The Layer-2 Revolution Unlocking Scalability, Speed, and DeFi on Bitcoin

Over the past years, Bitcoin’s rise has been nothing short of spectacular, fundamentally going from strength to strength regardless of its price, crypto scandals and general market sentiment. The biggest cryptocurrency of them all successfully managed to cement itself as the new gold due to its unique properties, but although the store of wealth argument is valid, Bitcoin is much more than that! Sure, its first, and arguably most important use case to be a new digital world reserve currency, but what if it could be more? The Bitcoin network is a network of trust. A network without any centralised parties could be used to do so much more than simply being digital gold.

A testament to this is the current Bitcoin Layer 2 landscape, which in the past couple of years, has seen a meteoric rise. A clear shift to build on the most secure and decentralised network on the planet has been evident, and therefore, we think now is the right time for us to have a closer look! But first, let’s make sure we understand what Bitcoin Layer 2s are!

What Are Bitcoin Layer 2 Solutions and Why Are They Important?

Bitcoin L2s are quickly becoming one of the most important developments in the crypto ecosystem. These layer 2 solutions are protocols built on top of the Bitcoin blockchain to solve scalability issues and enable faster and cheaper transactions off the main chain. Bitcoin L1 was designed to prioritise simplicity and security, which means it does not support smart contract functionality on its own. This is where layer 2s come in. These secondary protocols improve transaction speeds, reduce fees, and unlock entirely new use cases for Bitcoin, including smart contracts, token creation, and DeFi applications. Whether it’s the Liquid Network, Rootstock, or newer layer 2 projects, each Bitcoin layer 2 solution plays a key role in expanding the Bitcoin ecosystem. These protocols are often built as sidechains or execution layers, making them compatible with Bitcoin while supporting assets on the Bitcoin network such as tokenised securities, wrapped Bitcoin, or even DeFi apps.

From lending protocols on Bitcoin L2s to contracts on the Bitcoin network, we’re seeing an entirely new Bitcoin layer form on top of the main Bitcoin blockchain. These secondary layer solutions include all projects that aim to enhance Bitcoin by enabling high-performance apps and services without changing the protocol itself. As more assets are bridged into Bitcoin L2s, and more protocols built on Bitcoin continue to grow, we are looking at a future where the Bitcoin L2 sector plays a central role in bringing the best Bitcoin experience to both developers and users.

How Do Layer 2 Solutions Help Bitcoin Overcome Scalability Problems?

Bitcoin is famously secure, but not exactly fast. Its limited transaction capacity makes it hard to use for everyday payments or advanced applications like DeFi. This is where Layer 2 solutions make a difference. By moving transactions off the main Bitcoin chain and into separate execution layers, these networks improve throughput and reduce costs. Whether it is a payment or a complex smart contract, Bitcoin Layer 2s make it easier and more efficient to get things done using BTC.

To help guide us through this, we are going to divide the current Bitcoin L2 landscape into 4 categories, which are State Channels, Side Chains, Smart Contract Layers and Experimental Layer 2s.

State Channels: Lightning Network

Let’s start our deep dive with the Lightning Network, Bitcoin’s original Layer 2 and still the most widely adopted to date whose whitepaper written by Joseph Poon and Thaddeus Dryja was published in January 2016. Lightning is all about making Bitcoin payments faster and cheaper by taking transactions off-chain. It uses something called state channels, which act like private tabs between users. Once a channel is open, people can send BTC back and forth instantly, and only the final balance gets recorded on the blockchain. That means fewer fees, faster transactions, and much more scalability.

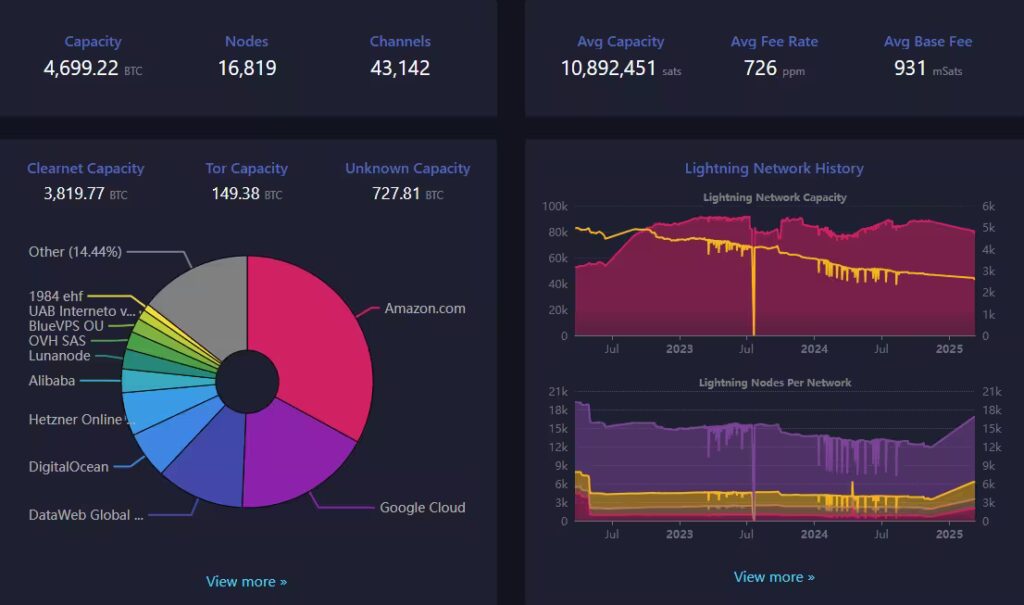

The Lightning Network has been live on Bitcoin’s mainnet since 2018 and is now integrated into major wallets, exchanges, and even apps like Cash App, Kraken, and OKX. It is safe to say that quietly, it is powering a big chunk of Bitcoin payments behind the scenes while at the same time, on the development front, the network is in great shape as there are several independent implementations including LND, Core Lightning, and Eclair, working to build and push the ecosystem forward.

Currently the network has a capacity of 4700 BTC and is secured by approximately 16 800 nodes, while the total number of channels is around 44 200.

Understanding Sidechains: What Are Liquid and Rootstock?

What are Sidechains? Sidechains are independent blockchains that operate in parallel with Bitcoin, allowing users to transfer BTC between the two networks. They give developers the opportunity to try out new features such as faster transactions or smart contracts without putting Bitcoin’s base layer at risk. You can think of them as a kind of playground for innovation which is still connected to Bitcoin’s solid foundation. Let’s have a look at 2 of these Sidechains.

Liquid Network: A Trusted Player in the World of Bitcoin L2s

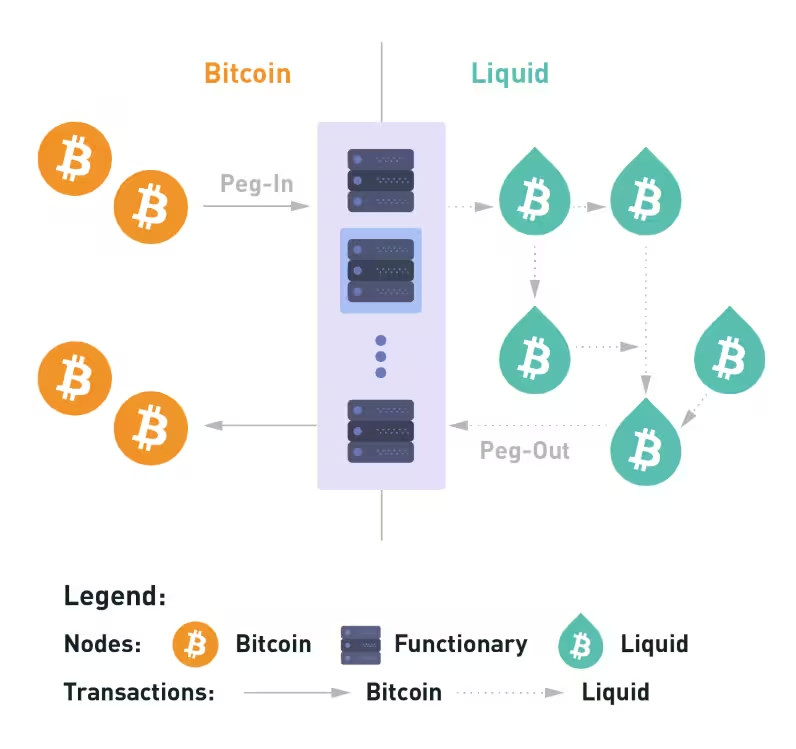

Developed by Blockstream, a blockchain technology company which is led and co-founded by Adam Back (yes, the same Adam Back referenced in the Bitcoin Whitepaper), the Liquid Network is able to offer 1-minute blocks, faster transfers, and private transactions via Confidential Transactions.

The Liquid Network has become a favourite among exchanges and professional traders thanks to its focus on speed and privacy. With fast block times and support for Confidential Transactions, it allows users to move BTC and tokenised assets quickly and discreetly. This is especially valuable in high-volume or arbitrage trading environments where timing and privacy matter. Liquid also makes it possible to issue tokenised versions of traditional assets such as securities or stablecoins, creating a bridge between the world of traditional finance and the Bitcoin ecosystem. Exchanges like Bitfinex have adopted Liquid to streamline transfers and support new types of financial products, all while relying on Bitcoin’s underlying security.

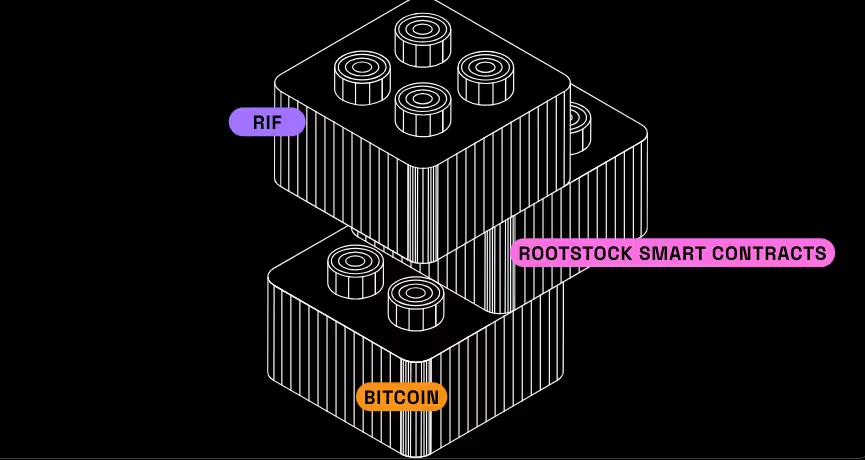

Rootstock (RSK): Bringing DeFi to the Bitcoin Ecosystem

The second Bitcoin Sidechain that we will be covering is Rootstock. Rootstock, or RSK, brings Ethereum-style smart contracts to the Bitcoin ecosystem. It is compatible with the Ethereum Virtual Machine and secured by Bitcoin miners through a process known as merged mining. This means it benefits from Bitcoin’s security while offering a familiar development environment for builders coming from Ethereum. RSK has been live since 2018 and currently powers a growing list of decentralised apps, including Sovryn for DeFi and Money on Chain for stablecoins. Developers have built over 150 apps on the network so far, and thanks to support for Solidity and MetaMask, it offers a smooth onboarding experience for those already familiar with Ethereum tools. RSK uses RBTC, which is pegged 1:1 with BTC, to fuel transactions and smart contracts. There is also RIF, a separate utility token used for services like identity, payments, and storage within the broader Rootstock ecosystem. Looking ahead, the team is working on expanding decentralisation, aims to improve scalability, and adding more flexibility for app developers.

Smart Contracts on Bitcoin: How Stacks Brings Programmability to BTC

Before diving into Stacks, let’s first understand what is meant by Smart Contract Layers. Smart Contract Layers are networks that work alongside Bitcoin to give it new powers—especially programmability. Bitcoin itself wasn’t built with smart contracts in mind, so developers have created additional layers that settle on top of it. These layers allow builders to launch apps, create tokens, and enable features like lending or trading, all while keeping Bitcoin as the foundation. One of the most prominent examples is Stacks.

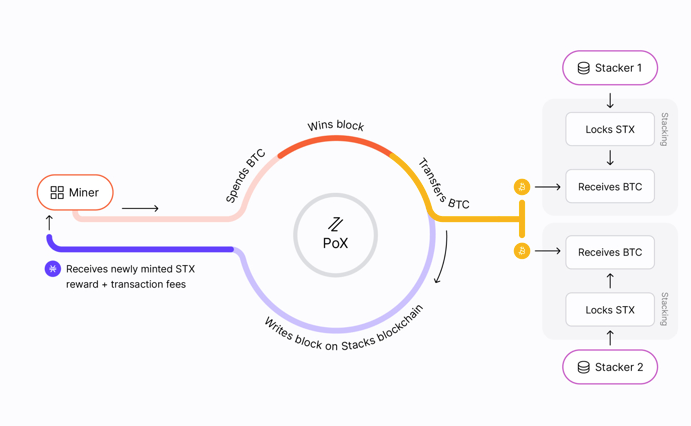

Stacks works by using a consensus mechanism called Proof of Transfer, or PoX for short, where miners spend BTC in order to secure the network. This system anchors Stacks to Bitcoin while giving it its own smart contract functionality. Contracts are written in a purpose-built language called Clarity, which is designed for security and transparency and can even read the state of the Bitcoin chain.

Stacks launched its mainnet in 2021, and since then, it has grown into one of the most active developer ecosystems building on Bitcoin. In 2024, it took a huge leap forward with the Nakamoto upgrade. This upgrade introduced faster finality and a trust-minimised two-way BTC peg known as sBTC, unlocking a major milestone for Bitcoin-native smart contracts. So far, the community has deployed over 5,000 smart contracts across areas like DeFi, NFTs, and even social apps, all powered by Bitcoin.

The network runs on the STX token, which is used to pay for contract execution and secure the protocol. You can also choose to “stack” STX, which allows participants to earn BTC rewards by supporting the network’s security.

Looking ahead, the focus is on delivering the full vision of sBTC, improving the developer experience, and making Bitcoin feel just as programmable as any modern Layer 1. The goal is simple but powerful: unlock the full potential of Bitcoin without changing its core.

Let’s now move on to discuss other Bitcoin Layer 2s that are testing bold new ideas.

Experimental Layer 2s: Citrea, BitVM, RGB, Botanix and Babylon.

Let’s start by defining what we mean by experimental Layer 2s. For the context of this article, experimental Layer 2s are often early-stage projects exploring cutting-edge ways to extend what Bitcoin can do. They often focus on advanced technologies like zero-knowledge proofs or off-chain computation, aiming to make Bitcoin more programmable, private, or efficient. While many are still in development, they offer a glimpse into what the future of Bitcoin could look like beyond payments and basic transfers.

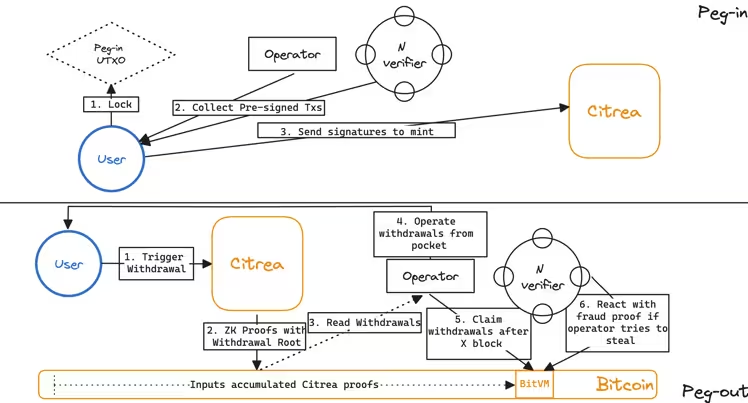

Citrea (ZK Rollup): Bringing Ethereum Style Scalability to Bitcoin

Citrea is the first zero-knowledge rollup built specifically for Bitcoin, and it’s aiming to bring serious scalability and programmability to the table. It runs an EVM-compatible environment where developers can build apps using familiar Ethereum tools, while posting zero-knowledge proofs directly to the Bitcoin blockchain. This means apps can run efficiently off-chain, while still inheriting Bitcoin’s trusted security. Although Citrea is still in development, excitement around it is already growing. It has attracted interest from both Ethereum and Bitcoin communities and is an active member of the BitVM Alliance, working closely with infrastructure partners to bring its vision to life.

It is interesting to note that Citrea has not announced a native token. The goal is to keep things Bitcoin-native by using BTC for all network fees. Looking ahead, the team plans to launch a public testnet, release detailed peg mechanics, and expand zero-knowledge capabilities. In the long run, Citrea aims to deliver fully trustless rollup verification on Bitcoin which is something that could change the game for smart contracts and scalability across the ecosystem.

Considering that BitVM was mentioned, let’s invest sometime to understand what BitVM is.

BitVM: A Novel Approach to Solving Bitcoin’s Scalability Issues

Essentially, BitVM is an experimental proposal that reimagines what programmability could look like on Bitcoin without needing to change Bitcoin’s consensus rules. Instead of adding smart contracts directly to the base layer, BitVM introduces a clever off-chain model that uses fraud proofs to verify computations between two parties. Think of it as a challenge-response system where one party runs a program, and the other can prove if they’re cheating. If fraud is detected, the issue is resolved using Bitcoin’s existing rules.

At this stage, BitVM is still deep in the research phase. There’s no testnet or live implementation yet, but the idea has already caught the attention of advanced Bitcoin developers. True to Bitcoin’s ethos, there’s no native token involved and everything runs on BTC and game theory, keeping it lean and aligned with decentralisation. The roadmap includes building developer libraries, extending support to multiparty applications, and enabling secure cross-chain bridges. While it’s still early days, BitVM opens up a fascinating new path for bringing programmability to Bitcoin without rewriting its foundations.

To help move BitVM from concept to reality, the BitVM Alliance was formed by Robin Linus and Lukas George. This collaborative effort brings together leading teams like Bitlayer, Citrea, Element, Fiamma, Strata, and ZeroSync. Together, they aim to fast-track development, share knowledge, and build secure infrastructure, including the first trust minimised bridges that can bring BitVM’s vision to life.

RGB: A Privacy Focused Scaling Solution for Bitcoin Assets

RGB is a smart contract and token protocol that lets you build on Bitcoin without putting the activity directly on-chain. Instead, everything happens off-chain and settles back to Bitcoin when needed, making it both scalable and efficient. Privacy comes built in from the start, and it even works over the Lightning Network, meaning you can issue and move assets like stablecoins and NFTs with speed and discretion.

Launched in 2023, RGB is already live and being used by developers and projects focused on asset issuance. The community behind it is small but passionate, and support from wallets and exchanges is steadily growing as adoption picks up. True to Bitcoin’s ethos, RGB doesn’t rely on a native token. Fees are paid in BTC, keeping things simple and aligned with the broader Bitcoin ecosystem.

Let’s now discuss Botanix!

Botanix (Spiderchain): An Ethereum Compatible Sidechain Secured by Bitcoin

Botanix is building something called the Spiderchain, which is a decentralised sidechain that is compatible with the EVM and secured by staked Bitcoin. Unlike traditional sidechains that rely on a central federation, Spiderchain uses a rotating network of multi-signature wallets to keep BTC safe and secure. This design lets developers build and deploy smart contracts using familiar EVM tools, all while using Bitcoin as the underlying asset for security.

Botanix is currently live on testnet, with a mainnet launch planned for 2025. Several DeFi applications are already up and running on the testnet, and the project has been steadily expanding through active grants and partnerships. Looking ahead, the roadmap includes launching the mainnet expected to happen by Q2 of this year!

Babylon: Strengthening Crypto Security with Bitcoin

The last project that we will be covering is Babylon. Babylon is interesting as it takes a different approach from most Bitcoin Layer 2 projects. Instead of focusing on payments or smart contracts, it introduces a new way for Bitcoin to play a key role in securing other blockchain networks—specifically, proof-of-stake chains. At its core, Babylon is a staking and security protocol that lets BTC holders help protect PoS networks without wrapping their Bitcoin or moving it off-chain. Users lock their BTC on the Bitcoin base layer, and this locked BTC acts as a cryptographic commitment that can be slashed if validators on those PoS chains misbehave. It’s like lending your Bitcoin’s credibility to other ecosystems and earning rewards in return, all while keeping your BTC safe and under your control.

If you are interested in learning more about Babylon, we highly encourage you to click here to read more!

Conclusion

Bitcoin’s Layer 2 ecosystem is no longer just an experiment. It is becoming a vibrant, practical extension of what Bitcoin can do. From instant payments to smart contracts and secure staking, these new layers are turning Bitcoin into something you can build with, not just store. The momentum is real, and we feel that it is only getting started.

Want to stay ahead of what is happening in the Bitcoin Layer 2 space? Follow @SimplyStaking on X for more insights, updates, and guides!

Additional Resources

- Lightning Network – https://lightning.network

- Liquid Network (Blockstream) – https://blockstream.com/liquid

- Rootstock (RSK) – https://www.rsk.co

- Stacks – https://www.stacks.co

- Citrea – https://www.citrea.xyz

- BitVM – https://bitvm.org

- RGB Protocol – https://rgb.tech

- Botanix (Spiderchain) – https://www.botanixlabs.xyz

- Babylon – https://www.babylonlabs.io