What if crypto trading felt faster, fairer, and more transparent than anything in traditional finance? Imagine no middlemen, no hidden Wall Street hands but just open markets powered entirely by code.

Well, imagine no longer. Welcome to Hyperliquid, a Layer 1 (L1) decentralised exchange rapidly redefining how trading happens onchain.

What Is Hyperliquid

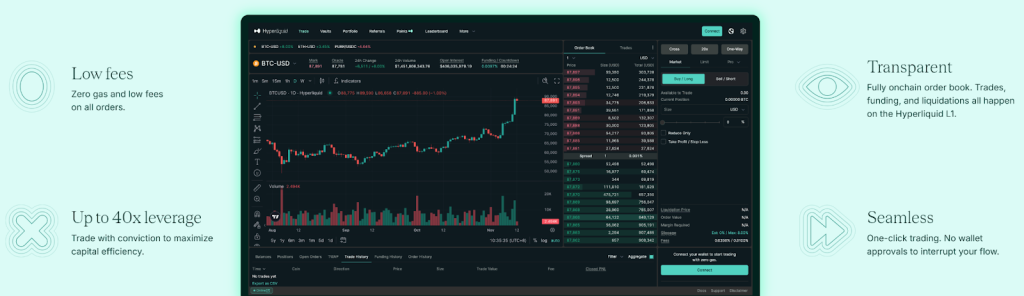

Hyperliquid is a decentralised exchange and L1 blockchain built entirely for onchain trading. It combines the speed of centralised exchanges with the transparency of decentralised finance, offering a fully onchain open financial system where users can trade, stake, and govern.

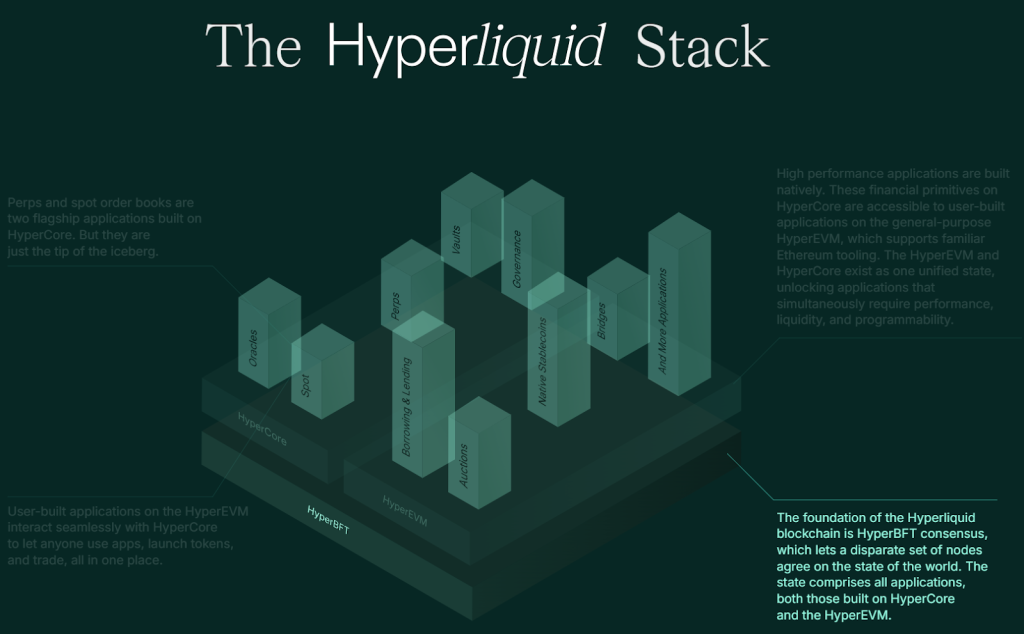

Unlike projects built on Ethereum or rollups, Hyperliquid uses its own Layer-1 blockchain with a custom consensus mechanism called HyperBFT. This consensus model, inspired by HotStuff, gives the network low-latency block confirmation and extremely high throughput.

At its core, Hyperliquid provides a fully onchain order book where perpetual futures, spot markets, and liquidity all exist natively on the chain. It also hosts the HyperEVM, a smart contract platform that lets developers build user driven financial applications that plug directly into Hyperliquid markets.

Every trade, match, and liquidation is processed on the blockchain, offering complete transparency and robust security measures for traders and builders alike.

What Makes Hyperliquid Special in Crypto Trading

Hyperliquid is not just another Layer 2 or sidechain project. It is a custom Layer 1 blockchain optimised from the ground up for performance and decentralisation.

To better understand the project, it is worth noting the key features that make Hyperliquid stand out from the rest:

Custom Consensus Algorithm (HyperBFT)

HyperBFT is Hyperliquid’s own consensus model inspired by HotStuff, a modern Byzantine Fault Tolerant design known for speed and security. It allows validators to agree on blocks quickly and safely without relying on any central coordinator. This results in low-latency confirmations and consistent performance, even when activity on the network surges. In practice, this means trades settle almost instantly and users experience a smooth, reliable onchain trading environment.

High Throughput

Throughput refers to how many transactions a blockchain can handle at once. Hyperliquid is built to process a very high volume of orders and smart contract interactions simultaneously. This capacity ensures that even when the network is busy, order execution remains fast and gas fees stay stable. For traders, it translates into a consistent experience that feels similar to centralised exchanges, but with full onchain transparency.

Fully Onchain Order Book

Most decentralised exchanges rely on automated market makers, which pool liquidity but often limit control and efficiency. Hyperliquid does it differently by running a complete onchain order book where every trade, order, and liquidation is recorded directly on the blockchain. Therefore, this structure allows real-time matching without intermediaries, giving users clearer pricing, fairer markets, and verifiable transparency.

Dual Block Structure

Hyperliquid’s architecture runs on two coordinated layers. HyperCore manages all native trading functions such as order matching, funding updates, and liquidations. The HyperEVM handles smart contracts and DeFi applications that can plug into the same liquidity pool. Both layers are secured by the HyperBFT consensus and share the same state, which means financial activity and programmability coexist in one unified system. This design combines the speed of an exchange with the flexibility of an EVM chain.

Community Ownership

Unlike many blockchain projects, Hyperliquid did not raise funds from venture capital or private investors. There was no token sale, no presale, and no allocation to insiders. The project is self-funded and community driven, with governance carried out through the HYPE token. This approach keeps decision-making transparent and ensures that the network’s direction aligns with its users, not external shareholders.

Smart Contract Compatibility

The HyperEVM brings full EVM compatibility to the network, allowing developers to deploy Solidity-based smart contracts that interact directly with onchain trading activity. Builders can create new financial tools, analytics systems, or liquidity products using the same pool that powers the exchange. This shared foundation gives Hyperliquid the versatility of a DeFi ecosystem and the efficiency of a purpose-built trading engine.

Hyperliquid is a self funded project built by a team from institutions such as Caltech and other tech and finance backgrounds. It is designed to become a secure and decentralised network that powers a future of fully onchain trading and settlement.

Hyperliquid Markets, Onchain Perpetual Exchange Trading and TVL Growth

Hyperliquid markets are designed for traders who want CEX speed without sacrificing decentralisation. Traders can place market and limit orders, monitor trading volume, and interact with liquidity exactly as they would on a centralised platform.

Every order is verified by the network’s consensus, making the user experience and overall trading environment fast, transparent, and fully decentralised. Furthermore, liquidation happens transparently, and every event is recorded onchain.

Hyperliquid is a perpetual exchange at its core, supporting advanced trading tools, spot pairs, and derivatives such as perpetual futures. A testament to this is its growing TVL (total value locked) and live trading volume show that it is quickly becoming one of the largest onchain trading ecosystems in crypto.

The HYPE Token and Tokenomics

The Native Token

The Hyperliquid network runs on HYPE, the native token used for gas fees, staking, and governance. It plays a central role in maintaining network security and distributing economic incentives across the ecosystem.

HYPE tokens are used to:

- Pay trading and transaction fees on the Hyperliquid DEX.

- Stake with validators to help secure the network.

- Vote on governance proposals that guide future development.

- Access trading fee discounts when paying with HYPE.

This design directly links Hyperliquid price and demand for HYPE to network activity, making the token integral to the platform’s growth and stability.

Token Distribution and Unlock Schedule

Hyperliquid’s launch of the HYPE token was not your typical Token Generation Event (TGE). At genesis, Hyperliquid launched one billion HYPE tokens and the distribution placed a big emphasis on being community first and transparency:

- 31% went to early users through the Genesis Airdrop.

- 38.888% reserved for staking rewards and future emissions.

- 23.8% allocated to core contributors with a one year cliff and two year linear unlock.

- 6% for the Hyper Foundation to support ecosystem development.

- 0.3% for community grants.

- 0.012% for Hyperliquidity initiatives.

As one might notice, there were no VC allocations or private sales, which makes this token launch quite unique. It may be said that Hyperliquid is truly self funded and therefore ensuring a decentralised ownership structure. Additionally, the unlock schedule ensures a gradual release of tokens to protect the token price and maintain a healthy market cap.

Staking on Hyperliquid

Hyperliquid uses delegated proof of stake through its HyperBFT consensus. Validators and delegators together maintain the network, with rewards distributed in HYPE tokens.

Key staking details include:

- Minimum validator requirement: 10,000 HYPE tokens.

- No slashing for errors, but validators can be jailed for poor uptime.

- Seven day unstaking period for security.

- Validator commission capped at one percent.

Users can stake their HYPE through the network’s staking interface or directly via smart contract. This process helps secure the blockchain while providing yield to long term participants. The system rewards active staking participation, creating a secure and decentralised network aligned with its community.

Governance and Community Proposals

Governance on Hyperliquid happens through Hyperliquid Improvement Proposals (HIPs), where token holders decide how the platform evolves.

- HIP 1 created the permissionless token listing system.

- HIP 2 introduced Hyperliquidity, an automated onchain liquidity engine.

- HIP 3 allowed anyone to deploy new perpetual markets by staking HYPE.

These votes show that governance is active and community driven. Token holders shape everything from liquidity systems to protocol rules, ensuring Hyperliquid remains decentralised and adaptive.

Security, Audits, and Transparency

Security is fundamental to Hyperliquid’s design. Its bridge contracts and validator logic have been independently audited by Zellic, and it operates a public bug bounty to encourage responsible disclosure. Additionally, due to the nature of the blockchain, every withdrawal, liquidation, and trade is visible onchain, supporting an open and verifiable environment.

This transparent structure allows users to confirm the protocol’s TVL, open interest, and trading activity directly from the blockchain, reinforcing confidence in its design.

Hyperliquid in Market Action

Hyperliquid proved its scalability and resilience during the largest twenty four hour liquidation event in crypto history that occurred on the 16th of October 2025. On the day more than one thousand wallets on Hyperliquid were completely liquidated, wiping over one point two billion dollars in trader capital as Bitcoin, Ethereum, and other major cryptocurrencies sold off sharply.

Despite the chaos, Hyperliquid remained fully functional, processing every liquidation onchain without downtime or disruption. This event showed both the volatility of leveraged trading and the resilience of the platform’s infrastructure. While billions were liquidated across global cryptocurrency markets, Hyperliquid’s onchain exchange handled record trading volume flawlessly. It was a stress test that underlined what makes Hyperliquid special: speed, security, and transparency even under historic pressure.

Why Hyperliquid Matters for the Future of DeFi

Hyperliquid represents a new generation of crypto trading infrastructure that merges high throughput, robust security measures, and permissionless access.

For traders, Hyperliquid is a fully onchain perpetual exchange with real liquidity, while for developers, it is a smart contract platform where user built applications can plug directly into active markets. Furthermore, for stakers, it offers a decentralised way to earn rewards while supporting one of the most advanced DEX networks in the blockchain space.

As DeFi continues to mature, Hyperliquid is well positioned to lead the move toward a fully onchain open financial system where all trading happens transparently and instantly.

The Hyperliquid Ecosystem

Before concluding, let’s have a quick look at Hyperliquid’s ecosystem which is expanding rapidly, driven by independent builders creating DeFi protocols, trading tools, and blockchain infrastructure. Together, these projects transform Hyperliquid into a full onchain ecosystem where trading, liquidity, and innovation coexist within one transparent financial network. It is worth noting that at the time of writing, according to DeFiLama, the total value locked (TVL) within various protocols on Hyperliquid is that of $2 billion.

Beacon Trade

Beacon Trade develops data-driven DeFi analytics for Hyperliquid. It provides real time blockchain insights, liquidity analysis, and market performance tools that help traders make informed decisions directly within the Hyperliquid ecosystem.

Hypersurface

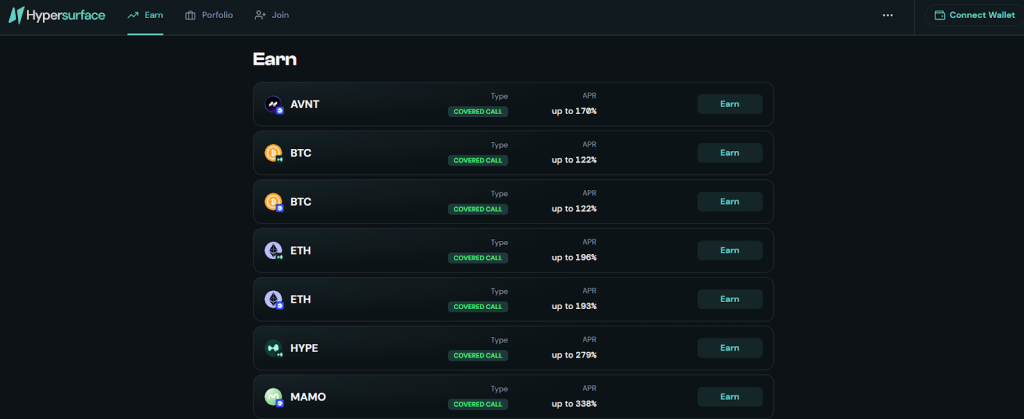

Hypersurface is a DeFi platform offering onchain structured products to help crypto holders earn additional income from assets they already own. Through strategies like covered calls and cash secured puts you retain control by choosing the strike price and the expiry. In a covered call for example you collect a premium by granting someone else the right to buy your asset at your chosen strike. The strategy is fully transparent through smart contracts and your asset remains productive rather than idle. Yield is paid upfront and the terms remain fixed until expiry, and if the option finishes in the money your asset will be sold at the strike. In simpler terms, Hypersurface is designed for individuals, funds and treasuries that want consistent yield from their crypto holdings.

HyperLend

HyperLend is a DeFi lending and borrowing protocol native to Hyperliquid. It allows users to deposit assets, supply liquidity, and earn yield while maintaining full transparency onchain. Integrated directly with Hyperliquid markets, it extends the blockchain’s functionality from trading to decentralised credit.

Kinetiq

Kinetiq introduces liquid staking to Hyperliquid, enabling holders of the HYPE token to stake while preserving liquidity through derivative assets. This strengthens the protocol’s security and increases capital efficiency within the DeFi ecosystem.

Circle and Native USDC

Circle has integrated native USDC and the Cross Chain Transfer Protocol (CCTP) into Hyperliquid. This development enhances blockchain interoperability and brings deep stablecoin liquidity to DeFi protocols operating within the Hyperliquid ecosystem. The importance of this cannot be underestimated as currently, 94.67% of the stable coin marketcap within Hyperliquid’s ecosystem is USDC.

HyperBridge

HyperBridge, built in collaboration with LayerZero, connects Hyperliquid to other major blockchains. Essentially, it allows secure and transparent asset transfers between ecosystems, reinforcing Hyperliquid’s role as a cross-chain DeFi protocol that supports global liquidity.

A Unified DeFi Network

Each project within the Hyperliquid ecosystem strengthens the network’s liquidity, scalability, and decentralisation. Traders gain access to powerful blockchain-based tools, developers can launch DeFi protocols with real utility, and users benefit from an open, high-performance financial ecosystem.

Final Thoughts

Hyperliquid is not just another DEX. It is a self funded, secure, and decentralised blockchain built to power the future of financial applications. Its combination of performance, transparency, and governance sets a new standard for how crypto markets can operate.

If Ethereum introduced programmable money, Hyperliquid is delivering fast, fair and community owned programmable markets. To keep yourself updated with the latest trends in Crypto, follow Simply Staking on X, while also encouraging you to explore Hyperliquid further by interacting with the platform.