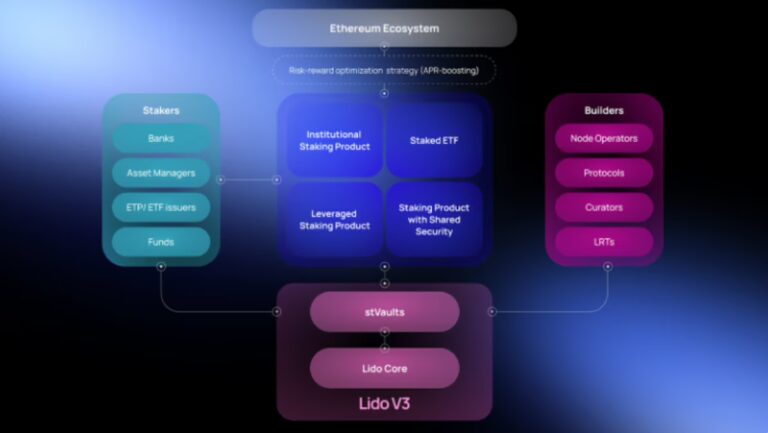

Ethereum staking is evolving again, and Lido V3 is leading the charge by introducing stVaults, a groundbreaking solution designed to bring more flexibility and further customisability to Ethereum staking like never before. This innovation unlocks a new era of staking, where users can optimise their strategies, manage risks, and scale operations with unprecedented control. Therefore, we at Simply Staking are thrilled to be part of this evolution, not just by being observers but by operating Lido V3 Vaults! We are excited to bring our industry-leading experience in validator operations to this new staking model as we believe that stVaults will empower Ethereum stakers to take full control of their staking strategies, offering tailored solutions to meet the needs of both individual and institutional participants.

Read more from our Ethereum Staking series:

- Analysis of the current Restaking Landscape

- Ethereum Pectra: Whats behind the Ethereum Upgrade

- Lido: a technical Overview

- How to stake on Lido

- How to Stake on Stakewise

- ETH staking yield

- Ethereum Staking

With the Ethereum Pectra upgrade on the horizon, and given how important Pectra is for the scalability and efficiency of Lido V3, now is the right time to explore how Lido V3 Vaults fit into the future of staking. If you’d like to get up to speed with Pectra, click here to learn more. Let’s dive in.

The Evolution of Ethereum Staking & Lido’s Role

Ethereum’s Beacon Chain introduced staking for ETH holders to support the network’s security and consensus in 2020, but at the time, these staking solutions were limited in terms of accessibility and flexibility. Lido’s launch introduced liquid staking, which meant that users had the opportunity to stake ETH but also maintain liquidity through stETH which is a liquid staking derivative. Effectively, this innovation enabled users to still participate in the Ethereum staking mechanism without having the user’s funds locked into a long-term commitment. As the staking landscape continued to evolve, new concepts like Restaking and protocols such as EigenLayer emerged, introducing mechanisms that allow stakers to secure additional networks and earn extra rewards using the same underlying stake.

As Ethereum started to gain more adoption, institutional investors started showing interest in staking ETH but faced challenges such as regulatory compliance, risk management, and operational control over their staked assets. As these institutional stakers and other advanced users started to demand more flexibility in their staking setups, it became ever more clear that a “one-size-fits-all” staking model no longer met the diverse needs of the growing Ethereum ecosystem, and therefore, Lido V3 is being introduced!

What is Lido V3?

Lido V3 introduced stVaults. stVaults is a new staking primitive built to operate alongside Lido’s existing protocol that allows for customisable staking setups which best align with the user’s specific goals. Let’s break down the key benefits of stVaults starting with validator selection.

Validator Selection

stVaults enable stakers to configure their staking strategies by selecting preferred Node Operators and therefore allowing for more diversified staking approaches. Simply Staking will be one of these operators and soon we will be launching our own vault. Additionally, by providing enhanced control over validator infrastructure, stVaults can cater to the specific needs of the user such as compliance, risk management, and performance optimisation.

Fee Structures

This new model introduces customisable fee structures that allow users to optimise the rewards gained by allowing them to select setups that best suit their needs. Additionally, fee adjustments can be dynamically structured within the vault, potentially aligning with performance metrics and validator selection criteria.

Risk Management

How can users manage risk better? Well, stVaults allows stakeholders to customise their staking experience by choosing different levels of risk exposure and potential rewards. In simple terms, the stalker may choose whether to maximise rewards or minimise potential losses. Furthermore, in order to ensure that stVaults remain resilient and sustainable, stVaults introduce a Reserve Ratio (RR) mechanism that ensures that stETH minted through stVaults is reasonably over-collateralised. This means that a portion of the ETH deposited will remain unminted as a buffer to help absorb potential losses from slashing events or prolonged penalties.

Tailored Reward Strategies

For the first time, users now have the opportunity to have tailored staking rewards based on their particular needs and also optimise returns based on validator performance. Furthermore, adjustments to staking rewards can be made according to market fluctuations while at the same time, capital efficiency is enhanced as users can select pools with different risk/reward profiles.

Advanced Staking Strategies with Simply Staking’s Vault

Advanced staking strategies will now be possible when making use of Simply Staking’s vault. First of all, stakers will be able to borrow funds through DeFi protocols to amplify their staking position and, therefore, boost potential rewards while taking on additional risks. This leveraged staking strategy optimises the staking reward by allowing more capital to be staked than the user’s initial investment. Lido V3 also allows for an opt-in approach to shared security, which, in turn, this strategy will yield higher returns. It should be noted that stakers will still have full control over how much of their stake is exposed to restaking, therefore providing flexibility while further balancing risk and rewards.

Enhancing Ethereum’s Decentralisation with Lido V3

Lido V3 is reshaping Ethereum’s staking landscape by introducing a more flexible, multi-faceted approach and by promoting greater validator diversity, Ethereum’s decentralisation and security are enhanced as the concentration of stakes is minimised. Furthermore, Lido V3 introduced a marketplace model that moves beyond a uniform approach to staking by allowing users more choices and flexibility in selecting validators, while features like ETH bonding, dynamic fee models, and performance-based validator metrics ensure more efficient use of capital, rewarding optimal validator behaviour and increasing overall staking effectiveness.

Conclusion

Lido V3 is paving the way for a more flexible and decentralised Etheruem staking ecosystem by providing tools that cater for the needs of institutions and also promote innovation. Simply Staking’s Vault on Mellow will offer personalised staking strategies and superior security to optimised performance for all users, and therefore, we highly encourage you to follow us on X to be amongst the first to be notified when released!

Additional Resources

Lido V3 Blog: https://blog.lido.fi/lido-v3-ethereum-staking-infrastructure/