Polymarket Liquidity Rewards Explained: How to Make Money on Prediction Markets

This article introduces Polymarket Rewards and Polymarket as a platform, one of the most popular prediction markets in the blockchain industry. We begin by explaining what prediction markets are, then move into a beginner friendly overview of Polymarket and its Liquidity Rewards Program.

What Are Prediction Markets? An Overview

A prediction market is a platform that enables users to forecast the outcomes of a particular event in areas like sports, politics and finance and earn rewards if their forecasts are accurate. Numerous applications for prediction markets, including market research, risk management, and entertainment also enable users to earn returns by accurately forecasting the outcomes of events. Many of us don’t realise that prediction markets go beyond industries, politics and economics to become important parts of our everyday lives. Think of playing rock-paper-scissors when you were a kid! Very high risk-high reward game right?… or Buying Insurance for your car, where you’re essentially betting on the likelihood of needing coverage. The insurer predicts the opposite, setting premiums based on risk.

Prediction markets in crypto are blockchain-based platforms that allow for decentralised and trustless operations, meaning they don’t rely on a central authority and ensure transparency. When an event concludes, the platform automatically distributes rewards to winners in cryptocurrency or other assets.

These markets let users bet on the outcome of various events, from elections to sports, with each asset’s price reflecting the perceived likelihood of an outcome. Successful predictions result in financial rewards. The system’s decentralised nature ensures that transactions and outcomes are recorded transparently on the blockchain.

Overall, prediction markets can apply in any scenario where three main variables are present:

- Event or outcome: A specific event with multiple potential outcomes that participants can predict. For example the price of a stock on a future date.

- Participants: Individuals or entities who make predictions by buying or selling shares in different outcomes, based on their beliefs about the event.

- Market Mechanism: A system that determines the price of shares for each outcome, reflecting the collective probability assigned by all participants and handling the settlement and distribution of rewards based on the actual outcome.

Introducing Polymarkets

Polymarket is the world’s largest blockchain-powered predictions market where users can bet on the outcome of future events in multiple areas such as sports, politics, business and science.

Since it’s launch in 2020, Polymarket has encountered several challenges and wins, such as settling a $1.4 million civil penalty with the Commodity Futures Trading Commission (CFT) and recently closing a $400m funding round from prominent blockchain stakeholders such as Vitalik Buterin and Peter Thiel’s Founders Fund, respectively.

The platform gained the first significant traction during the 2021 U.S. General Elections, facilitating 91% of the total betting volume or $3.5 million worth of bets during the election cycle alone. In today’s crypto market, where the blockchain complexities are being actively abstracted and web3 gains more adoption, Polymarkets is able to capture significant share of prediction markets via ease of use such as email login and plentiful choice of betting venues ranging from bets on what Kamala Harris will say in the next debate, to how many % points Mr Powell will increase the fed rate with.

To this end, Pymarket now secures $82.18 million in total value locked (TVL) with 150,000 X following and an active discord community.

How Does Polymarket Work?

Polymarket has been acting as a non-custodial betting platform, meaning that, unlike centralised betting websites that custody users’ assets, Polymarket has no control over users’ funds. Therefore, users are granted full autonomy over the deployment and withdrawal of their digital assets, leading to a flexible, yet secure and autonomous betting experience.

The platform is built on the Ethereum blockchain using Polygon’s technology for scalability and efficiency, which we have already introduced on our blog. Polygon’s Layer 2 solution, made for scaling Ethereum and lowering blockchain operation costs, allows Polymarket to handle a high volume of predictions at low cost and high speed, therefore offering a fast and low-cost betting environment for users.

Furthermore, Polymarket hosts prediction markets where participants can bet on future outcomes, or for example upcoming US elections, with clear yes or no answers, which are verified by reliable external sources. As a hypothetical example, If Bob believes a certain outcome is likely, he will wager cryptocurrency against others with differing views. This system motivates participants to bet based on their true beliefs, as they risk their own digital assets since accurate predictions lead to profits, while incorrect ones result in losses, creating a high-stakes environment that encourages thoughtful speculation.

Polymarket displays the odds of an event occurring at a dollar value. For instance, if the likelihood of former president Donald Trump being reelected in 2024 was at 70 percent, Polymarket would display this as $0.70. Once the event is completed, rewards are distributed directly to the user’s wallet. Shares on the correct side resolve to one dollar, so a share bought at $0.70 would then be worth one dollar. This calculation makes it clear how traders can earn rewards, while shares on the wrong side are worth nothing.

Additionally, Polymarket allows users to place limit orders on specific events, like predicting a Trump presidency. A limit order is when a user sets a specific price at which they want to buy or sell an asset. For example, if a user believes that certain events might lower Trump’s chances of winning, they might place a limit order at $0.40 instead of the current $0.70. If the price drops to $0.40, their order will be filled, increasing their potential return if their prediction is correct.

Polymarket Examples

Polymarket is one of the best representations of the applicability of blockchain technology to real-world scenarios, showcasing the potential of this technology to find product-market fit in a number of other industries.

The screenshot below provides an example of how users are betting on whether Trump and Harris will debate before the 2024 election. The chart shows the probability of this event happening, with the current odds showing a 95.2% chance that it will occur.

To make money, a user would buy shares of “Yes” if they believe the event will happen. For instance, buying $100 worth of shares at 95.2¢ each gives them 105.04 shares. If the event occurs, each share becomes worth $1, giving them a profit. Conversely, if the event doesn’t occur, they’d lose their investment.

Additionally, users can place limit orders, allowing them to set a specific price they want to buy or sell at. If the market reaches that price, their order is filled automatically. For example, if someone thinks the odds will drop to 90%, they could set a limit order to buy shares at that price, increasing their potential profit if they’re correct.

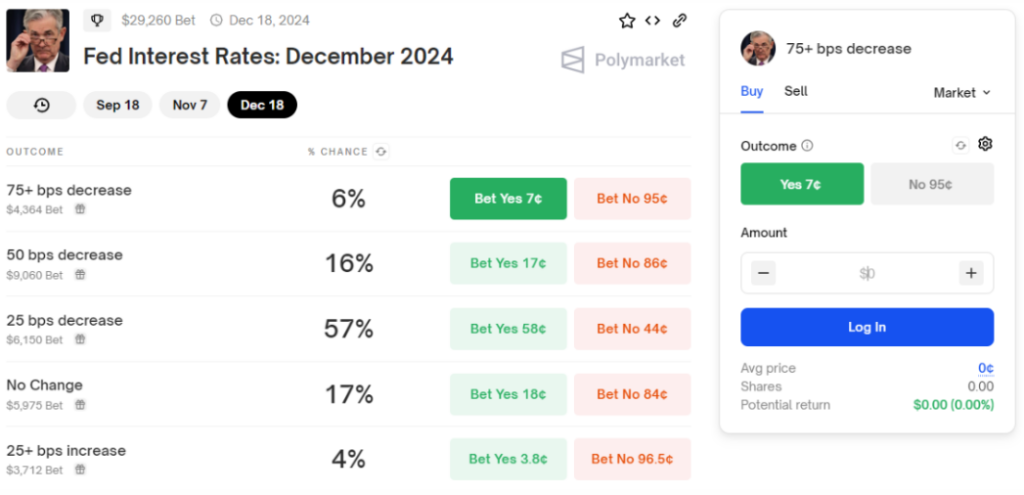

A second interesting example is the Fed Interest Rates. The Federal Reserve meets regularly throughout the year to review economic conditions and make decisions on monetary policy. These meetings occur approximately every six to eight weeks, totalling around eight times a year. At these meetings, the Federal Open Market Committee (FOMC) assesses economic indicators like inflation, employment, and overall economic growth. Based on this assessment, the FOMC decides whether to raise, lower, or maintain the federal funds rate, which influences interest rates across the economy.

As shown in the picture below, the next Fed Rate change is anticipated to take place in December 2024. In the provided example, users can bet on whether the Fed will decrease interest rates by different amounts (measured in basis points, or bps), where each outcome has a price, shown as cents on the dollar, representing the market’s consensus on the likelihood of that event happening.

To make money, you would buy shares in an outcome you believe is underpriced. For instance, if you think there’s a higher chance of a “75+ bps decrease” than the market predicts, you could buy the “Yes” shares at 7 cents. If the event occurs, each share would pay out $1, meaning you would make a significant profit. Conversely, if it doesn’t happen, you lose your investment.

The prices fluctuate as more people place bets, and you can sell your shares before the event concludes if the market price changes in your favour, allowing you to lock in profits early.

Essentially, the idea behind each trade is to find markets where one disagrees with the current odds, and profit by betting on their beliefs. Also, it is important to mention that users are not locked into their trades, meaning that they can sell shares at any time at the current market odds.

Naturally, it does not take long for users to question the accuracy of the existing predictions. However, as argued by Polymarket itself, the research has shown prediction markets to be considerably more accurate, on average, than polls and pundits. Higher accuracy stems from the fact that traders combine all available information on the market including news, polls, and expert opinions, hence making informed trades based on that combined market knowledge.

Additionally, traders put their own capital down, which acts as an economic incentive to predict as accurately as possible and ensures that as more savvy traders participate, the market’s price (probability) will change to reflect the true current odds.

Last but not least, Polymarket not only caters to enthusiasts, fans traders, but it also attracts subject matter experts, and if you are a professional in one of the many topics available on the platform, then Polymarket is your opportunity to profit from trading based on your knowledge, while improving the market’s accuracy.

By now, you should have a good understanding of what prediction markets are and how Polymarket works. Thus, for the rest of the article, we cover the mechanics (order book) behind the user-facing platform and review how liquidity rewards work on Polymarket.

Understanding the Polymarket Order Book

To effectively navigate advanced trading on Polymarket, it’s important to grasp how its order book system works.

Polymarket utilizes a hybrid-decentralized order book system, meaning that while an operator manages the matching and ordering process off the blockchain, the actual trade settlements occur on-chain. Such a hybrid approach combines the efficiency of off-chain operations with the security and transparency of on-chain execution.

As mentioned previously, users can place either market orders or limit orders:

- Market Orders execute immediately at the current market price. These are ideal for quick trades where users accept the existing price without any conditions.

- Limit Orders allow traders to set a specific price at which they want to buy or sell. For instance, if a trader believes the current price is too high, he can set a limit order at a lower price. As a next step, the order will only be executed if the market reaches that price.

*Note that limit orders may be filled partially if others agree to the trader’s price over time.

The order book displays all active buy and sell orders. The “bid” side shows the highest price buyers are willing to pay, while the “ask” side shows the lowest price sellers are asking and the difference between these prices is called the spread. Additionally, users can monitor the status of their orders—whether they are filled, partially filled, or still open—through the order book. Orders can be cancelled and opened anytime, while the Portfolio page tracks users’ activity across different markets.

Overall, understanding and utilizing the order book effectively helps traders make more informed trading decisions and manage positions more strategically.

How Liquidity Rewards Work on Polymarket

Polymarket operates a Liquidity Rewards Program designed to encourage traders to place orders that keep the market active and balanced.

To earn rewards, traders place limit orders close to the market midpoint, which is the average between the highest bid and the lowest ask. The closer the order is to this midpoint, the higher the rewards. This system encourages traders to help maintain a liquid marketplace.

Each day, reward amounts are calculated per market and determined by the relative share of each participant. Factors include the distance from the midpoint and the size of the order compared to others. The more competitive and well positioned the order, the higher the reward. Rewards are paid automatically and are distributed directly to users’ wallets, ensuring full transparency.

Rewards are distributed automatically and directly to users’ wallets. By participating, traders both support the health of the market and gain additional income on top of their trading activity.

In simple terms, the program rewards traders who act like market makers, helping to balance supply and demand.

Conclusion:

In conclusion, Polymarket exemplifies how prediction markets can harness blockchain technology to offer transparent and decentralised platforms for forecasting future events. By allowing users to place bets on various outcomes, from political elections to interest rate changes, Polymarket leverages the Ethereum blockchain and Polygon’s Layer 2 solution to ensure efficient and cost-effective transactions. A blockchain-based approach provides a flexible environment where participants can engage in both market and limit orders, with the order book system offering valuable insights into market dynamics and active trades.

The platform’s Liquidity Rewards Program further enhances its appeal by incentivising users to contribute to market stability. By positioning limit orders close to the market’s midpoint, participants are automatically eligible for Polymarket’s incentive program. Rewards earned are determined by the relative share of each participant and multiplied by the rewards available, which are distributed directly to their wallet. Such dual focus on efficient trade execution and incentivised liquidity management underscores Polymarket’s commitment to creating a robust and user-friendly prediction market experience.You can simply stake and secure your assets with the Ledger wallet.

Disclaimer: This article contains affiliate links. If you click on these links and make a purchase, we may receive a small commission at no additional cost to you. These commissions help support our work and allow us to continue providing valuable content. Thank you for your support!

This article is provided for informational purposes only and is not intended as investment advice. Investing in cryptocurrencies carries significant risks and is highly speculative. The opinions and analyses presented do not reflect the official stance of any company or entity. We strongly advise consulting with a qualified financial professional before making any investment decisions. The author and publisher assume no liability for any actions taken based on the content of this article. Always conduct your own due diligence before investing.