Stablecoins have become one of the most important parts of the modern crypto ecosystem. Essentially, they are digital currencies designed to maintain a stable value and they act as the primary medium of exchange across blockchain networks. Many stablecoins are pegged to the United States dollar and aim to provide a reliable store of value that avoids the price swings of volatile crypto assets. In recent years, their growth has been noting short of remarkable. Stablecoin transactions now settle more value each year than many traditional payment systems. For example, in 2024 alone, stablecoins transferred more than $18 trillion on-chain, which is more than Visa and Mastercard combined! Furthermore, it is clear that the global stablecoin market continues to expand as users look for a simple and predictable way to move money on the internet.

Stablecoins emerged to bridge the gap between traditional fiat currencies and programmable crypto networks. They give users a consistent value reference point, they make decentralised finance more efficient and they support liquidity across exchanges. Traders use stablecoins to move capital between positions quickly. People in emerging markets use stablecoins as a hedge against inflation while businesses use stablecoins to settle international payments instantly. As adoption grows, it becomes essential to understand how stablecoins work and how different stablecoin issuers maintain their value.

Considering all this, we think it is time to have a deep dive in this topic, and explain the main types of stablecoins, how these digital currencies maintain price stability, what risks and benefits stablecoins present, and how new infrastructure such as Plasma is shaping the future of stablecoin usage.

Types of Stablecoins and How Stablecoins Work to Maintain Their Value

Stablecoins are digital currencies designed to maintain a consistent value relative to a reference asset. Although many stablecoins are pegged to fiat currencies such as the United States dollar, each type of stablecoin uses a different mechanism to maintain the peg. These mechanisms influence how much confidence users place in the token and how resilient the stablecoin is during times of stress. To understand clearly, it helps to examine each type of stablecoin and learn how they work under the hood.

The 4 main categories of stablecoins are fiat backed stablecoins, crypto collateralised stablecoins, algorithmic stablecoins and commodity backed stablecoins. Each category relies on a different asset structure, a different level of decentralisation and a different set of incentives that stabilise its price.

Let’s explore them one by one to appreciate their commonalities and differences.

Fiat Backed Stablecoins and the Benefits of Stablecoins Backed by Real World Assets

Fiat backed stablecoins are a type of stablecoin issued by a central organisation that holds traditional financial assets such as cash, short term government securities and money market funds. These stablecoins are pegged to fiat currencies and maintain their value by holding one dollar of reserve assets for each token issued. This design makes stablecoins backed by fiat reliable and easy to understand, while a stablecoin issuer promises full redemption. Furthermore, through arbitrage (the act of buying an asset at a lower price in one place and selling it at a higher price in another place) the stablecoin is able to keep close to its peg.

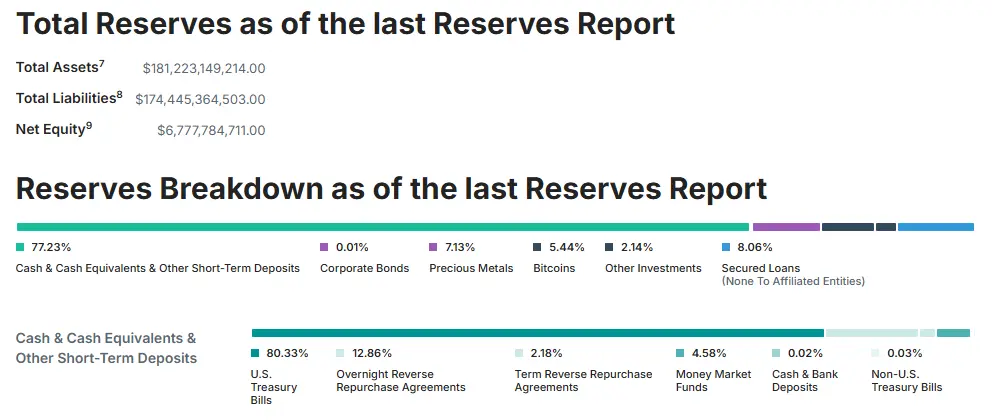

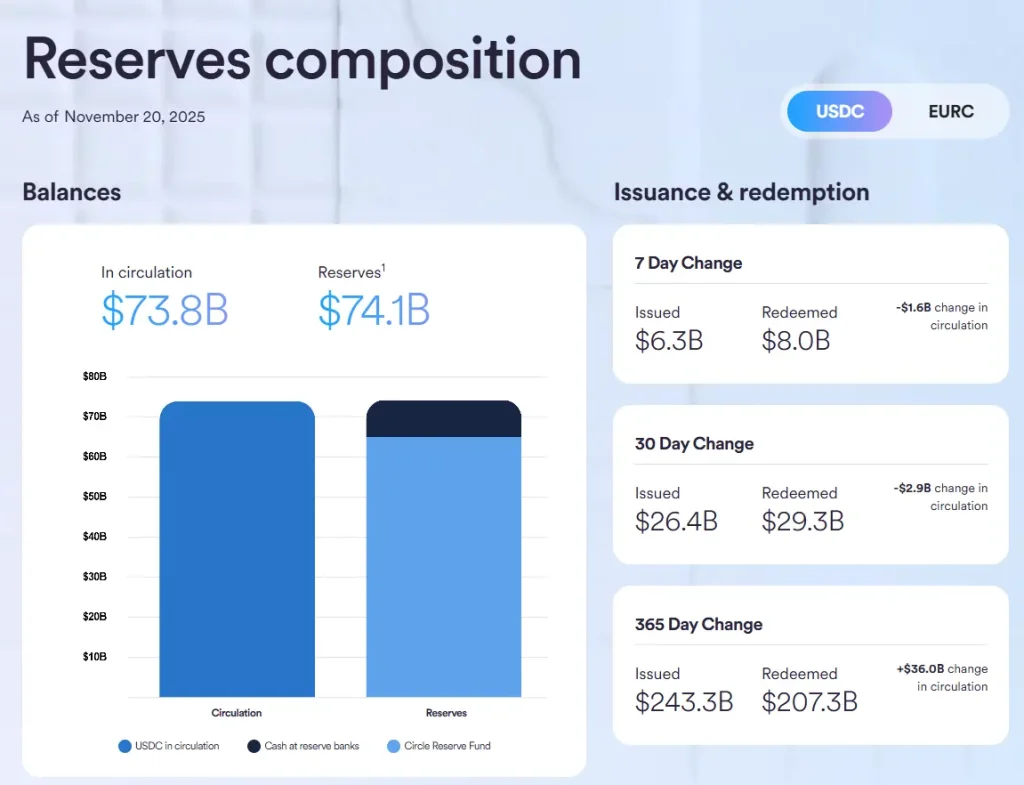

Tether and Circle are the largest issuers of fiat backed stablecoins. Tether’s USDT and Circle’s USDC dominate the stablecoin market and act as the main source of liquidity across the crypto ecosystem. Both stablecoins are designed to maintain a stable value and both rely on highly liquid assets such as United States Treasury bills. These reserves reduce price volatility and allow large scale redemptions during periods of uncertainty.Tether holds a mix of cash, short term government securities and other investments, and over time Tether has increased its transparency and now publishes regular reserve reports.

On the other hand, Circle takes a very conservative approach and holds its reserves in cash, government backed securities and regulated money market funds managed by BlackRock. In contrast to Tether, Circle does not hold Bitcoin or other volatile instruments as their main goal is simple. Circle wants USDC to maintain a consistent value at all times, even during the most turbulent times.

Fiat backed stablecoins are the most popular type of stablecoin because they are simple to understand, supported by established financial institutions and easy to redeem. Although these stablecoins are digital currencies, they remain closely tied to the financial system that backs them.

Crypto Collateralised Stablecoins and How Crypto Backed Stablecoins Maintain Price Stability

The second type of stablecoins are crypto backed stablecoins are digital currencies that maintain their value through over collateralisation. Instead of relying on fiat reserves held by a stablecoin issuer, crypto collateralised stablecoins are backed by crypto assets stored in smart contracts. These smart contracts enforce collateral requirements, manage liquidations and automate many parts of the system, effectively making crypto backed stablecoins permissionless and transparent, because users can verify reserves on-chain.

DAI, created by MakerDAO, is the most widely used crypto backed stablecoin. Users lock assets such as Ether or wrapped Bitcoin as collateral. Because these assets experience price volatility, the collateral value must exceed the value of the DAI minted. So much so, that many users must maintain a collateral ratio of around one 150% or more. If the collateral value falls below the required threshold, the smart contract liquidates the position automatically, and therefore, this protects the stablecoin and maintains stability even during sudden market changes.

DAI is able to maintain its peg through supply and demand incentives. If DAI trades below $1, users buy discounted DAI and use it to repay their positions, effectively redeeming DAI for $1 of collateral. If DAI trades above $1, users mint new DAI and sell it, increasing supply and stabilising the price.

Crypto collateralised stablecoins show how decentralised finance can maintain a stable value without relying on traditional institutions. However, their main drawback is that they require more capital than the value they issue. They also depend on liquid crypto markets to process liquidations efficiently. During extreme market events, crypto collateralised stablecoins may experience temporary fluctuations because liquidations can take time, but the system is designed to restore stability through collateral adjustments and market incentives.

Algorithmic Stablecoins and the Risks of Stablecoins That Rely on Supply and Demand Adjustments

Algorithmic stablecoins use a completely different approach. Instead of holding reserves, they adjust supply and demand to maintain a stable value, and uses incentives such as minting or burning tokens to keep its peg. The main aim of this category is to show that stablecoins are digital currencies that can remain stable without any external collateral, but in practice, this approach has proven risky.

The most well known example is TerraUSD, often called UST. TerraUSD attempted to maintain its peg by allowing conversions between the stablecoin and the LUNA token. When TerraUSD traded below $1, arbitrageurs could buy it and exchange it for $1 worth of LUNA, but the issue with this mechanism is that it depended on the market confidence in LUNA. In 2022, as confidence disappeared, LUNA collapsed and TerraUSD lost its peg completely and never recovered. The supply expansion could not stabilise the token and the algorithmic stablecoin failed.

This highly violent collapse highlighted the risks of stablecoins without strong collateral. Algorithmic stablecoins aim to provide a new model but they can unravel quickly when demand falls or when secondary tokens lose value. Therefore, many regulators and analysts now-a-days view algorithmic stablecoins as unstable because they rely entirely on supply and demand incentives without real backing. As a result, several regions now restrict or prohibit uncollateralised algorithmic designs.

Commodity-Backed Stablecoins and How Commodity Backed Stablecoins Are Collateralised

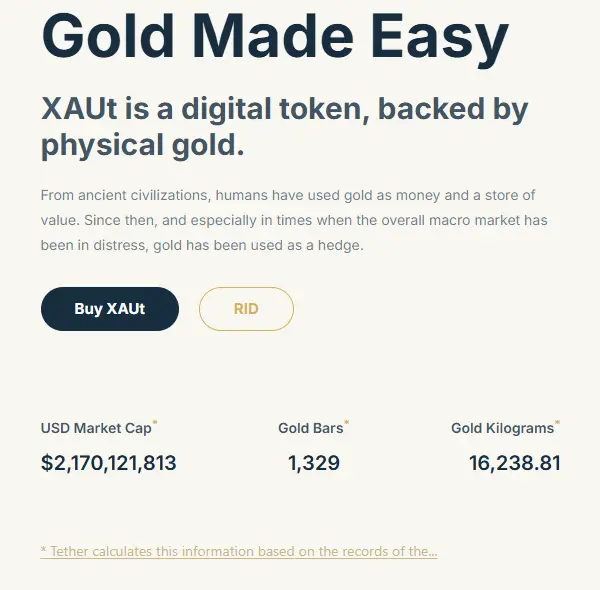

Commodity backed stablecoins represent ownership of real world assets such as gold. Pax Gold and Tether Gold are examples where each token corresponds to one fine troy ounce of physical gold held in custody. These stablecoins offer a type of stablecoin that is tied to the value of a commodity rather than a fiat currency, and therefore, they can act as a store of value and as a digital representation of traditional assets.

Although commodity backed stablecoins are a smaller segment of the stablecoin market, they show how stablecoins can represent many different types of collateral. Commodity backed stablecoins are collateralised by assets with real monetary value, which helps maintain a consistent value relative to the underlying commodity.

Benefits of Stablecoins as Digital Currencies, Medium of Exchange and Store of Value

Stablecoins are digital currencies that provide a clear medium of exchange across the crypto ecosystem. They allow users to send and receive value quickly, regardless of borders or banking hours, and because stablecoins maintain a stable value relative to a reference currency, they make budgeting, trading and saving far easier than using volatile crypto assets.

Stablecoins also act as a bridge between traditional finance and decentralised networks. People can convert fiat currencies into stablecoins and gain immediate access to new financial tools. Businesses can accept stablecoin payments from anywhere in the world while traders rely on stablecoins to avoid price volatility. Furthermore, users rely on stablecoins as a store of value when their local currency loses purchasing power.

How Stablecoins Maintain Price Stability and Protect Financial Stability

The sole purpose of a stablecoin is to remain stable, and therefore if a stable coin looses its value it also losses all its usefulness. Another way to describe this would that that if a stablecoin loses its peg, users lose their confidence. To prevent this, stablecoins use a combination of redemption mechanisms, collateral requirements and market incentives that help maintain price stability.

Let’s have a quick overview.

Redemption and Arbitrage

Fiat backed stablecoins maintain stability through redemption rights. If a fiat backed stablecoin trades below $1, traders buy it and redeem it for $1 of fiat. This process reduces supply and restores the price, while on the other hand, if it trades above $1, traders can mint new tokens by depositing fiat with the stablecoin issuer. This increases supply and lowers the price. Effectively, these actions keep fiat backed stablecoins close to their peg.

Collateral and Smart Contract Enforcement

Crypto backed stablecoins use over collateralisation and automated liquidation. Smart contract rules make sure every token remains fully backed by crypto assets. It is worth nothing that although these mechanisms maintain a consistent value during volatility but depend on liquid markets and reliable infrastructure.

Algorithmic Incentives

In practice, algorithmic stablecoins use supply and demand adjustments. These designs aim to maintain price stability through incentives rather than reserves. They depend heavily on confidence and liquidity. When confidence drops, algorithmic systems can fail quickly.

Why Confidence Matters

Stablecoins are digital currencies that rely on trust. Even fully backed stablecoins can face temporary instability if users fear that reserves are inaccessible. For example, this occurred when a portion of USDC reserves were trapped temporarily during the collapse of Silicon Valley Bank, but once regulators secured deposits, USDC quickly returned to its peg. This real-life example shows how important transparency, strong reserves and oversight of stablecoins are to their long term stability.

Stablecoin Use Cases and How Stablecoins Facilitate the Crypto Ecosystem

Saying that stablecoins have become essential for many crypto ecosystems probably is an understatement as they serve as the foundation for trading, lending, payments and many use cases across decentralised finance.

Let’s break down stablecoins main uses.

Trading and Market Liquidity

Stablecoins act as the primary medium of exchange on centralised exchanges, so much so that more than 80% of trading pairs involve a stablecoin. Traders rely on stablecoins to move between positions quickly without touching fiat currencies. This liquidity makes stablecoins a core part of the global stablecoin market.

Decentralised Finance

Stablecoins are used throughout DeFi. Liquidity pools depend on stablecoins to offer predictable pricing, while lending protocols allow users to borrow stablecoins using crypto as collateral. Additionally, many stablecoins are issued on multiple networks to support cross chain DeFi activity.

Global Payments

Stablecoins offer a way to move money across borders instantly. Unlike traditional payment systems, stablecoin payments settle within minutes and operate continuously. People use stablecoins to protect savings from inflation, to send remittances or as a simple method of online payment. At this stage, the use of stablecoins to send and receive value is now becoming a common occurrence across emerging markets.

Interaction With Traditional Markets

Often, stablecoin issuers hold large amounts of government debt to back their tokens. Interestingly, this has created new direct links between stablecoin usage and traditional money markets. Stablecoin issuers would often convert their cash reserves backing the stablecoin token into government issued bonds, better know as Treasury bills. Within traditional finance, Treasury bills are viewed as the safest, risk free investment as essentially, Treasury bills are debt issued by a centralised government. Therefore, stablecoin issuers use the token reserves to buy these Treasury bills to generate a small, but risk free yield. This setup, both benefits the stablecoin issuer as they would be turning a profit, but also centralised governments. The higher the rate of stablecoin adoption, the more stablecoin issuers would buy government Treasury bills, meaning that centralised governments would have more buyers for their debt.

You might be interested in these articles:

- Looking to explore more of the infrastructure that powers modern crypto trading?

- Read our deep dive on Hyperliquid, the fully on-chain Layer 1 designed for high performance trading. It shows how next generation networks are reshaping liquidity and execution in the same way stablecoins reshaped value transfer across crypto.

- Read here: What is Hyperliquid and why does it matter for the future of trading?

Oversight of Stablecoins and the Regulatory Framework for Stablecoins

As stablecoins grow, governments and regulators focus more closely on their risk profile. The oversight of stablecoins is becoming a major policy priority as regulators want to ensure that stablecoins issued at scale are safe, fully backed and properly supervised.

International organisations are increasingly seeing stablecoins as potential financial market infrastructure. The European Union has enacted stablecoin regulations through its MiCA framework while the United States enacted the GENIUS Act in July 2025 to define which institutions can issue stablecoins and what assets must support them.

These regulatory efforts aim to enhance trust, protect users and preserve financial stability. Clear rules will likely accelerate institutional acceptance of stablecoin payments.

Use of Stablecoins on New Networks and the Rise of Stablecoin Focused Infrastructure

Stablecoins are now issued across many blockchain networks. As the demand for stablecoin transactions grows, the industry is creating new blockchains designed specifically for stablecoin usage.

Multi-Chain Expansion

Stablecoins such as USDT and USDC now exist on Ethereum, Tron, Solana, Polygon, Arbitrum and many other networks. Tron in particular has captured a large share of USDT transfers thanks to its low transaction costs and rapid settlement. Multi-chain stablecoins allow users to choose the most efficient network for each transaction.

Plasma: A Blockchain Optimised for Stablecoins

Plasma represents a new category of blockchain infrastructure designed for stablecoin payments. Plasma offers fast block times, zero fee USDT transfers and EVM compatibility as it allows users to send stablecoins without needing the native token for gas. Plasma maintains security through a proof-of-stake model and provides privacy features for stablecoin payments.

The project is backed by Tether, Bitfinex and multiple infrastructure partners, and it is built to process high volumes of stablecoin transactions while also aming to support the next phase of stablecoin growth.

Conclusion: What You Need to Know About Stablecoins

Stablecoins are digital currencies designed to maintain a stable value and they have become essential to the crypto ecosystem. They act as a medium of exchange, a store of value and a bridge between fiat currencies and decentralised networks. They also power decentralised finance, global payments and cross chain liquidity. New networks such as Plasma are emerging to support stablecoin growth at scale while regulators continue to develop frameworks that keep stablecoins safe and resilient.

The stablecoin industry is evolving rapidly and further updates are expected as adoption expands. To stay informed about the latest developments, we encourage you to follow Simply Staking on X so you never miss anything important.