With the imminent launch of Mainnet for Operators and EigenDA, the EigenLayer ecosystem is set to launch itself as a key player to address multiple underlying issues of the Ethereum network. With the new primitive of restaking entering the fray through EigenLayer, now is a great time to get up to speed on what EigenLayer is all about and what it intends to do.If you’re new to EigenLayer, we have a great introductory article to provide an easy overview of the project.

This article will go into further detail surrounding the tech, the core concepts underlying EigenLayer, and some of the exciting developments that are coming to the EigenLayer ecosystem.

What is EigenLayer?

EigenLayer is a set of smart contracts that allows consensus layer (base layer) ETH stakers to opt-in to validating new modules on Ethereum.

EigenLayer introduces a new primitive in the cryptoeconomic security space to Ethereum. Restaking enables the reuse of staked ETH tokens on the consensus layer. In Trad-Fi, simply put, this is making use of previously pledged collateral as collateral for a new loan (mortgage of a mortgage).

Users that stake ETH natively or with liquid staked tokens (LST) can grant the EigenLayer smart contract (opt-in) to restake their ETH or LST to extend the cryptoeconomic security of Ethereum to additional applications (smart contracts such as consensus protocols, data availability layers, oracle networks, and more) on the network to earn additional rewards on that ETH. The implication behind the additional rewards however, is that restakers are subject to greater slashing conditions in case of a bad acting operator.

What does EigenLayer solve?

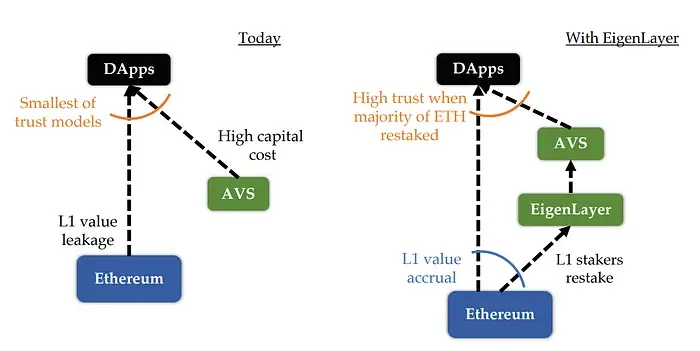

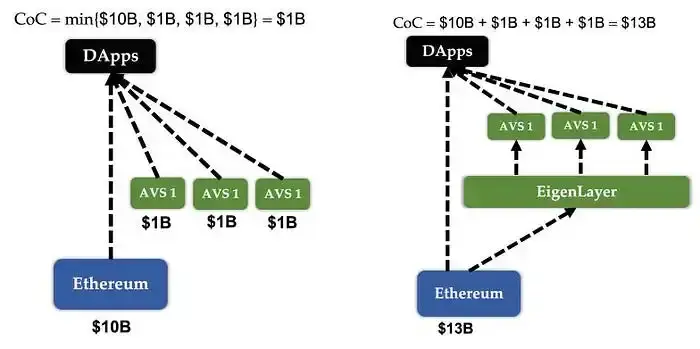

At its core, EigenLayer solves the issue of fragmented economic security (assets securing a particular project/chain) by creating a market for decentralised and programmable trust by allowing projects to tap into a single pool of security.

Developers can plug their platform into the EigenLayer pool for their security network. Having a singular platform where all ETH gets staked and restaked onto other platforms is also beneficial for the Operators who no longer have to incur high capital costs of joining a new Actively Validated Service (AVS). Using the EigenLayer Opt-In feature, an Operator can choose what networks they wish to help secure and in return earn extra revenue.

The chart below illustrates the existing framework for AVSs compared to the EigenLayer Framework. As observed, EigenLayer functions as a kind of middleware between the base protocol (Ethereum) and the DApps.

The Restaking Ecosystem

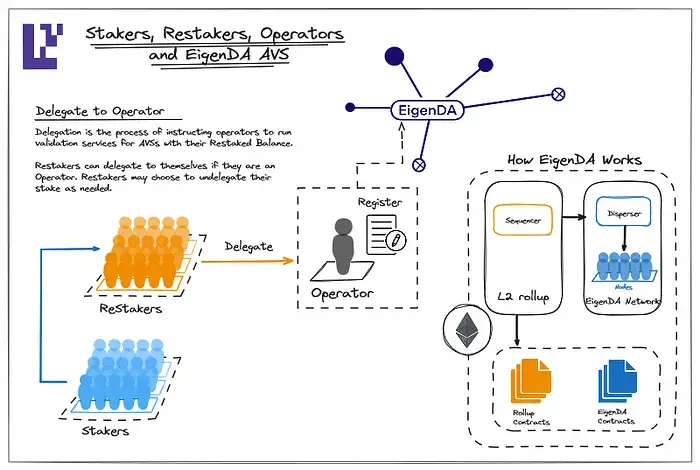

The restaking ecosystem on EigenLayer is structured around three essential components: restakers, operators, and actively validated services (AVS).

Restakers

Restakers, whether individuals or projects, actively engage in the staking process by contributing their assets to support network operations. These users stake either ETH or LST ETH (Liquid Staked Ethereum) on the platform and expect to earn a higher APR than traditional staking due to the increased risk that they are subjecting their stake to.

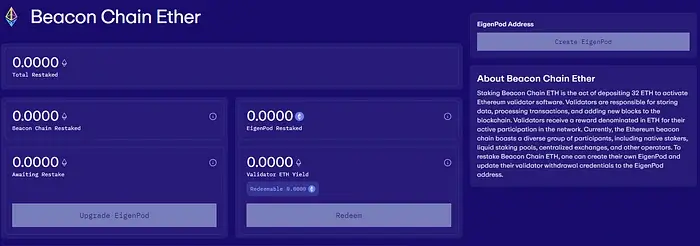

EigenLayer offers various staking methods. For those with Native ETH, the best way is to create an EigenPOD. An EigenPod is a contract that allows native restaking by configuring the beacon chain withdrawal credentials to the EigenPod addresses.

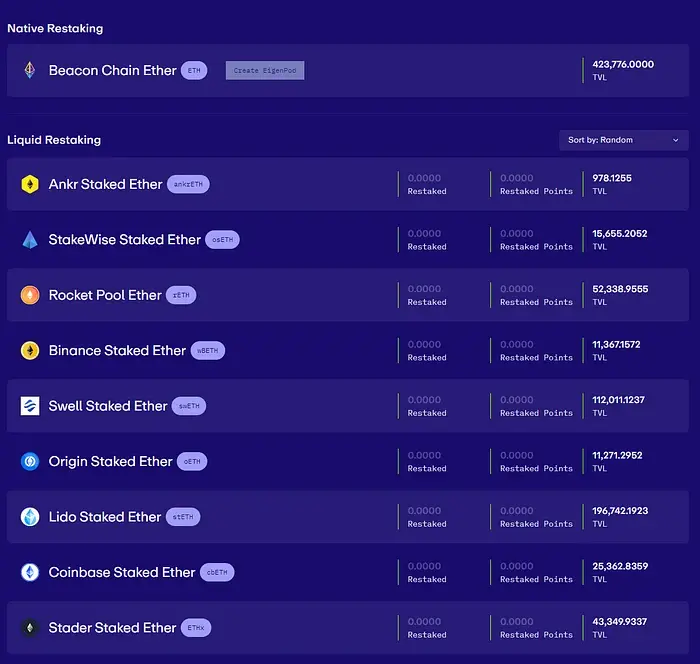

Another method for restaking is through LSTs such as LIDOs stETH. The team over at EigenLayer (Eigen Labs) are constantly adding new LSTs to their platform that users can restake in an attempt to capture more market share. At the same time, they are carefully setting and increasing caps on deposits in an attempt not to overwhelm the system.

EigenLayer currently accepts ankrETH, osETH, xETH, wBETH, swETH, oETH, stETH, cbETH, ETHx as collateral for restaking.

EtherFi

A third-option for staking and earning additional rewards from using EigenLayer is through protocols like Ether.Fi that utilise Liquid Restaking Tokens (LRTs).

EtherFi launched their eETH token. When a user stakes their Native ETH on the EtherFi platform, it gets liquid staked into eETH and automatically restaked through EigenLayer and users would then be left with eETH to use in DeFi.

Operators

Operators function like Ethereum Validators. Operators enroll to EigenLayer and their job is to ensure that the software is running correctly alongside securing the AVSs it opted into.

Delegators on EigenLayer have the choice of which Operator to choose based on multiple subjective factors.

Currently, Operators are not part of the mainnet however they are being tested on the ‘Stage 2’ Testnet that EigenLayer currently is operating.

Actively Validated Services (AVS)

An Actively Validated Service (AVS) is any system that requires its own distributed validation set for verification, such as sidechains, data availability layers, oracle networks, bridges, and trusted execution environments (TEEs).

AVSs leverage restaked ETH via EigenLayer smart contracts to use the programmable trust from the Ethereum network. AVSs using EigenLayer enjoy some of the benefits mentioned above as well as contributing to the overall security of DApps and services within Ethereum.

AVSs benefit from the Pooled Security effect that EigenLayer offers.

Currently, an attacker would have an easier time compromising an AVS secured by a $1 billion stake to impact a DApp. Through EigenLayer and the Pooled Security effect, an attacker would need $13BN to corrupt any of the AVSs in order to corrupt the DApp on top.

EigenDA

EigenDA, the first AVS built on EigenLayer and currently on Testnet, is a decentralised hyperscale data availability layer secured by Ethereum.

Once launched, Rollups will be able to post data to EigenDA (which will be secured by the node operators performing validation tasks) to benefit from lower transaction costs and higher transaction throughput.

EigenDA is designed to horizontally scale with the amount of restake and operators opting to validate and service the protocol.

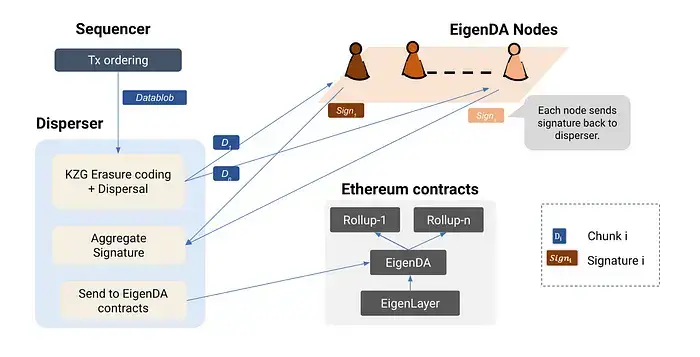

How does EigenDA work?

With the help of the above graphic, we can somewhat understand the process beginning with the Sequencer and progressing to the transmission of data to the Rollups.

The more detailed explanation begins with the Rollup Sequencer generating a block containing transactions. This Sequencer then requests the dispersion of the data blob.

The Disperser is responsible for encoding data blobs (through KZG or Kate-Zaverucha-Goldberg commitments and proofs) and transmitting them as chunks to the operators nodes on EigenDA.

The nodes on EigenDA validate the received chunks from the Disperser and provide a signature for aggregation. The Disperser is then responsible for forwarding these signatures and associated information to the EigenDA contracts, which, in turn, relay the data back to the Rollups.

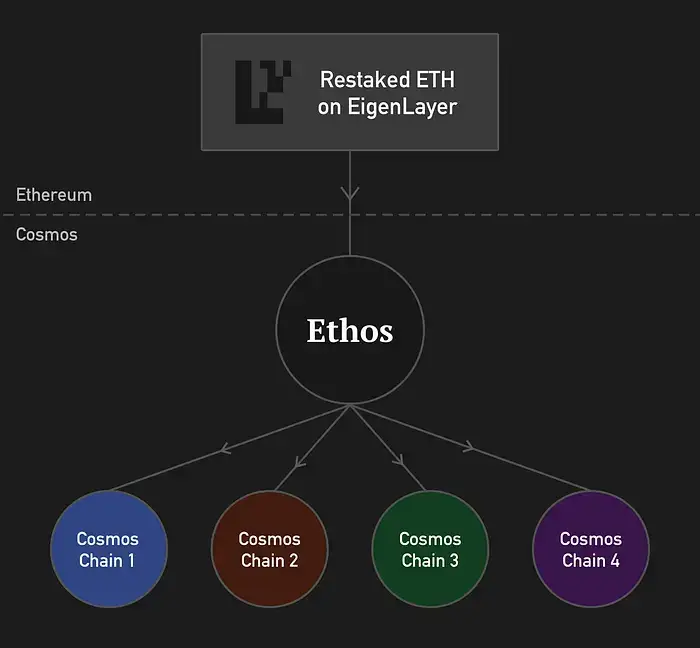

Ethos

Ethos is connecting Ethereum and Cosmos. This connection will allow for Cosmos Chains to tap into Ethereum’s decentralised security and this will allow Ethereum to tap into the experimentation that is happening in Cosmos.

The Cosmos SDK allows developers to easily spin up a chain and create a native staking token. Oftentimes, the cost of security (or the security budget) of this network will be high. This is mainly due to the underlying asset being considered volatile (which could lead to overall security value being affected negatively) apart from the fact that most Validators in the space would need to spin up dedicated hardware for that specific chain.

Replicated (or Interchain) Security is live on the Cosmos Hub which allows for a chain to leverage the Cosmos Hub Validator set for their project. The project would then be considered a ‘Consumer Chain’. In return for Validators supporting this chain, the Consumer Chain would have an agreement with the main provider chain to send a portion of tokens to be distributed.

While the concept of borrowing economic security is not new to the ecosystem, what distinguishes this approach is the use of restaked ETH. Through this method, new chains can potentially benefit from over $60 billion of economic security. Importantly, the maturity of the network contributes to the reduced volatility of the economic security backing the network.

Restaked ETH will allow chains to reduce their economic security budgets drastically. Ethos plans to be the central source of restaked ETH on the Cosmos where Cosmos-based chains can borrow security to help bootstrap their trust layer with minimal cost.

AltLayer

AltLayer is another exciting AVS utilising EigenLayer and EigenDA. AltLayer introduces the idea of ‘Restaked Rollups’ which takes existing rollups (built on any stack) and provides enhanced security, decentralisation, and fast finality thanks to EigenLayer and its other ecosystem partners.

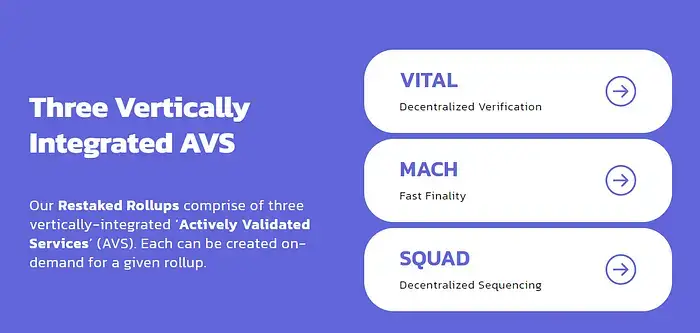

Restaked Rollups are a set of three AVSs that are created on-demand for any rollup. The three AVSs are:

- VITAL (AVS for decentralised verification of rollup’s state)

- MACH (AVS for fast finality)

- SQUAD (AVS for decentralised sequencing)

We will reserve going into detail on AltLayer and Ethos for a seperate research report in the near future.

Conclusion

EigenLayer is poised to be one of the more important projects of the year by leveraging an exciting new primitive to Ethereum.

EigenLayer doesn’t only address the current limitations within the Ethereum ecosystem, but it also helps create a more interconnected and secure blockchain system by reducing the fragmentation of economic security.

EigenDA, showcases the potential for decentralized hyperscale data availability layers on Ethereum while projects like Ethos and AltLayer showcase EigenLayer’s broader impact beyond Ethereum. Ethos facilitates the connection between Ethereum and Cosmos, allowing Cosmos chains to tap into Ethereum’s security while providing Ethereum access to innovative experiments within Cosmos. AltLayer introduces Restaked Rollups, enhancing the security, decentralization, and finality of existing rollups.

Please Note: Simply Staking is an EigenLayer Node Operator on the Testnet.

DISCLAIMER: The information provided in our research and content is for informational purposes only and should not be considered as financial or investment advice. Any decision to invest or engage in financial activities is solely your responsibility. We do not endorse or recommend any specific investment strategy, and individuals should conduct their research and seek professional advice before making any investment decisions. We are not liable for any financial loss, damage, or inconvenience resulting from the use of our content for investment purposes. Always be aware of the risks associated with financial markets, and carefully consider your financial situation and risk tolerance before making any investment choices.