Abstract

Ethervista is a protocol looking to address a significant challenge with Automated Market Makers (AMMs) — their inability to encourage the long-term success of blockchain projects. Token creators often prioritise short-term profits by withdrawing liquidity and selling tokens quickly, which misaligns with the goals of sustainable growth. Ethervista introduces a new AMM model designed to foster continuous growth and resilience in the blockchain ecosystem.

Introduction

Ethervista introduces a novel AMM standard with several key differences from traditional models:

- Custom Fee Structure: Instead of the typical 0.3% fee on swaps, Ethervista charges a custom fee paid in native ETH. A 0.3% fee is distributed among liquidity providers and token creators in the pool.

- Delayed Liquidity Removal: This mechanism prevents developers from quickly pulling out liquidity, reducing the risk of “rug-pulls.”

- Incentivizing Longevity: The model incentivizes participants based on transaction volume rather than token price, promoting long-term project success.

Ethervista aims to evolve beyond traditional AMM pools, eventually incorporating lending, futures, and feeless flash loans, making it a comprehensive decentralized application.

A Technical Overview: The Mathematics Behind Ethervista

Ethervista introduces a unique fee structure and reward distribution mechanism that differentiates it from other AMM models. This section offers a quick overview of the mathematics and logic behind the system:

Fee Structure and Distribution:

- Native ETH Fees: Every swap on the Ethervista platform incurs a fee in native ETH, not in the tokens being traded. This fee is split between liquidity providers and the protocol.

- Fee Variables: Each pool has four uint8 fee variables that must be initialized. These variables define the fee distribution for both buy and sell transactions. For example, a pool could be set up with a $10 fee for buys and a $15 fee for sells. When a user sells their tokens, they must pay $15 worth of ETH, which is then distributed to liquidity providers and the protocol.

Euler Sequence:

- The Ethervista pair smart contract maintains a sequence of ascending values known as Euler amounts. These values are updated each time ETH is transferred to the pool contract.

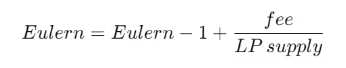

- The Euler amount for each transaction is calculated by adding the previous Euler amount to the ratio of the fee collected to the total supply of liquidity provider (LP) tokens at that time. Mathematically, Euler-LP relation is represented as:

- Purpose of Euler Sequence: The Euler sequence ensures that each liquidity provider is fairly compensated based on the amount of liquidity they have provided and the number of swaps that have occurred since they last interacted with the pool.

Provider Rewards:

- Each liquidity provider is represented by a struct that stores their LP holdings and a variable called euler0, which corresponds to the Euler amount at the time they added liquidity.

- When a provider decides to claim rewards, the system calculates their rewards based on the difference between the current Euler amount and the euler0 value at the time they added liquidity. The reward is calculated as:

- LP Token Non-transferability: LP tokens in Ethervista are non-transferable except when they are burned or when liquidity is added/removed, hence preventing liquidity providers from manipulating their share of the rewards by transferring LP tokens.

- Refreshing Euler Values: Each time a liquidity provider adds or removes liquidity, the euler0 value is refreshed to the current Euler amount. Refreshed value ensures accurate reward calculations and prevents exploitation of the system.

The mathematical approach used in Ethervista ensures that rewards are distributed fairly among liquidity providers, even as the total supply of LP tokens changes over time.

Pool Configuration and Protocol Fee

This section explains how liquidity pools are configured and how protocol fees are managed in Ethervista.

Role of the Pool Creator:

- Creator Rights: The individual who initiates liquidity provision in a pool is designated as the Creator. Creator role grants subjects the ability to configure several important settings for the pool, such as:

- Pool Fees: The Creator can set the fee structure for the pool, defining how fees are distributed between liquidity providers and the protocol.

- Protocol Address: The Creator can specify a protocol-assigned smart contract address that will receive ETH from the protocol fee. Protocol addresses can be used to implement various DeFi applications, such as adding permanently locked liquidity or distributing staking rewards.

- Metadata Configuration: Creators can define on-chain metadata for their tokens, including the project’s website URL, logo, description, social media handles, and chat URLs. This information is accessible to users via the Ethervista DEX’s Explorer window, which helps ensure transparency and reduce the risk of phishing attacks.

SuperChat Integration:

- Global Live Chat: Ethervista features SuperChat, a global live chat integrated into the DEX platform. Users can communicate in real-time, facilitating quick information exchange. Access to SuperChat is tier-based, depending on the number of $VISTA tokens a user holds.

Renouncing Creator Rights:

- Locking Pool Settings: Creators have the option to renounce their write access rights, which effectively locks all pool settings permanently. The pool lock feature can be used to provide additional security and assurance to users.

- Restricting Token Trading: Creators can also choose to limit the trading of their tokens exclusively to the Ethervista platform. This is done by restricting the ERC20 transferFrom function to the Ethervista router address, which is stored in the factory contract.

Protocol Fee Allocation:

- Development and $VISTA: In addition to the pool and protocol fees, a fixed $1 fee is allocated to the ongoing development of the Ethervista DEX and the $VISTA token. The $1 fee supports the implementation of new features like feeless flash loans, futures, and lending, as well as potential CEX listings and marketing efforts.

VISTA Token

$VISTA is the native token of the Ethervista DEX, with a supply cap of 1 million tokens. The design of the $VISTA token incorporates mechanisms to ensure its value increases over time, making it a central component of the Ethervista ecosystem.

Deflationary Mechanics:

- Capped Supply: The total supply of $VISTA is limited to 1 million tokens, ensuring scarcity.

- Burn Mechanism: The Ethervista protocol includes an on-chain process that reduces the circulating supply of $VISTA through burn events. Each burn event not only decreases the number of tokens in circulation but also raises the token’s price floor.

Price Floor Growth:

- Sustainable Value Increase: The price floor of $VISTA increases with every transaction. Such sustained increase is achieved through the continuous acquisition and destruction of tokens, funded by fees generated within the protocol.

- Hedge Against Inflation: The deflationary nature of $VISTA serves as a hedge against inflation. As the supply decreases and the price floor rises, the value of each remaining token is strengthened, driving sustained growth and increasing scarcity.

Ethervista Today

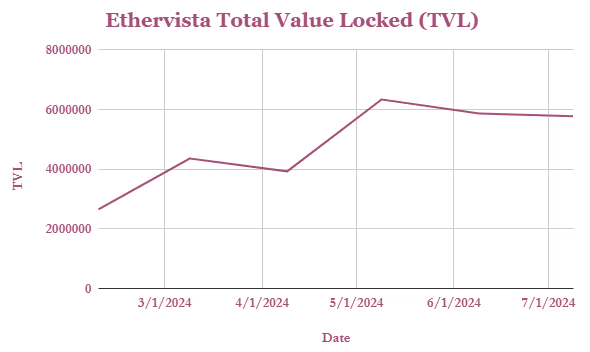

Ethervista went live just recently and has already reached a total value locked (TVL) of nearly $6 million:

(Data: Defillama)

$VISTA’s market capitalisation (Market cap = Current price x Circulating supply) stands at $21,469,677, with 24 hour volume (A measure of how much of a cryptocurrency was traded in the last 24 hours) standing at around $13 million, with 7,363 holders.

Before you interact with Ethervista, make sure to check the validity against the official address: 0xC9bCa88B04581699fAb5aa276CCafF7Df957cbbf

You can access Ethervista via their official website and also join their recently launched Telegram chat via this link.

Conclusion

In conclusion, Ethervista offers an innovative approach to Automated Market Makers (AMMs) by addressing the common pitfalls of short-term focus and liquidity withdrawal. Through its unique fee structure, fair reward distribution, and deflationary $VISTA token, Ethervista fosters long-term sustainability and growth within the blockchain ecosystem. By incentivizing longevity and incorporating advanced features such as feeless flash loans and real-time communication, Ethervista positions itself as a comprehensive solution for decentralized finance, promoting resilience and value appreciation in the projects it supports.

You can simply stake and secure your assets with the Ledger wallet.

Disclaimer: This article contains affiliate links. If you click on these links and make a purchase, we may receive a small commission at no additional cost to you. These commissions help support our work and allow us to continue providing valuable content. Thank you for your support!

This article is provided for informational purposes only and is not intended as investment advice. Investing in cryptocurrencies carries significant risks and is highly speculative. The opinions and analyses presented do not reflect the official stance of any company or entity. We strongly advise consulting with a qualified financial professional before making any investment decisions. The author and publisher assume no liability for any actions taken based on the content of this article. Always conduct your own due diligence before investing.