As blockchain adoption accelerates and DeFi applications expand, the crypto landscape becomes increasingly complex. With hundreds of chains, numerous ecosystems, various scaling solutions, dApps, and bridges, the environment must accommodate over 22,000 cryptocurrencies, each with unique use cases, token standards, and lifespans. This multi-chain/currency/system complexity is expected to grow as the industry’s focus on modularity intensifies, with the increasing emergence of solutions and startups addressing specific issues or providing niche services. Consequently, both users and developers must familiarise themselves with diverse wallets, interfaces, and systems to navigate the evolving DeFi space.

Read more from our Initia series:

- Initia Staking Guide: How to Stake Initia

- Initia Staking

- Omnitoa Shared Security: A technical Analysis

- Initia Staking APR

However, Initia – a network for interwoven rollups, was created to tackle the above-mentioned challenges by simplifying the user experience via a unified platform that feels as intuitive and interconnected as using a smartphone.

In this piece, we first present Initia and its architecture on a high level, followed by features such as the Enshrined Liquidity, InitiaDEX, Omnitia Shared Security (OSS), and the L1/L2 transaction flow.

What is Initia?

Initia is a primary blockchain (Layer 1) that incorporates advanced technology (Layer 2) to support a network of interconnected, modular sub-networks, enhancing scalability, efficiency, and flexibility within the Inita ecosystem. The harmony between the L1 and L2 is achieved through an Initia-specific technology stack that allows developers to implement chain-level mechanisms that align the economic interests of users and developers across the ecosystem. Effectively, Initia architecturally embeds specific L2s (minitias) into the foundational L1, which is why it is described as a network for interwoven rollups.

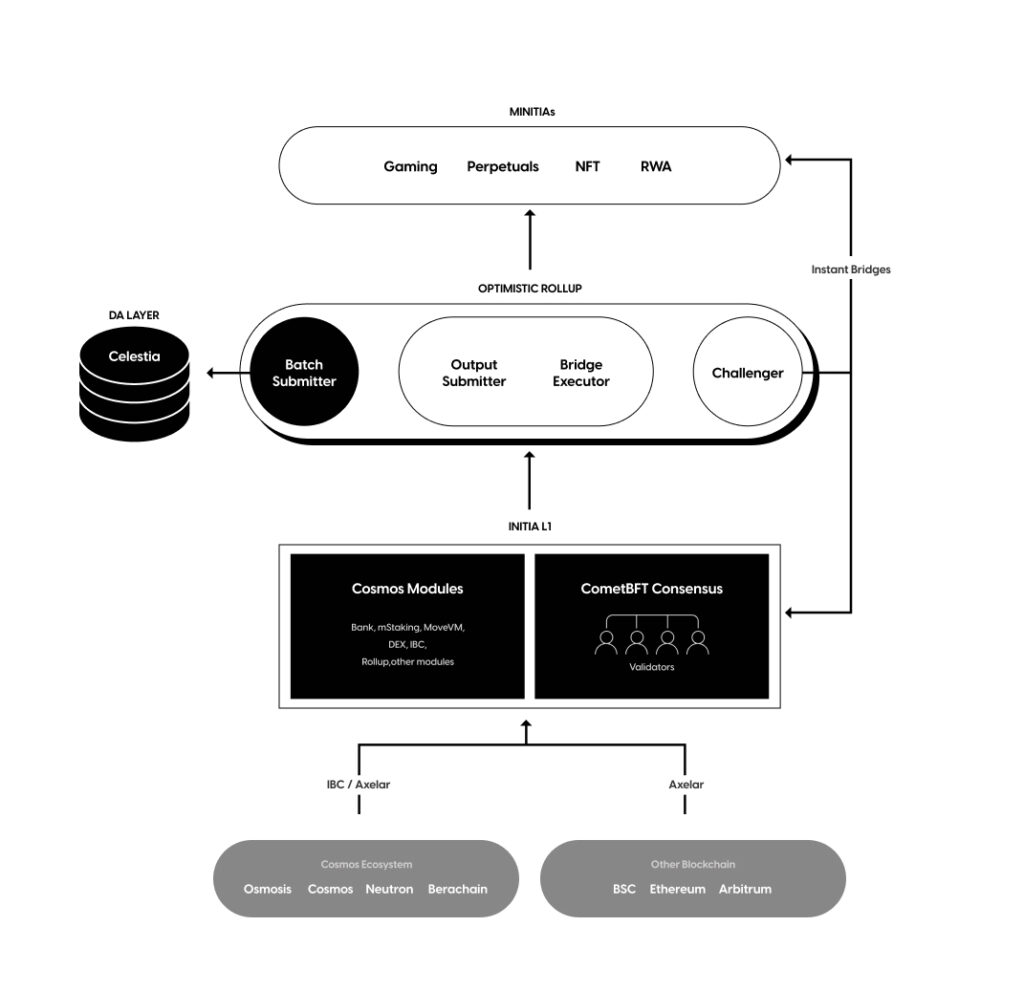

Inistia’s Architecture (A.K.A: Omnitia)

The integration of Minitias with the Initia creates a platform characterised by a 2 layer architecture called the Omnitia. Below we break down the components of this architecture.

- Initia Orchestration Layer (Layer 1): Known as “Initia Base Chain”, this foundational blockchain orchestration layer manages network security, consensus, governance, interoperability, liquidity, and inter-chain messaging.

- Initia Rollups (Layer 2s): Referred to as “Minitia” or mini Initias, these Layer 2 solutions are built on the Initia Base Chain to boost scalability and transaction throughput. They can operate in EVM, MoveVM, or WasmVM environments, utilising the CosmosSDK.

- Initia Optimistic Rollup Framework (OPinit Stack): The OPinit Stack is Initia’s Optimistic Rollup (OR) framework, built using the CosmosSDK, securing Initia Rollups through fraud proofs and rollbacks.

- Interoperability/Bridging Middleware: The Inter-Blockchain Communication (IBC) protocol and selected bridge provider are combined to facilitate seamless cross-chain asset and data transfer as well as transfers between the Layer 1 and Layer 2s within Omnitia.

Overall, Omnitia represents a system that combines Initia Orchestration Layer, Initia Rollups, Initia Optimistic Rollup Framework and Interoperability/Bridging Middleware, therefore creating an ecosystem depicted below.

(Source: Initia docs)

Initia (Layer 1)

The L1 is built on two main pillars of liquidity and security, represented by the Enshrined Liquidity and the Omnitia Shared Security (OSS) frameworks, which are decomposed below.

Enshrined Liquidity

Enshrined liquidity aims to create a liquidity hub within Layer 1 that bolsters security, amplifies liquidity, and acts as an Inter-L2 router, therefore positioning Initia as a chain that fosters an L1/L2 hybrid model. To deliver Enshrined Liquidity, several key components such as Staking, InitiaDEX, Whitelisting, and Governance should come together. We break down each of these components below.

Staking

The Initia L1 architecture is built using the Cosmos SDK, allowing it to leverage the Byzantine-Fault-Tolerant CometBFT for the Delegated Proof-of-Stake (DPoS) consensus and integrates the Move VM (a wrapper connecting Move Runtime to Cosmos SDK) for smart contract functionality. The mstaking module enables multiple tokens to be staked directly with validators to gain voting power, provided these tokens are approved through a Governance whitelist proposal such as INIT-X LP (Liquidity Provider) tokens from InitiaDEX or INIT-USDC.

Simply Stake and Secure your assets with the Ledger wallet!

InitiaDEX

A native Decentralised Exchange (DEX) is incorporated within L1 which, similarly to Balancer, offers Weighted, StableSwap and MinitSwap pools and acts as a bridge between L1 and L2. Besides, the L1 DEX supports both the native INIT token and the pairs of INIT/other tokens that have been whitelisted (INIT-USDC, INIT-stATOM) for staking purposes.

- Weighted Pools: Designed to accommodate assets with different price points, these pools enable efficient trading between assets with varying values. They ensure that liquidity remains optimal, even when trading between assets with significant price differences.

- StableSwaps: These pools are ideal for assets with closely aligned prices, offering efficient swaps with minimal slippage, thus being particularly suited for stablecoins or other assets with similar values.

- MinitSwap Pools: Specifically designed for tokens bridged through the IBC (Inter-Blockchain Communication) and their native Layer 1 counterparts, these pools boost interoperability within the Omnitia ecosystem.

* The pool configuration does not limit the 50-50 split between the INIT and the pair token, as long as INIT is represented as a majority of the pool

Besides establishing the resilient liquidity foundation on the L1, the integrated InitiaDEX allows users to use the liquidity that would traditionally be locked in staking for active trading and yield generation. Token pairs like INIT-LSD, enable users to concurrently earn staking yields, LSD yields, and trading fees.

Furthermore, by using the Just-in-Time Gas feature, L1 users can convert their assets into gas for L2 operations in a single transaction, enhancing flexibility and accessibility.

Minitia-Routing functionality is also introduced that facilitates transfers between L2 chains by routing them through the L1 DEX, hence opening the potential for swaps during the transfer process. The routing functionality establishes a link between the inita and minitias is established to achieve a hybrid L1/L2 model.

Whitelisting

For an LP token to be eligible for staking and earning block rewards on the Initia Layer 1 platform, it must first be whitelisted through the Initia L1 governance process. A key eligibility criteria for whitelisting is that the LP token must include INIT as part of its pair. Specifically, if the LP token is part of a weighted DEX pool, the INIT weight within the pool must be at least 50%. To initiate the whitelisting process, a whitelist proposal must be submitted, including the LP token’s reward weight, which is crucial for determining the distribution of block rewards and is governed by a specific inflation schedule, beyond being calculated using a standardised formula. Tokens within whitelisted LPs can be utilised for gas payments on the L1, broadening their utility beyond yield generation, trading, and swapping.

Governance Power

A staker’s governance power on the Initia L1 platform is based on the total number of staked INIT tokens, including both solo INIT and LP pair tokens. Governance power is measured in INIT, combining the balance of staked solo INIT and the INIT value of staked LP tokens and it is not influenced by the reward weight of an LP token.

To eliminate the impact of external assets on governance, the voting power of an LP token is determined by the amount of INIT in the pair at the time of the snapshot for a proposal, ensuring that potential swaps in liquidity pools do not affect the ongoing voting proposals.

Overall, the Enshrined Liquidity model enhances staking rewards since LP stakers benefit from swap fees, the yield from other tokens within the pair, and exposure to additional assets of interest, while diversifying security by reducing dependence on the volatility of solo INIT.

Omnitia Shared Security (OSS)

The OSS is a scalable security framework designed to safeguard assets across millions of Minitias that can be interwoven into Initia. In cases of fraud challenges on an L2, the L1 validator set is called upon to resolve the dispute. It is possible to call the L1 set to take care of L2 thanks to the integration of Celestia light nodes within the validator nodes, which enables data verification across Minitias without downloading complete blocks. The reliance on the Initia Layer 1 for security and data settlement enables the integration of advanced rollup functionalities and the use of standard Cosmos SDK modules like AuthZ and Feegrant, as well as custom modules like the Skip Protocol’s Proof-of-Burn (POB).

(Source: Initia docs)

The Key Components of OSS include:

- Shared Data Availability Layer: Provides the Initia Layer 1 validator set, challengers, and bridge operators with access to the state data required to construct fraud proofs against invalid rollup operations.

- Direct Posting to Celestia: Allows Minitias to post transaction data directly to Celestia, enabling deterministic verification of the rollup chain’s state transitions.

- Data Verification: Utilises Celestia’s Namespaced Merkle Trees (NMT) and Data Availability Sampling (DAS), enabling relevant actors to download and verify only the necessary transactions, optimising resource usage

Initia OSS serves as a security foundation for the Minitias and the wider Omnitia ecosystem, and Simply is happy to be contributing to its robustness as a validator! You can delegate to us through our networks page.

Minitias

Minitias are Layer 2 application chains within the Initia ecosystem, functioning as fully operational Cosmos SDK blockchains that utilise optimistic rollups for settlement. These high-performance chains feature rapid block times of 500 milliseconds (ms) and can handle over 10,000 transactions per second (TPS), making them suitable for a variety of applications. In addition to inheriting security and interoperability from Initia, Minitias offer other features such as the OPinit Stack and Out-of-the-Box solutions for developers.

The OPinit Stack

As mentioned, the OPinit Stack is Initia’s Optimistic Rollup (OR) framework, built using the Cosmos SDK, securing Initia Rollups through fraud proofs and rollbacks. OPinit is VM-agnostic, meaning that Minitias can support various virtual machines, including MoveVM, WasmVM, and EVM, hence allowing Minitias to accommodate a broad spectrum of applications and developer preferences.

Out-of-the-Box Solutions for Developers

Minitias offer a set of built-in features for developers, including:

- Instant bridging & access to native USDC and Circle’s Cross Chain Transfer Protocol (CCTP)

- Token fungibility across different virtual machines

- Pre-built Oracle interfaces and fiat gateways

- Frontend widgets for easy access on the end-user side

The above resources significantly lower the workload for developers on Minitias, allowing them to optimise resources instead of tackling infrastructural barriers.

Transaction Flow (L1 & L2)

The transaction lifecycles on L1 and L2 have both differences and similarities. Below we break down each step and show how L2 transactions are connected to L1.

L1 Transaction Flow:

- Transaction Submission: When a transaction is submitted, it undergoes a check process. If valid, it enters the mempool; if invalid, an error response is delivered.

- Mempool Validation: Once a transaction is submitted a block is created, and the mempool performs a recheck to filter out those transactions that failed due to state changes during block execution

- Transaction Propagation to Validators: Once a transaction successfully enters the mempool, all nodes share it through peer-to-peer (p2p) communication, ensuring it reaches the block-generating validator.

- Block Generation (Execution): A chosen validator creates a block using the transactions in the mempool, following the CometBFT rules.

L2 Transaction flow:

The steps of Transaction Submission, Mempool Validation, Transaction Propagation to Sequencers and Block Generation are identical to L1 as Minitias need to inherit the security of the foundational Initia layer, meanwhile offloading the computational overhead from it.

Once the blocks are generated off L1, they are ready to be posted to Initia, through the following steps:

- L2 Output Submission to L1: After an epoch of blocks is generated, the L2 state root is submitted to L1 for finalization.

- Finalisation Period: A 7-day period is set aside for the challenge period of the optimistic rollup (transactions are assumed to be valid by default but for fraud proofs can be submitted within a challenge period to ensure correctness).

- Finalized: If no fraud is poved, the transaction is confirmed.

Interacting with Initia

Initia prioritises an intuitive interface and coupes it with a one-stop-shop approach to achieve a seamless user experience. To this end, it has developed multiple complementary tools:

Wallet – Chrome extension wallet that allows users to access Initia dApps within a web browser environment.

Initia Usernames – Blockchain-wide on-chain identity system, much like an Ethereum Name Service (ENS).

InitiaScan – A multi-chain explorer with Virtual Machine-specific tools and information in one place.

Initia App – Centralised platform for all things related to Initia including swaps, LP, staking, and more.

Faucet – Your first step for developers to receive testnet INIT tokens and interact with the Initia Testnet.

Bridge – A place to transact multiple tokens and pairs from L1 to L2.

Conclusion

In conclusion, Initia presents a sophisticated solution for navigating the complexities of the blockchain and DeFi landscapes by offering a unified platform that seamlessly integrates Layer 1 and Layer 2 functionalities. Its architecture, comprising the Initia Orchestration Layer, Initia Rollups, and the OPinit Stack, provides enhanced scalability, security, and interoperability. By leveraging advanced technologies such as Celestia’s Namespaced Merkle Trees and Data Availability Sampling, Initia ensures efficient transaction validation and data verification. Furthermore, with built-in developer tools, a robust governance framework, and innovative liquidity solutions like InitiaDEX, Initia simplifies the user experience while fostering a modular and interconnected ecosystem. This network for interwoven rollups positions itself as a high-performance platform capable of accommodating the evolving needs of the DeFi space.

Disclaimer: This article contains affiliate links. If you click on these links and make a purchase, we may receive a small commission at no additional cost to you. These commissions help support our work and allow us to continue providing valuable content. Thank you for your support!

Disclaimer: This article is provided for informational purposes only and is not intended as investment advice. Investing in cryptocurrencies carries significant risks and is highly speculative. The opinions and analyses presented do not reflect the official stance of any company or entity. We strongly advise consulting with a qualified financial professional before making any investment decisions. The author and publisher assume no liability for any actions taken based on the content of this article. Always conduct your own due diligence before investing.