Ever felt like everything is getting more expensive faster than the news reports say? Groceries, rent, bills, you name it. Your wallet is screaming, but the official numbers barely seem to reflect this reality. Are you imagining all of this? Well, probably not. The way we measure inflation might actually be broken.

Most of us just accept those numbers as the truth, without questioning where they come from or how they are calculated. But what if there was a better way? A way to track inflation in real time, with full transparency and no hidden strings?

That is exactly what Truflation is aiming to do, and in this article, we are going to explore how it works, why it matters, and how it could reshape the way we understand the economy.

What Is Truflation and Why Real-Time Inflation Data Matters

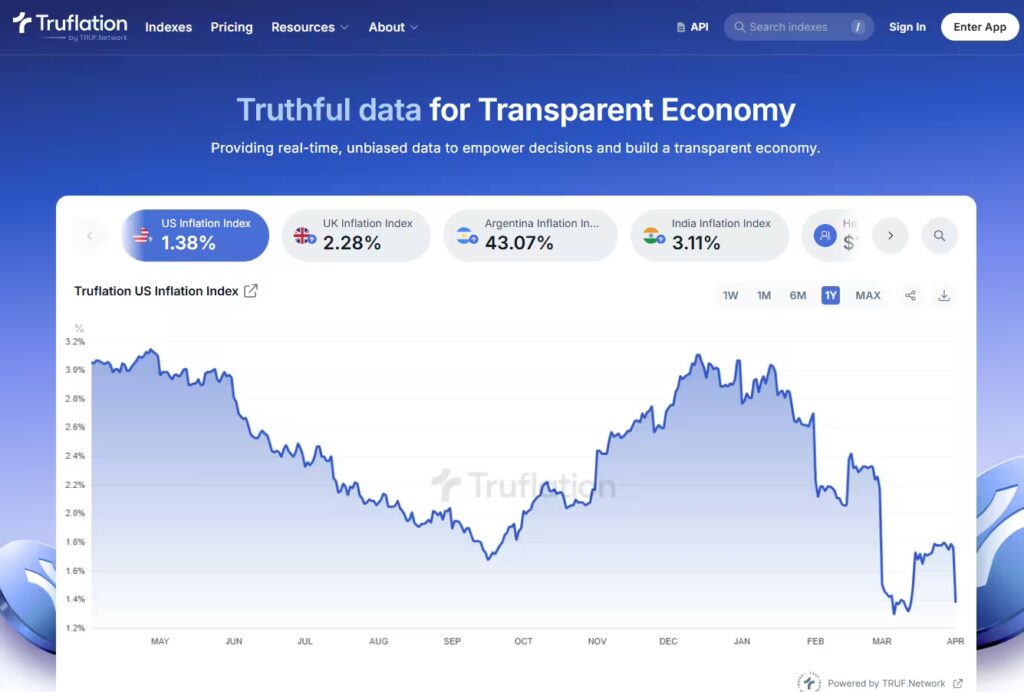

Truflation is building a new way to track inflation and economic trends. Instead of relying on slow, centralised government reports, it offers real-time data that anyone can access. The platform pulls in information from dozens of trusted sources and uses blockchain technology to keep everything transparent and tamper-proof.

At its core, Truflation wants to change how we understand the economy. It is on a mission to make financial data open, accurate, and truly decentralised. By shifting control away from traditional institutions, it gives people and developers better tools to make informed decisions about money and markets.

The Evolution of Truflation

Truflation started its journey in December 2021 with a bold question. What if we could measure inflation better? Faster? More transparently? Back then, most people relied on monthly reports like the US Consumer Price Index. These figures often lagged behind what was actually happening in the real world. Prices were rising, but official stats seemed stuck in the past.

Not only were these traditional metrics slow, but they were also hard to understand and even harder to verify. Most of us never question where inflation data comes from or how it is calculated. We just take it as fact. Truflation wanted to change that.

Its first big milestone was the launch of a real-time US CPI index. Instead of using outdated surveys or closed-door estimates, Truflation built something entirely new. It tapped into live pricing data from over 30 trusted sources including retailers, public databases and research institutes. The result was an inflation index that updates daily and reflects what is really going on in the economy.

But collecting data is only part of the equation. Truflation also developed a full end-to-end methodology to transform raw numbers into reliable and transparent inflation metrics. The process follows seven core steps. Each one is designed to reduce bias, improve clarity and reflect modern economic realities.

Let’s walk through what that looks like.

Step One – Household Expenditure

Truflation starts by defining what it wants to measure. It uses twelve household spending categories that reflect real-life budgets and can be applied across different regions.

Step Two – Data Sources

It gathers prices from a wide mix of sources, including commercial data, public records and credit card transactions. All new sources are tested before going live.

Step Three – Ingesting the Data

Fresh data is pulled in every day, then checked for accuracy and compared to historical trends. There is always at least thirteen months of data for reliable comparisons.

Step Four – Normalisation and Indexing

The data is cleaned and scaled to match a standard base from one January twenty ten. This helps track long-term changes clearly.

Step Five – Weighting Categories

Each spending category is given a weight based on how important it is in everyday life. These weights are reviewed each year.

Step Six – Bringing it all Together

The category indexes are combined into one overall inflation figure. This is done using a weighted average.

Step Seven – Publishing the Results

Truflation shares the current and year-old data, along with the percentage change. It now offers over thirty different indexes, all available both online and on-chain.

Each of these steps reflects Truflation’s commitment to doing things differently. Instead of hiding behind complex models or waiting weeks for updates, it puts the data out there for everyone to see. It adapts to how people actually live and spend. It builds trust through openness.

As explained in their January twenty twenty four article titled Everything You Need to Know About Truflation’s Index Methodology, the team set out not to copy what already exists but to rethink inflation tracking from the ground up.

Transition to TRUF.Network

As Truflation started to grow, so did the needs of its user base. Some people came looking for inflation and economic trends and insights, while others wanted tools to build decentralised apps with reliable data. Therefore, to better support both communities, Truflation made a bold move in December 2024 to split its core offering into two dedicated platforms, Truflation.com and the TRUF.Network.

On one side, Trueflation.com is now the home for investors, analysts and anyone who wants to explore economic data through charts, dashboards and clean visual tools. It is designed to help people understand the numbers and make more informed decisions.

On the other side is TRUF.Network. This platform is built for developers who want to use Truflation’s real-world data inside decentralised applications. The platform brings together accurate data and on-chain infrastructure so anyone can build tools, indexes and even synthetic markets that reflect the real economy. What makes TRUF.Network exciting is how much power it gives back to the user. Instead of relying on centralised sources, data is processed through a decentralised network of nodes, which in practice means more transparency, more security and fewer single points of failure.

Diving deeper, one must say that some of the data is impressive. TRUF.Network pulls in over thirty million data points from more than eighty sources, which include pricing data, housing trends, commodity markets and more. Furthermore, the platform is updated daily and gives developers access to a growing library of indexes that reflect what is really happening in the economy.

For builders, TRUF.Network is more than just data. It is a toolkit. You can create your own indexes, tokenise real-world assets or power the next generation of DeFi protocols, while all being backed by a decentralised engine that ensures accuracy and accountability at every step.

This shift is about more than just organisation. It is about unlocking the full potential of Truflation’s vision. By separating the platform into two distinct parts, Truflation is creating space for deeper insights, stronger tools and more innovation. Whether you are reading the data or building with it, there is now a place for you.

What is Truflation: The TRUF Token

In the Truflation ecosystem, the TRUF token serves as the economic backbone, facilitating various functions that ensure the network’s efficiency and decentralization.

Purpose and Utility

The TRUF token is integral to the Truflation Stream Network (TSN), offering three primary utilities. First of all, the digital asset is used for Data Provider Node Operation. This means that data providers must stake TRUF tokens to join the network, demonstrating their commitment and aligning their interests with the protocol’s objectives.

The second use of the token is for data provision and consumption. Users access Truflation’s data services by paying with TRUF tokens, which in turn, these payments are then distributed to reward data providers and contributors, fostering a sustainable data-sharing environment.

The third use is for governance participation where TRUF token holders can engage in protocol governance by staking and locking their tokens for specified periods. This process grants them Vote-Escrow TRUF (veTRUF) tokens, which confer voting rights in various decision-making proposals within the ecosystem.

Staking Program

The staking mechanism within Truflation is designed to incentivise active participation and long-term commitment. How does this mechanism work? Stakers lock their TRUF tokens to receive veTRUF tokens, with the amount of veTRUF determined by the quantity of TRUF staked and the duration of the stake. This system encourages longer staking periods by offering greater governance influence and potential rewards.

Rewards are allocated proportionally based on each participant’s share of the total veTRUF pool. As the number of stakers and the total amount staked increase, individual Annual Percentage Yields (APYs) may adjust to reflect the broader distribution.

Since its inception, the staking program has witnessed substantial engagement. In its first month, 273 stakers participated, collectively staking 13,825,000 TRUF tokens, with an average APY of 60%. This growth underscores the community’s confidence in Truflation’s vision and the TRUF token’s utility.

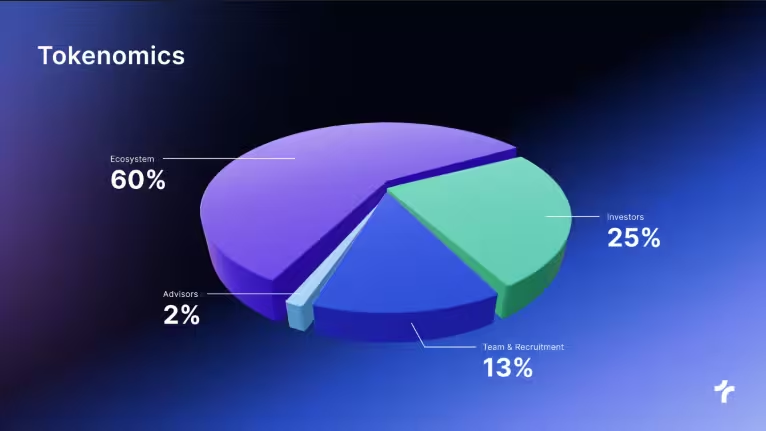

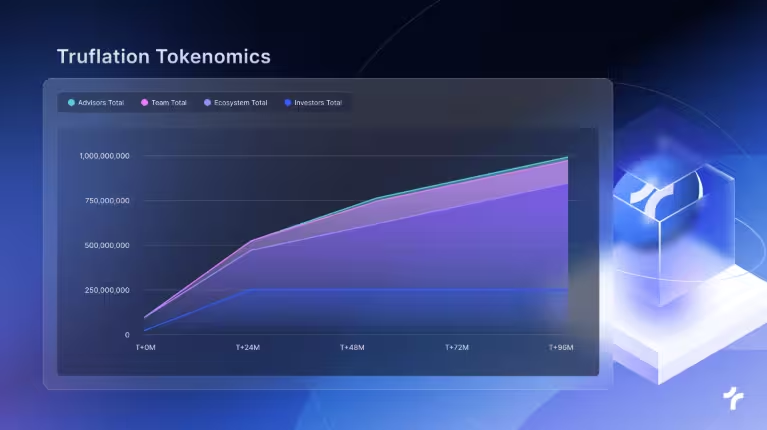

Tokenomics

At launch, the TRUF token supply was capped at one billion tokens. 25% of the token supply is allocated to long-term investors and early backers to help bootstrap growth, with a vesting schedule of 5% at Token Generation Event (TGE) and daily linear release over 24 months. 13% is reserved for the core development team and recruitment, with a 6-month cliff and daily linear release over 48 months. Advisors where allocated 2% of the supply with a 12-month cliff and daily linear release over 48 months while the rest of the 60% were dedicated to ecosystem growth rewards and liquidity supplied to exchanges, with 13.58% at TGE, followed by 0.96% monthly for 10 months, and 0.89% monthly for the next 86 months.

This structured allocation and vesting schedule aims to ensure the long-term sustainability and decentralisation of the Truflation ecosystem. By integrating staking, governance, and data access functionalities, the TRUF token not only fuels the Truflation ecosystem but also empowers its community to actively shape the platform’s future.

Recent Developments and Partnerships

Truflation has recently achieved significant advancements through product enhancements and strategic partnerships, reinforcing its role as a leader in real-time economic data provision.

Product Updates

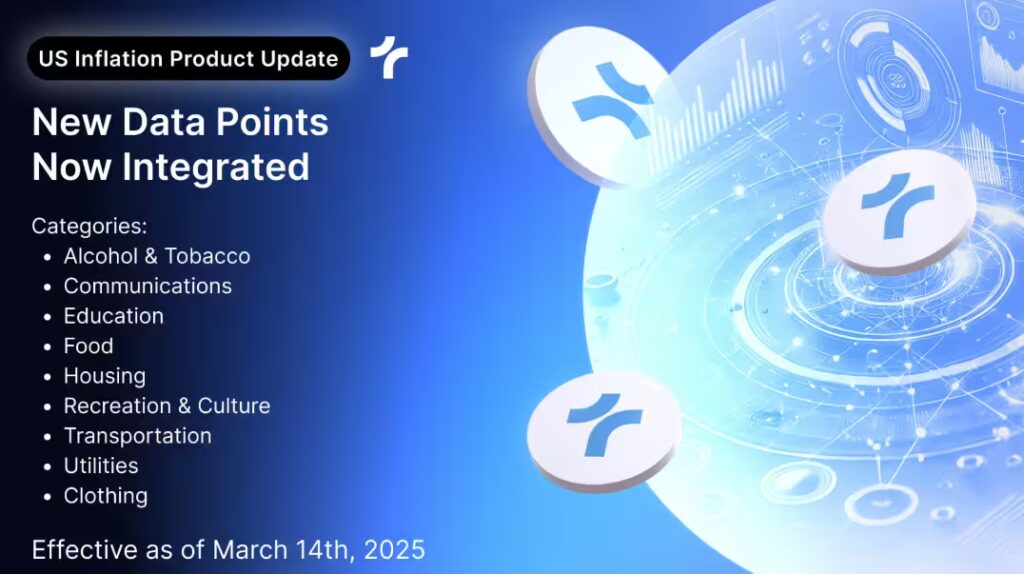

In March 2025, Truflation announced an update to its US inflation index by integrating new data points from Numbeo. This enhancement aims to provide a more comprehensive and accurate measurement of inflation, ensuring users have access to the most up-to-date information. By incorporating Numbeo’s extensive dataset, Truflation continues to refine its methodologies to reflect real-world economic conditions more precisely.

Strategic Collaborations

Truflation has also formed key partnerships to expand its accessibility and drive innovation within the DeFi space. A notable collaboration is with BitGo, a pioneer in digital asset financial services. This partnership aims to enhance the accessibility of Truflation’s native token, TRUF, for institutional investors, marking a significant milestone in the DeFi sector. By leveraging BitGo’s secure and compliant custody solutions, Truflation seeks to bridge the gap between traditional finance and decentralised platforms, fostering broader adoption and trust in blockchain-based financial services.

These developments underscore Truflation’s commitment to providing accurate economic data and fostering innovation through strategic alliances.

Community Engagement and Future Outlook

Truflation is actively fostering a vibrant community and charting a course for future growth through various initiatives and strategic plans.

Community Initiatives

To encourage developer participation and innovation within its ecosystem, Truflation has launched the Merge & Earn Grant Program, offering $100,000 in rewards. This initiative aims to connect data consumers with talented developers, enhancing the TRUF.Network by integrating diverse data sources and applications. By providing financial incentives, Truflation seeks to cultivate a collaborative environment where developers can contribute to the platform’s evolution and utility.

Vision Ahead

Looking forward, Truflation is committed to continuous improvement and expansion. The platform plans to introduce new products and indices, focusing on synthetic indexes as a market trend. Collaborations with partners like Levitate Labs are crucial for expansion into new countries, including India.

Additionally, Truflation is dedicated to enhancing accessibility in financial markets and sharing insights on economic trends and predictions. The platform aims to innovate within the index realm, developing tools that track companies entering and exiting major indices like the S&P 500. These efforts reflect Truflation’s commitment to providing real-time, unbiased data to empower decisions and build a transparent economy.

Through these community-focused initiatives and forward-looking strategies, Truflation aims to solidify its position as a leader in decentralized finance, offering valuable tools and data to users worldwide.

Conclusion

From its bold beginnings to its most recent innovations, Truflation is on a mission to rethink how we measure, share and use economic data. It is building tools that are faster, fairer and more transparent than anything we have seen before. Whether you are a builder, investor or just curious about where crypto and finance are heading, Truflation offers something worth paying attention to.

If you are ready to dig deeper, we encourage you to visit TRUF.Network to explore developer tools and staking opportunities! Additionally, if you enjoyed this article, follow Simply Staking on X for more beginner-friendly guides, project breakdowns and crypto insights.