Smart contracts are often described as “not that smart”, and that was never meant as a criticism. When Nick Szabo introduced the concept in the mid-1990s, he was describing systems designed to execute instructions reliably, not to reason or interpret context. Smart contracts are very good at doing exactly what they are told. They execute code deterministically, settle value reliably, and do not need to trust anyone in the middle. The problem is that most real applications need more than that.

Modern decentralised applications rely on external data, scheduled actions, cross-chain execution, and coordination with systems that live entirely outside the blockchain. Prices, identity checks, compliance rules, automation logic, and even simple timing conditions often sit off-chain. Traditional oracles solved one part of this problem by bringing data on-chain, but as applications have grown to be more complex, that has started to feel like only part of the solution.

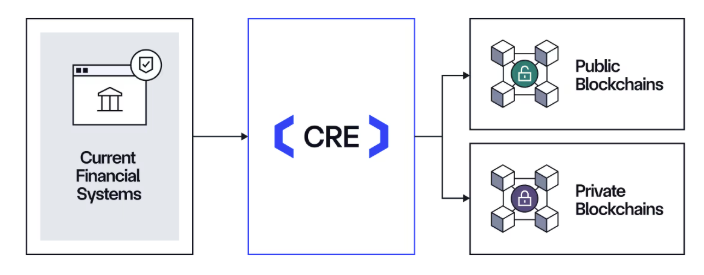

This is where Chainlink Runtime Environment (CRE) enters the picture. Rather than focusing only on data delivery, CRE aims to provide a way for decentralised applications to coordinate full workflows that span on chain and off chain logic, without falling back on trusted servers or centralised middleware.

What Is Chainlink Runtime Environment (CRE)

Essentially, Chainlink Runtime Environment is a runtime for decentralised services. It is not a new blockchain, and it does not replace smart contracts. Instead, it provides an execution environment where off-chain computation and coordination can happen securely, while remaining verifiable and decentralised.

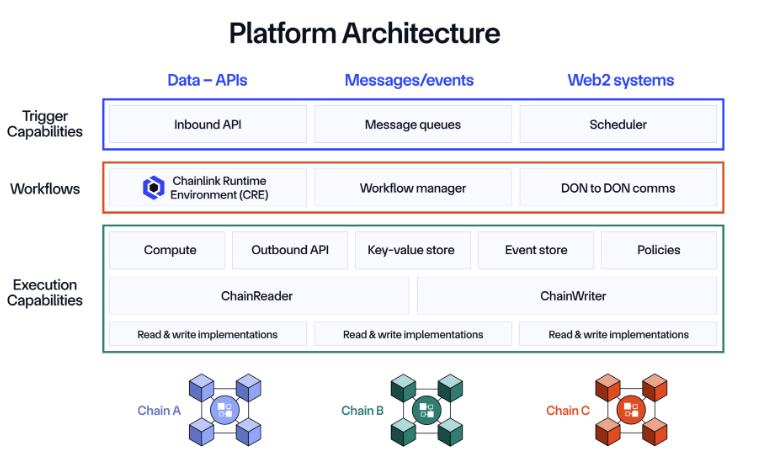

At a high level, CRE allows developers to define workflows that involve multiple steps. These workflows might fetch data from external systems, apply logic or policy checks, wait for certain conditions to be met, and then trigger actions on one or more blockchains. All of this happens outside the constraints of smart contract execution, but without giving up trust guarantees.

Under the hood, CRE is built on upgraded Decentralized Oracle Networks, or DONs. Instead of acting as simple data relays, these networks operate as execution clusters. Multiple independent nodes run the same workflow logic and agree on the result, which is then used to drive on chain actions.

If you are new to Chainlink, it helps to understand how decentralised oracles work first. Simply Staking has a clear explainer on what decentralised data oracles do and why they matter, which makes it much easier to see why CRE is a logical next step.

Why Chainlink Built CRE

Chainlink started as a solution to a very specific problem. Smart contracts could not access reliable external data and therefore, price feeds and other oracle services filled that gap and became critical infrastructure for decentralised finance.

Over time, however, the demands placed on blockchain applications have changed. Projects now need more than single data points. They need off-chain computation, complex conditional logic, automation, and coordination across multiple chains and systems. Building this safely has often meant stitching together custom servers, scripts, and bridges, which introduces trust assumptions and operational risk.

CRE exists because that approach effectively does not scale. As applications become more interconnected and more valuable, the infrastructure supporting them needs to offer the same security and decentralisation guarantees as the blockchains themselves. In that sense, CRE is not a pivot for Chainlink, but it may be viewed as the next logical evolution as it extends the oracle model from data delivery into execution and coordination.

The Core Components of Chainlink Runtime Environment

To understand how CRE works, it helps to break it down into its main building blocks.

Decentralised Services

Instead of one off oracle requests, CRE enables decentralised services. These are workflows made up of multiple steps that can run over time. A service might monitor external conditions, perform calculations, enforce rules, and only trigger an on chain transaction once all requirements are satisfied.

This kind of logic is difficult or impractical to run entirely on-chain. CRE allows it to live off chain while remaining verifiable.

Decentralized Oracle Networks as Execution Clusters

At the heart of CRE are Decentralized Oracle Networks. In this model, DONs do more than deliver data. They execute workflow logic collectively. Each node runs the same computation, and the network reaches agreement on the outcome.

This approach provides fault tolerance and removes reliance on any single operator. If one node fails or behaves unexpectedly, the network can still reach a correct result.

Secure Off-Chain Computation

Off-chain computation is a key concept in CRE. By moving heavy or complex logic off chain, applications avoid high gas costs and execution limits. At the same time, determinism and verification ensure that all participating nodes reach the same outcome.

This balance allows developers to build richer applications without sacrificing trust.

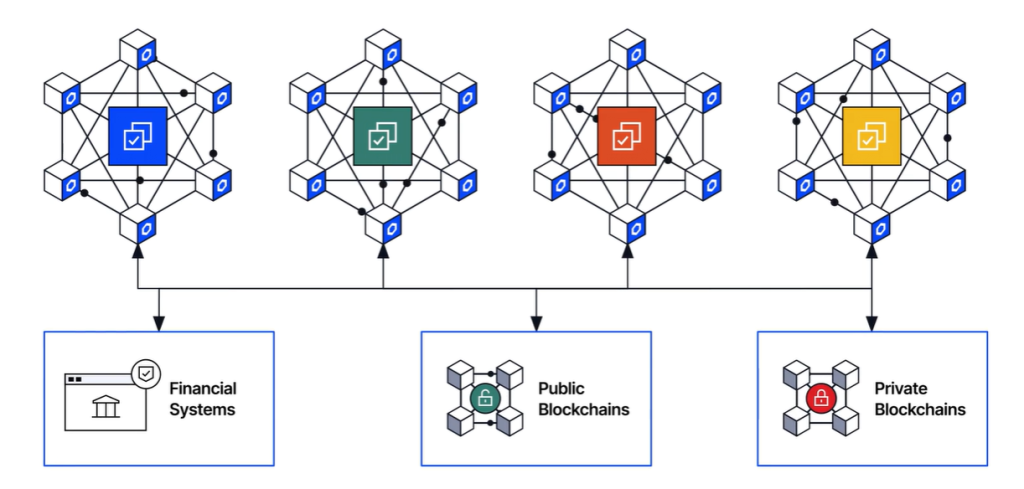

Native Multi-Chain Alignment

CRE is designed with a multi-chain world in mind. Many applications already operate across several networks, and coordination between them is becoming increasingly important.

It is worth noting that CRE aligns closely with Chainlink’s broader cross-chain strategy, including CCIP, Chainlink’s cross chain interoperability protocol. While CRE and CCIP serve different roles, they are complementary pieces of infrastructure aimed at making cross chain coordination more reliable and secure.

Real World Use Cases Enabled by CRE

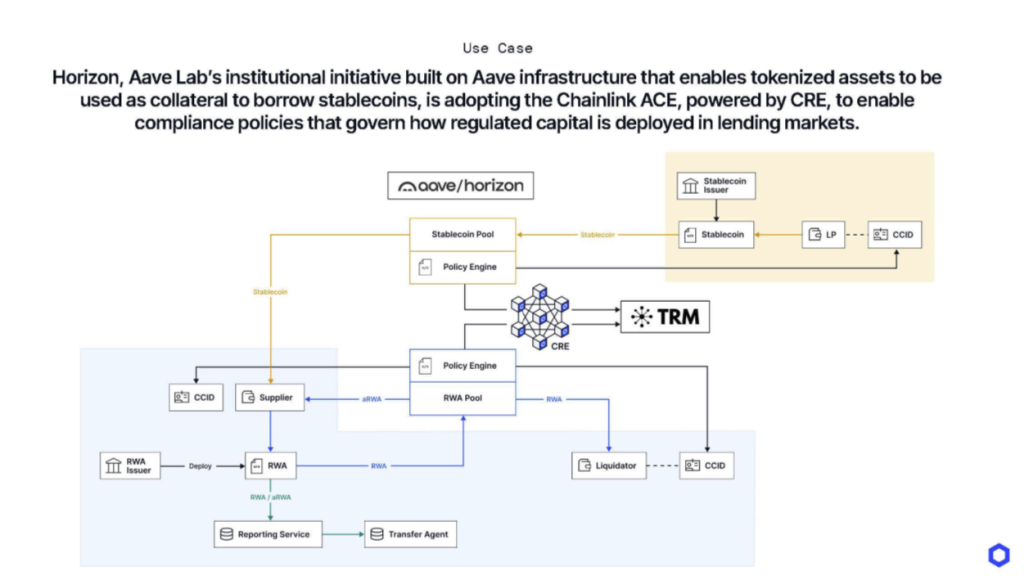

The fastest and easiest way to understand CRE is through what it enables. One clear example is tokenised real world assets (RWAs). These systems often require compliance checks, data verification, and conditional execution before assets can be issued or transferred, and CRE allows these steps to be coordinated off-chain and enforced on-chain without manual intervention.

In decentralised finance, protocols increasingly rely on complex execution logic. Liquidations, rebalancing strategies, and risk management often depend on multiple data sources and conditions. CRE makes it possible to manage these workflows in a decentralised way.

Cross-chain asset management is another area where CRE fits naturally. Coordinating actions across networks requires more than message passing, but it requires logic, timing, and verification, all of which CRE is designed to handle.

Additionally, institutional automation is also a major driver. Financial institutions operate across legacy systems, private networks, and public blockchains. CRE provides a way to orchestrate workflows across these environments while maintaining clear auditability.

Finally, CRE opens the door for AI agents that can act on-chain under defined rules. Instead of autonomous systems pushing transactions directly, CRE allows their actions to be mediated, verified, and constrained by decentralised execution logic.

Why Chainlink Runtime Environment Matters

CRE changes how Chainlink fits into the crypto stack. Rather than being seen only as an oracle provider, Chainlink increasingly acts as a coordination and execution layer for decentralised applications. In turn, this reduces the need for trusted middleware and custom infrastructure, which are often the weakest links in otherwise decentralised systems. By providing a standard way to run off chain workflows securely, CRE enables more advanced applications without compromising on trust.

Where This Leaves Crypto Infrastructure

Chainlink Runtime Environment is not a small incremental upgrade, but it is a signal of where crypto infrastructure is heading. As applications grow more complex, the distinction between on chain and off chain logic matters less than how well they are coordinated.

CRE aims to bridge that gap, allowing smart contracts to interact with the real world in richer and more reliable ways. If that vision succeeds, it will shape how decentralised applications are built for years to come.

Want to Dive Deeper?

If you are interested in how Chainlink participants engage with the network, Simply Staking’s Ultimate Chainlink Staking Guide is a good next step, and if you want to stay up to date with Chainlink infrastructure developments, staking updates, and deep dives like this one, follow Simply Staking on X for the latest insights.