What is Lido?

Lido is a decentralised liquid staking protocol that enables users to stake assets like Ethereum without locking them up, allowing them to access liquidity and DeFi opportunities while earning staking rewards. Instead of directly staking assets, users receive derivative tokens (e.g., stETH on Ethereum) that represent their staked holdings and accrue staking rewards over time. These tokens can be used across various DeFi protocols, adding flexibility for stakers who otherwise would have to lock up assets, sometimes for long periods.

Read more from our Ethereum Staking series:

- Analysis of the current Restaking Landscape

- Ethereum Pectra: Whats behind the Ethereum Upgrade

- Simply Staking and Lido V3

- How to stake on Lido

- How to Stake on Stakewise

- ETH Staking yield

- Ethereum Staking

By simplifying and decentralising access to staking, Lido has become a widely used ution for enhancing staking liquidity on major proof-of-stake networks. For the rest of this article, we will cover Lido’s architecture in depth and look at the protocol’s on-chain metrics.

Architecture Overview

Let’s dive into the core components of Lido’s architecture! Our goal is to grasp the distinct parts and understand how they interact when a user engages with the protocol.

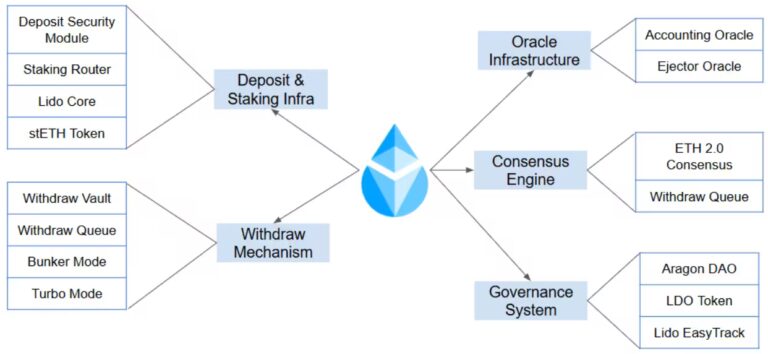

Understanding the full architecture is complex, so we’ll start with a high-level overview. The diagram below organizes Lido’s protocol into five main functional groups, each with its specialized modules.

Deposit & Staking Infrastructure

The Deposit & Staking Infra(structure) component represents the starting point of the Lido ecosystem. It includes essential modules like the Deposit Security Module, Staking Router, Lido Core, and stETH Token. When users deposit their ETH into Lido, these modules work together to issue stETH, a liquid token that represents the user’s share in the staking pool, allowing participation in Ethereum 2.0 without directly managing validators.

Oracle Infrastructure

The Oracle Infrastructure ensures the protocol’s data is up-to-date and reliable and includes parts such as Accounting Oracle and Ejector Oracle, which update the value of stETH to reflect the actual staking income on Ethereum 2.0. These oracles also handle off-chain information and monitor network status, feeding this data into Lido’s smart contracts for accurate on-chain interactions.

Consensus Engine

The Consensus Engine orchestrates the rules and order for validator activities. It contains the ETH 2.0 Consensus and Withdraw Queue modules, governing deposits, withdrawals, and reward mechanisms. This component ensures that validators adhere to the correct order for earning rewards, and helps prevent potential issues that could arise in validator behavior.

Withdraw Mechanism

The Withdraw Mechanism was designed to accommodate Ethereum’s Beacon Chain upgrade, which introduced validator exits. The mechanism includes modules like the Withdraw Vault, Withdraw Queue, Bunker Mode, and Turbo Mode. These features allow users not only to stake funds but also to withdraw them while managing risk and optimising efficiency in withdrawal processing.

Governance System

Lido’s Governance System provides decentralised and transparent management of the protocol, ensuring security and adaptability. Using Aragon DAO, LDO Token, and Lido EasyTrack, the governance system empowers stakeholders to vote on crucial protocol decisions, ensuring a community-driven approach to Lido’s future.

Lido Distributed Validator Technology

Distributed Validator Technology (DVT) is an innovative approach to enhance the resilience, decentralisation, and security of Ethereum staking. By splitting the responsibilities of a validator among multiple node operators, DVT reduces the risks associated with single points of failure and ensures that the network remains robust, even in cases of individual operator downtime.

Key Components of DVT:

Under DVT, instead of a single entity managing the private keys for a validator, the keys are divided into multiple shares. These shares are distributed across a group of operators using cryptographic methods like threshold signatures.

Additionally, a subset of operators—known as the quorum—must work together to sign blocks and perform validator duties. The quorum ensures decentralisation and fault tolerance since no single operator can act unilaterally.

Further, on fault tolerance, DVT allows validators to remain operational even if some operators fail or experience downtime. As long as the quorum is met, the validator can continue functioning without penalties.

The Simple DVT Module in Lido

Lido’s Simple DVT Module is an initiative to enhance the security, resilience, and decentralisation of Ethereum staking within the Lido ecosystem. By employing DVT, the module allows multiple node operators to collaboratively manage a single validator, distributing responsibilities and mitigating the risks of downtime or mismanagement.

Lido leverages implementations of Obol Network and SSV Network to integrate cryptographic key-sharing techniques that ensure validators remain operational even if some operators face disruptions. This approach not only strengthens validator performance but also attracts solo and community stakers, diversifying Lido’s validator set while reducing the potential for single points of failure.

The Simple DVT Module is an important step toward the future of scalable, permissionless staking modules for Ethereum. By allocating staking rewards equitably—2% to the Lido DAO treasury and 8% to the module’s participants—it incentivizes operators while ensuring sustainability. With the module live on Ethereum’s mainnet, it provides a robust testing ground for DVT technology and fosters a growing community of decentralised node operators. This aligns with Lido’s broader vision of creating a resilient, censorship-resistant staking foundation, setting the stage for a more secure and inclusive Ethereum network.

How does Lido work?

To understand how Lido deposits and withdrawals work, let’s go through some hypothetical examples that cover both instances.

Let’s consider the example of a user, Bob, who wants to stake his 1 ETH. The process begins in the Lido on-chain infrastructure, where Bob initiates a deposit. Once he calls the relevant function, 1 ETH is deducted from his wallet and stETH is issued in return, representing her share in the staking pool. This stETH is now under the management of the Lido on-chain infrastructure, which securely holds the tokenized representation of Bob’s stake.

As more users like Bob (such as Lewis and Damien) make deposits, ETH accumulates in the Deposit & Staking Infrastructure. Once a total that is a multiple of 32 ETH is gathered (e.g., Bob’s 1 ETH plus Damien’s 15 ETH and Lewis’s 16 ETH), the protocol can allocate these funds to validators on the ETH 2.0 Consensus network, allowing the collective deposit to begin earning rewards.

To complete the deposit process, the Lido on-chain infrastructure collaborates with Node Operators to collect the necessary validator information, including public keys and withdrawal addresses. Once the data is prepared, a group of validators verifies and signs the transaction to safeguard it from front-running and other risks. After all signatures are confirmed, the protocol performs a final check before transferring the funds to the Beacon Chain for staking. Bob’s funds, along with others, are now actively earning rewards.

Bob’s Withdrawl

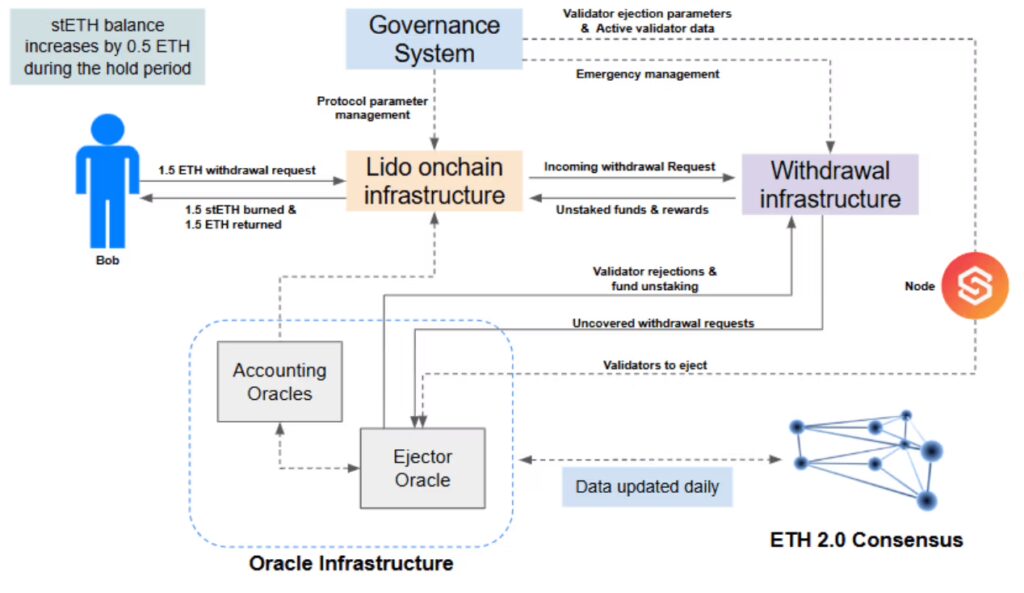

Let’s now assume that Bob is back from his vacation, and since he is low on pocket money, wants to withdraw some of his ETH and the associated rewards. Below, is the graph depicting the architecture of the withdrawals process, which we will break down further in this article.

First Bob submits a withdrawal request through the Lido on-chain infrastructure. In our example, assume his stETH balance has increased by 0.1 ETH due to accrued rewards, so Bob’s stETH balance is now 1.1. Once his request is finalized, he receives 1.1 ETH, and his stETH is burned to reflect the withdrawal.

Within Lido’s on-chain ecosystem, all withdrawal requests are collected into the Withdrawal Infrastructure. The Ejector Oracle then examines the network’s validators to identify those eligible for unstaking. After choosing the appropriate validators to be ejected, the unstaked funds are transferred back to the Withdrawal Infrastructure for processing, which handles the calculation and disbursement of rewards, ensuring that each user receives their updated balance as per the accrued interest.

The Oracle Infrastructure, specifically the Accounting Oracles and Ejector Oracle, are instrumental in maintaining accurate records of staked assets and validator status. Oracles update daily, providing vital data to the Lido on-chain infrastructure and Governance System to manage protocol parameters and ensure smooth operation, including handling emergencies and managing validator rejections when necessary.

Governance – Lido DAO

The Lido DAO (Decentralized Autonomous Organization) manages Lido’s liquid staking protocols through community governance. Decisions on protocol parameters, such as fees, node operator assignments, and oracle selection, are made by governance token (LDO) holders who vote on these matters. The DAO accumulates service fees, which are used to fund development, research, liquidity incentives, and protocol upgrades.

Lido DAO balances decentralisation and centralisation, allowing the project to avoid full custodial control by exchanges. A completely trustless liquid staking protocol may not be feasible shortly, so the DAO structure provides an optimal compromise. The DAO enables community-focused, socially responsible decision-making while funding protocol development through its treasury. Additionally, the DAO directs service fees toward insurance and development funds.

Lido DAO governs and manages the protocol with the following responsibilities:

- Protocol Management: Builds, deploys, updates, and sets key parameters for liquid staking protocols, including approving incentives for contributors.

- Node Operator Oversight: Assigns vetted node operators, qualifies new ones, and penalizes operators for slashing incidents.

- LEGO Grants: Approves grants to support research and initiatives that contribute to protocol development.

- Operational Tasks: Manages payments to contributors, and operational duties, and maintains a bug bounty program for security.

- Service Fee Accumulation: Collects service fees, which are used to fund insurance, development, and other DAO initiatives.

Governance in the Lido DAO is powered by the LDO token. Holders of LDO tokens can vote on governance and network decisions, shaping Lido’s future. Voting power is proportional to the amount of LDO a member holds. Token holders can also bring forward initiatives that they believe will benefit the protocol.

The DAO’s governance is facilitated by the Aragon framework, which is a full end-to-end DAO-building tool. Voting takes place on the Ethereum network, while other networks are managed through committees and multisig mechanisms.

Alongside its streamlined governance operations, Lido includes five specialized sub-governance committees that operate with enhanced governance privileges through the Easy Track module (a governance tool designed to simplify and automate routine, low-stakes decisions within Lido DAO): the Lido Node Operator Subgovernance Group (LNOSG), Lido Ecosystem Grants Organization (LEGO), reWARDS Committee, Resourcing and Compensation Committee (RCC), and the Referral Program Committee.

| Lido DAO | ||||

|---|---|---|---|---|

| LEGO | LONSG | RCC | Referral Program Committee | reWARDS Committee |

The governance process in Lido constrains four key stages and the table provides a comprehensive overview of the governance structure in LidoDAO, showing how proposals progress from initial ideas to final execution, with varying levels of engagement, requirements, and durations at each step.

| Governance Stage | Stage Description | Voting & Participation Requirements | Stage Duration |

|---|---|---|---|

| Research Forum | Initial public discussion phase for Lido community feedback on proposed governance ideas. | Open participation; no token requirement. | 7 days |

| Snapshot (Off-Chain Voting) | Snapshot voting by LDO token holders; proposal delegation is permitted. | Requires 100 LDO to submit; >5% quorum to pass. | 7 days (excluding weekends) |

| Aragon (On-Chain Voting) | Proposals approved in Snapshot are voted on-chain using the Aragon platform. | Requires a majority vote with >5% quorum; 72-hour voting period. | 72 hours |

| Easy Track Governance | Committee-led motion approvals with an option to veto if >0.5% of LDO supply objects. | Proposed by governance committees; veto possible with >0.5% LDO supply. | Depends on veto response |

| Execution | Final step in Lido governance where on-chain approved proposals are executed automatically. | Requires a successful on-chain vote. | Immediately after vote |

LIP-21: Simple On-Chain Delegation

The LIP-21 (Lido Improvement Proposal) was introduced by Lido’s DAO-ops workstream contributors to address critical challenges in governance participation, particularly the lack of delegation mechanisms for on-chain voting. By allowing $LDO token holders to delegate their voting power to other addresses, the proposal provides a quick and cost-effective ution to boost engagement and overcome the hurdles of direct voting.

What problem does LIP-21 ve?

The absence of an on-chain delegation mechanism has made achieving a quorum increasingly difficult, with several consecutive votes failing. The absence of delegations posed a risk to Lido’s governance stability and its ability to drive protocol development. LIP-21 addresses this by:

- Activating dormant voting power: Many token holders who participated in governance off-chain through snapshot.org, but avoided on-chain votes due to operational complexities, are now able to easily delegate

- Simplifying participation: Token holders with cold wallets, multi-sig setups, or limited access during short 48-hour voting windows can delegate without losing control over their funds

- Encouraging broader engagement: An open delegation framework attracts new participants by easing the voting process

What Does LIP-21 Deliver?

This initial implementation provides a streamlined ution to meet urgent governance needs while contributors work on a more comprehensive delegation system. Key features include:

- Delegate mapping: Token holders can assign or revoke delegates at any time

- Voting on behalf: Delegates can vote using the power of multiple delegators, enhancing efficiency

- Ultimate control: Delegators retain authority to override delegate decisions, ensuring security and accountability

- TRP (Token Rewards Plan) integration: TRP participants can delegate their $LDO rewards, further engaging contributors

Although some might argue that a fully-fledged delegation mechanism, present in ecosystems like Cosmosm, could track delegated voting power with greater precision, such a system is resource-intensive and time-consuming to build. On the other hand, LIP-21 delivers an effective, simplified alternative.

Furthermore, the DAO-ops contributors aim to increase quarterly active voting power by 20-30M $LDO, complementing the ~90M $LDO already participating in Q4 2023 on-chain votes. Combined with the ~120M off-chain votes, this initiative is expected to dramatically boost governance activity and ensure decisions reflect the broader community’s will.

Notably, this proposal passed with the highest number of votes in Lido DAO’s history via Vote #178 on August 24, 2024, with contract details available for transparency. With its overwhelming support and strategic design, LIP-21 is set to boost governance for the Lido ecosystem.

Community Staking Module

The Community Staking Module (CSM) is the first feature in the Lido on Ethereum protocol, designed to promote decentralisation by introducing permissionless access for node operators.

The CSM allows anyone, from o stakers to amateur operators, to run validators by providing an ETH-based bond as security collateral. CSM aims to make validator operation more accessible and attractive, especially for community stakers and o operators, while contributing to a decentralised Ethereum staking ecosystem.

Key Features of CSM include:

- Permissionless Participation: Over time, the entry to CSM will become fully public for any type of operator, allowing broader inclusion beyond curated sets. Furthermore, a much lower bond varies from 2.4 to 1.3 ETH is intoduced, which is based on Lido’s reduction bond curve.

- Collateral in ETH and stETH: Operators can bond using ETH, stETH, or wstETH, simplifying access and eliminating the need for secondary token collaterals

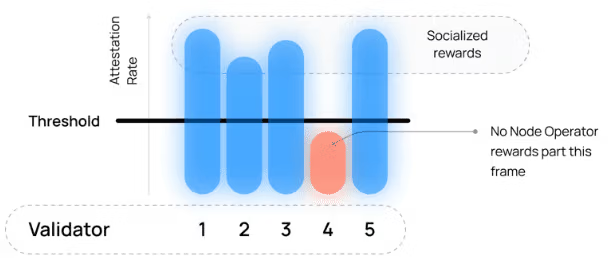

- Reward Smoothing: Validator rewards, including EL rewards and MEV, are smoothed across modules, offering more consistent returns. The mechanism works in a way that any reward that goes beyond the set threshold, is allocated to socialised rewards. However, to optimise for a freeriding problem, those validators that underperform, will not be eligible to claim rewards from the socialised pool.

The CSM launched on the Holesky testnet in Q4, 2024 and is now live on the mainnet in the form of Early Adoption mode. It is expected that the early adoption phase will end soon and the enablement of permissionless mode will kick off in Q1 2025

Lido has truly made the setup of CSM accessible for less technical operators, showcasing its determination toward inclusion and decentralisation. Node operators can choose to use existing Plug & Play utions that offer a pre-integrated CSM module so that the operators do not have to spend time on manual setup. These utions include service providers such as Sedge, Setereum and EthPillar.

Lido’s Tokenomics

Lido’s tokenomics centres around two main token types, each with specific roles: LDO (Lido DAO Token) for governance and stETH (Lido Staked ETH) and similar “st” derivatives for other chains (like stDOT for Polkadot and st for ana) to represent staked assets.

stETH Derivative Token

When a user deposits assets like ETH into Lido’s staking service, they receive stETH in return. This ERC-20 token reflects the staked ETH’s value, including any rewards or changes in ETH value over time. As validators generate rewards, they’re distributed to stETH holders, which means the value of stETH gradually grows, corresponding to the underlying ETH and staking rewards.

In the context of staked assets like stETH, “rebasing” refers to an automatic adjustment in the token’s supply to reflect accrued staking rewards.

When an asset like stETH is rebasing, its total supply periodically increases to distribute staking rewards to holders directly in the form of more tokens. So if you hold stETH, and it’s a rebasing asset, your balance will automatically increase over time as rewards are added, without requiring any action from you. This system ensures that your stETH balance reflects the total amount of staked ETH plus any additional rewards accumulated.

LDO (Lido DAO Token)

The LDO token serves governance purposes within the Lido DAO. As an ERC-20 token, it gives holders voting power over protocol upgrades, validator selection, and fee structures, making it central to Lido’s decentralized governance. Initially, the token had a maximum supply of 1 billion LDO, with the initial allocation where founders received 64%, and early project participants received 0.4% through an airdrop.

Currently, over 895.72 million LDO are in circulation, with a vesting schedule where founder tokens were initially locked for one year, and then progressively released over the following year, leading to full unlocking within two years.

Lido’s Traction

Since its inception in 2020, Lido has seen steady growth in all key metrics. For example, in 4 years, Lido protocol has paid out $1,908,438,602 worth of rewards and fostered 200+ operators across the globe to facilitate a decentralised run.

Additionally, Lidos core code is open source, with 204 repositories and a baseline of 30 developers actively contributing to the project.

The wide reach of Lido is backed by its rich ecosystem, consisting of 104 projects that integrate with the protocol on 12 different networks. These projects range from industry giants like Curve and TrustWallet to analytics providers such as Dune and yield boosters like EigenLayer.

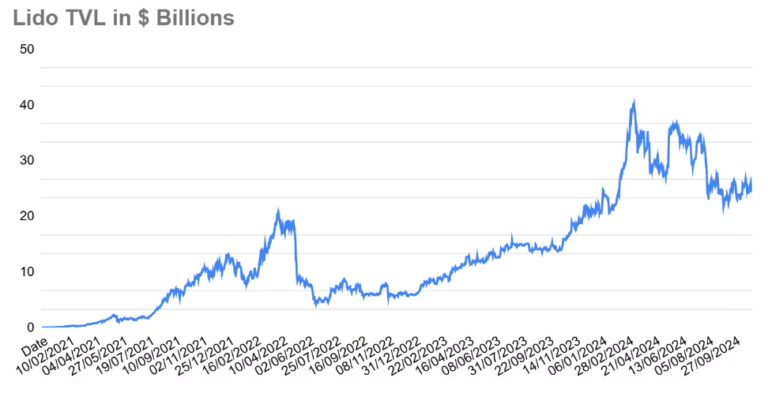

The rich ecosystem directly translates into stably growing Total Value Locked (TVL), which despite turmoils like the collapse of FTX and multiple bear markets, has grown to reach $24 billion as shown in the graph below:

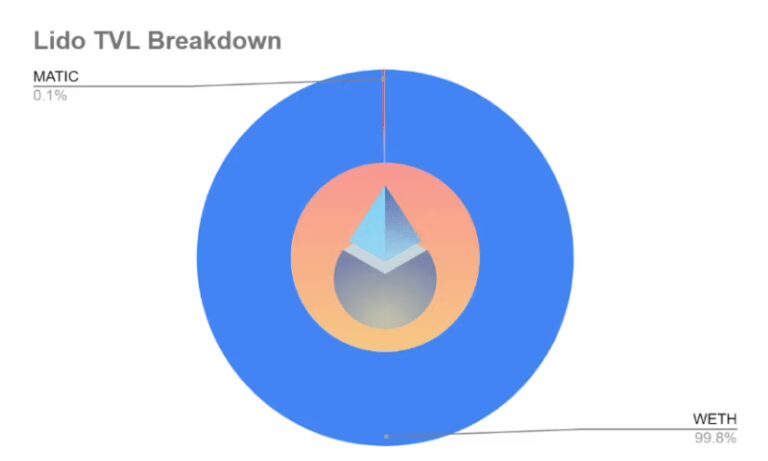

Most of the Lidos’ TVL is on Ethereum. Hence it is not a surprise to see that nearly 100% of Lido’s TVL is taken up by wrapped ETH (WETH) – an ERC-20 token that represents ETH and is pegged 1:1 to the value of ETH. It can be used to interact with DeFi protocols and applications whereas ETH, by itself, can not be used in many dApps.

Conclusion

In conclusion, Lido is a powerful decentralized ution for liquid staking across major proof-of-stake networks, facilitating staking participation without the traditional trade-off of illiquidity. By issuing derivative tokens like stETH for Ethereum or st for ana, Lido allows users to earn staking rewards while maintaining flexibility for DeFi engagement. The protocol’s architecture—comprising robust modules for deposits, oracles, consensus, withdrawals, and governance—ensures secure, efficient staking operations. Additionally, the governance is controlled via the LDO token, giving holders influence over protocol upgrades and validator management. Lido’s rebase mechanism for assets like stETH further automates reward distribution by adjusting token balances to reflect staking returns, while non-rebasing assets accumulate rewards through value appreciation.

Since its launch, Lido has fostered significant growth, collaborating with a wide ecosystem of DeFi protocols, which has helped grow its TVL and maintain resilience through market fluctuations.

(Terms & Conditions Apply)

About Simply Staking

We are a Blockchain Services Provider who operates Validators and Nodes on over 30 Networks with over $1 Billion in Assets Staked. Our journey started in 2018, with Simply entering the Cosmos Hub Testnets, and now have expanded our operations to most major ecosystems including networks such as LIDO, Polygon, EigenLayer, Oasis Network, Cosmos Hub, Polkadot, and many more, all while being an Oracle Operator on Chainlink.

We offer additional services such as Nodes-As-A-Service (RPCs), Blockchain Development work, Tooling, Governance Services as well as Blockchain Consultancy Services.

More Information on our offerings can be found on our website.

Disclaimer: This article contains affiliate links. If you click on these links and make a purchase, we may receive a small commission at no additional cost to you. These commissions help support our work and allow us to continue providing valuable content. Thank you for your support!

Terms & Conditions apply on all partnership offers.

This article is provided for informational purposes only and is not intended as investment advice. Investing in cryptocurrencies carries significant risks and is highly speculative. The opinions and analyses presented do not reflect the official stance of any company or entity. We strongly advise consulting with a qualified financial professional before making any investment decisions. The author and publisher assume no liability for any actions taken based on the content of this article. Always conduct your own due diligence before investing.