusive Binance partnership link to claim $600 Sign-Up bonus!

Activity on Testnet-4

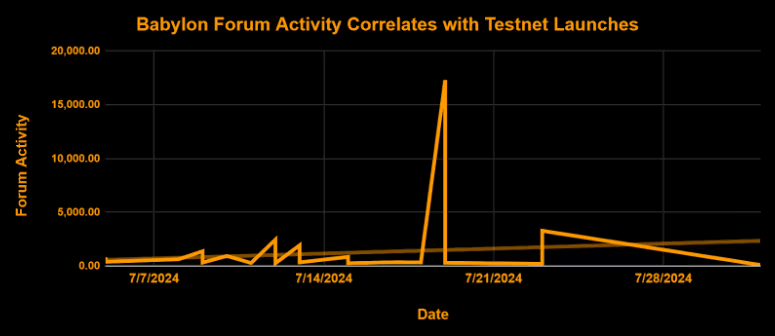

Interest and activity on the Babylon forum spiked right after the Testnet-4 launch, surpassing 15,000, with activity stabilising at around 2,000 as the testing phase was finalised. Generally speaking, despite Babylon being a brand-new protocol that has not even been fully launched, it has been showing a stable community growth trend.

Babylon also launched a Bitcoin Staking Chronicles on Galxe – a community-first web3 super app. The chronicles aimed to educate and activate users around Bitcoins taking, and as data shows, Babylon gained more than 230K followers on Glaxe, with total quest participants surpassing 600K!

Following Galxe’s campaign, Babylon was able to grow its discord userbase to nearly half a million, with daily active users averaging 25K.

Overall, Babylons’ Testnet-4 solidified the groundwork for the Mainnet Phase 1 launch, by fostering a tight-knit community, coupled with a set of established finality providers and Tier 1 wallet apps – all while stress-testing its consensus and yield infrastructure.

Phased Mainnet launch

It has become clear that Babylon is very strategic when it comes to gradually moving to full decentralisation and complete mainnet launch. To this end, Babylon plans to launch its mainnet in a 2-phased approach. Below, we break each one down.

Mainnet Phase 1

In Phase 1, users were given a Bitcoin staking opportunity by sending Bitcoin staking transactions directly to the Bitcoin blockchain. These transactions lock the designated BTCs in a secure, self-custodial staking script, where stakers specify key parameters, such as the public key of the finality provider they wish to delegate their PoS voting power. Importantly, only the voting power is delegated, while the locked BTCs remain in the speaker’s control. If the staker holds the private key of the finality provider, it is considered self-delegation.

As of September 25, and according to the Babylon Staking Explorer, the staking TVL cap stands at 1000 BTC, with a Confirmed TVL of 999.96 BTCs, which equates to USD63,888,744. The number of stake delegations stands at 20.16K, while the number of BTC stakers is above 12K.

Babylon capped this phase at 1,000 BTC, with the next phase starting in early October (date undisclosed). If you missed this cap, don’t worry – Simply simply has your back with our seamless Babylon Staking UI.

Furthermore, in Phase 1, each stake is locked for a maximum of 64,000 Bitcoin blocks (around 15 months). However, stakers can unbond their BTC anytime before expiration, with a 7-day unbonding period (1,008 Bitcoin blocks) before the stake becomes available for withdrawal. While there were no direct staking rewards during Phase 1, stakers’ activities are tracked using a point system linked to their public key.

A point system is used to track staker activity. Stakers earn points based on the number of Bitcoin blocks their stake is active, with finality providers taking a commission. Babylon staking points are distributed to both staker and finality providers, with a total of 3,125 points to be allocated proportionally among all active stakes within that block. To exemplify how points work, once a 1,000 BTC cap was filled, each active stake of 0.05 BTCs earned 0.15625 points per Bitcoin block.

Essentially, Points are virtual and have no monetary value but serve to measure staker engagement and could possibly be used by Babylon to create a monetary incentives program

Additionally, in Phase 1, the on-demand unbonding process is secured by a 6-of-9 multi-signature scheme called the Covenant Committee. This committee co-signs unbonding transactions to verify their correctness but cannot steal or prevent staked BTC from being withdrawn.

The members of the committee include:

- AltLayer (1 key) – Rollup-as-a-Service provider

- Babylon Labs (3 keys) – The core development team behind the project

- CoinSummer Labs (1 key) – Affiliated with a top staking service provider (StakeFish) and a top mining pool (F2Pool)

- Cubist (1 key) – Secure staking infrastructure provider

- Informal Systems (1 key) – Cosmos ecosystem validator

- RockX (1 key) – PoS validator and liquid staking provider

- Zellic (1 key) – Security auditor

The committee members monitor BTC transactions and when a certain action is proposed, like transferring BTC, these validators come together to review and approve it.

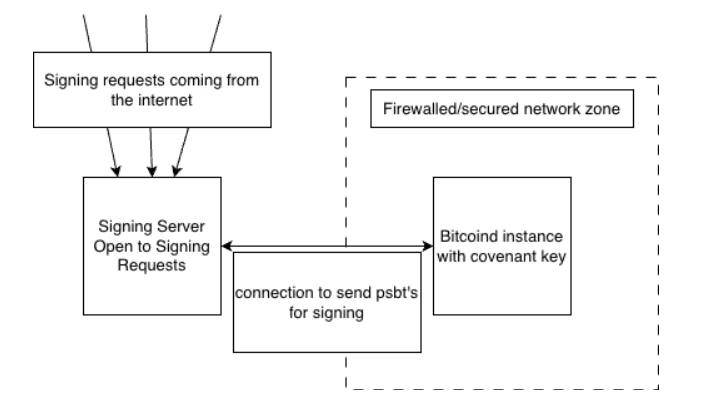

The covenant signer is used to sign off the transaction – a server operated by committee members that collects their signatures on these early unlocking requests. Once two-thirds of enough signatures are gathered, the transaction is processed, and the staked BTC is unlocked.

For a visual breakdown of transaction flow, see the diagram below:

(Source: Babylon Github)

The second cap of Mainnet Phase 1 will be opening in the second week of October, be sure to keep an eye out for the announcement on their X.

Mainnet Phase 2

In Phase 2, Babylon is set to launch its Proof of Stake (PoS) chain, which derives security from the Bitcoins locked during Phase 1. The finality providers, who were delegated voting power by stakers, now actively participate in Babylon’s PoS consensus mechanism. These finality providers are responsible for determining the finality of blocks on the Babylon chain, ensuring that transactions are finalized securely and accurately.

Further, phase 2 also introduces the Bitcoin timestamping protocol, a critical feature for cross-chain synchronization. The protocol anchors Babylon’s PoS chain to the Bitcoin blockchain, allowing Babylon to benefit from Bitcoin’s robust security while maintaining a time-based synchronization system across chains. By regularly timestamping Babylon PoS chain blocks with Bitcoin block headers, the protocol enhances the security and trustworthiness of the Babylon network.

Finality providers who meet the necessary delegation thresholds will be able to validate blocks on the Babylon chain, ensuring that the network runs smoothly and securely. This connection between Bitcoin’s Proof of Work and Babylon’s Proof of Stake strengthens the overall security model, making the system more resistant to attacks.

In essence, Phase 2 enables Bitcoin holders, through their chosen finality providers, to contribute to Babylon’s PoS consensus while still maintaining the security of their locked bitcoins. The Babylon chain serves as the foundation for future cross-chain integrations and sets the stage for the advanced multi-staking capabilities that will be introduced in the subsequent phase.

You can see more information on Phase 2 here, and we will also be publishing another article to review Phase 2.

Conclusion

Babylon’s journey from Testnet-4 to Mainnet Phase 1 highlights significant progress in securing decentralized systems using Bitcoin. Testnet-4 successfully showcased Babylon’s robust infrastructure, with overwhelming community participation and technical advancements that stress-tested its consensus model and staking mechanisms. The introduction of finality providers, alongside high-demand BTC staking, laid a strong foundation for the phased Mainnet launch. As Babylon transitions into Phase 1 and beyond, it continues to redefine the role of Bitcoin in securing Proof of Stake networks, setting the stage for its future as a leader in cross-chain security and Bitcoin staking innovation.

You can simply stake and secure your assets with the Ledger wallet.

About Simply Staking

We are a Blockchain Services Provider who operates Validators and Nodes on over 30 Networks with over $1 Billion in Assets Staked. Our journey started in 2018, with Simply entering the Cosmos Hub Testnets, and now have expanded our operations to most major ecosystems including networks such as LIDO, Polygon, EigenLayer, Oasis Network, Cosmos Hub, Polkadot, and many more, all while being an Oracle Operator on Chainlink.

We offer additional services such as Nodes-As-A-Service (RPCs), Blockchain Development work, Tooling, Governance Services as well as Blockchain Consultancy Services.

More Information on our offerings can be found on our website.

Disclaimer:

Terms & Conditions apply on all partnership offers.

This article contains affiliate links. If you click on these links and make a purchase, we may receive a small commission at no additional cost to you. These commissions help support our work and allow us to continue providing valuable content. Thank you for your support!

This article is provided for informational purposes only and is not intended as investment advice. Investing in cryptocurrencies carries significant risks and is highly speculative. The opinions and analyses presented do not reflect the official stance of any company or entity. We strongly advise consulting with a qualified financial professional before making any investment decisions. The author and publisher assume no liability for any actions taken based on the content of this article. Always conduct your own due diligence before investing.