A Recap on Namada

Namada, branded as the “Shielded Asset Hub”, is a privacy-focused blockchain protocol designed to enhance user privacy and interoperability of privacy transactions. Developed by the Anoma Foundation (and serving as the first instance of the Anoma Protocol), the Namada Protocol is a privacy-centric layer that facilitates the transfer of assets (both fungible and non-fungible) across ecosystems to ensure that privacy is maintained across the different ecosystems. Key among these features is the implementation of zero-knowledge proofs which enable transactions to occur without revealing any underlying data about the transaction contents or the parties involved.

For more details, see the following article: Namada: The Shielded Asset Hub.

Developments Post Shielded Expeditions

Shielded Expedition Testnet

The Namada Shielded Expedition was a massively multiplayer incentivised test net where 10,469 Pilots and 129,238 Crew Members competed in an asteroid mining race to test the Namada protocol before its mainnet launch. The event ran for 21 days from January 30, 2024 and a total of 30 million NAM (3% of the total supply) was awarded to winners based on rankings from top 1 to 100.

Key incentivisation tools of the Shielded Expedition included NAAN & ROID.

- NAAN: The native token of the expedition, used for network staking and fees.

- ROID: Points earned by completing tasks (mining asteroids), and determining rankings.

Note that NAM – the native token of the Namada mainnet, was not used in the expedition.

Structure & ROIDs points:

The expedition Participants had to cooperate to upgrade the protocol through governance to move forward in the shielded space. Meanwhile, the Nebb, a powerful tool akin to the Webb telescope, provided real-time stats and rankings and allowed task submissions.

Furthermore, ROID points were earned by Pilots and Crew Members through task completion, with points redistributed based on the number of participants.

The type of testnet tasks were divided into four asteroid classes (C, B, A, S), each with different tasks and ROIDs allocation. For example, Class S asteroids required participants to submit evidence of completion through the Nebb manually, and spamming resulted in bans.

What did the testnet test for?

The testnet evaluated Namdass capabilities on various fronts ranging from Sybil resistance to task execution.

Sybil Resistance and Consensus Mechanisms: Testing the network’s ability to prevent manipulation and maintain security under various participation levels proved a community-led initiative. The governance outputs were voted in, while those crews that tried to game the rules, were quickly identified.

On-chain Governance and Protocol Upgrades: evaluated how smoothly the community can implement critical upgrades to the protocol through coordinated governance actions. For example, the community first updated the protocol from v0 to v1 (a parameter change), followed by upgrading from v1 to v2 (a protocol code and state change).

Namada also tested for Incentive Structures and Task Execution. Mainly, including the evaluation of the effectiveness of the ROID point system and rewards distribution in motivating participants and managing performance under real-world conditions.

Following the successful completion of the shielded expedition, Namada proceeded with more structural community involvement in Networks’ development, which you can find out about below.

Community-driven Mainnet Configuration

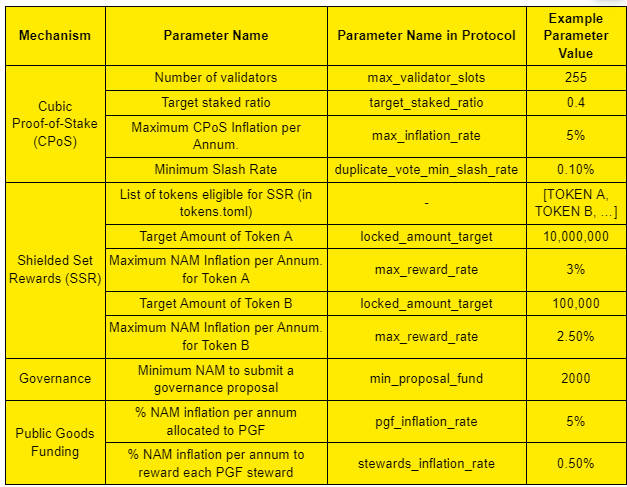

After closing the expedition, Namada announced the process of mainnet configuration, with community decision-making at its core. In Namada’s vision, Having a strong core community will be essential to stewarding Namada’s mission and roadmap. To this end, on June 26th, one of Namada’s leads proposed an initial set of parameters for the Namada protocol, which was further discussed by the community on the forums. Let’s break down the initial parameters below:

The NAM Token: The NAM token allows holders to transact on the network and gives them the right to stake tokens and participate in governance. If holders stake their tokens, they help secure the network, and their ownership is proportionate to the total supply of tokens. However, as new NAM tokens are issued to incentivise staking, public goods, and shielded deposits, those who don’t stake may see their proportional ownership decrease over time.

Incentivising Staking: The Namada network aims to have 40% of its token supply staked to secure the protocol. At the start, staking inflation is set at 0%, but the maximum possible inflation rate is 5%. The inflation rate ensures that rewards are distributed to those who stake their tokens, with a target of a 15% reward rate if 33% of the supply is staked at a 5% inflation rate. There is also a proposed unbonding period of 14 days, meaning stakers can withdraw their tokens after that time without affecting security.

Validating: The network will have 255 active validators, making it easier for new validators to join. Validators must have a minimum of 1,000 NAM delegated to them to qualify and won’t face penalties for minor downtime but will be jailed if they remain offline for more than 15 hours. Jailed validators can return to the active set after two epochs (about 12 hours), and delegators won’t receive rewards during the time the validator is jailed.

Slashing: If validators engage in actions like double-signing or launching a light client attack, they will face penalties, known as slashing. The latter depends on the amount of stake involved, with a minimum slashing of 0.1%. If multiple validators commit the same fault within a specific period, their penalties increase exponentially, hence encouraging validators and delegators to distribute their stakes across multiple validators to minimise risks.

Provisioning and Rewarding Public Goods: Namada will issue new NAM tokens to fund public goods like development, advancing the ecosystem, and community projects. Public Goods Fund (PGF) inflation will start at 0% at Genesis but gradually increase to 5% in Phase 2 and 10% three months after Phase 5. Initially, the organisation will have one steward to oversee the performance of public goods, with a potential increase in the number of stewards as more goods emerge.

Incentivizing Shielded Set Deposits: Namada faces a challenge at launch, as its data protection relies on having enough deposits. To bootstrap early deposits, the network will reward those who deposit assets with shielded set NAM rewards. These rewards will incentivise early participation and data protection. However, at launch, these rewards will be turned off, and there will be a dedicated discussion to determine which assets to target for rewards and the inflation rates associated with each.

Governance: Namada’s governance system allows stakers to vote based on the amount of NAM they have staked. Validators can vote for 2/3 of the voting period, while delegators can vote throughout. Proposals require a deposit of 2,000 NAM, and the voting period ranges from 7.25 to 21 days, with a 2-day grace period before implementation.

IBC (Inter-Blockchain Communication): Initially, IBC transfers will be turned off and after launch, governance will determine how to manage IBC parameters, including which assets can be transferred and how to secure asset deposits. Such stage-based design ensures that assets transferred across different blockchains remain secure.

Overall, the NAM token, incentivised staking, validator policy and governance, coupled with introperabilty standards, create a set of core modules necessary for a minimum viable ecosystem to exist. Please note that Namada still has time before launching to mainnet, hence the above parameters could be subject to change.

The full set of proposed parameters can be found at the bottom of this doc: draft proposal for Namada mainnet parameter discussions. We also put the latest parameters in the table below, so that you can have a cheat sheet!

Mainnet Release Candidate

Before the actual mainnet release and full decentralisation, together with the Anoma foundation, Namada released the Mainnet candidate – a software that has fully integrated the outcomes of the shielded experiment as well as the previously discussed parameters. You can see the original version of the Namada mainnet release candidate here, meanwhile, we will give you a quick rundown of the improvements below:

Namada v0.40.0 brought improvements to shielded actions, allowing users to make more secure transactions, and safeguarding privacy across the network. The update also enabled MASP fee payments, so that participants could pay transaction fees with multiple assets, increasing flexibility for users engaging in cross-chain activities.

Another key addition is replay protection for MASP-IBC transactions, which prevents duplicated transactions from being accepted. For example, if a user sends tokens from Namada to another blockchain, the replay protection ensures the transaction can’t be duplicated and exploited.

The update also introduced batched transactions, which allows users to send multiple transactions in one go, improving efficiency. For instance, if a developer needs to perform multiple token transfers or updates, they can now execute them in a single batch rather than individually.

The improved database snapshotting reduces the time needed to take snapshots of the blockchain’s current state, ensuring that validator nodes can operate more efficiently. Snapshotting is particularly beneficial in cases where node operators need to restore the blockchain state from a backup.

In the broader context of Namada’s mainnet preparation, each feature is a critical step toward ensuring the smooth operation of the network once it moves out of the testnet phase and into live production.

Namada Security Programme

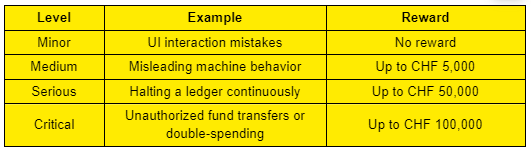

Together with the Candidate release, Namada and Anoma also launched the Mainnet Security Program – an initiative that incentivises discovering and reporting security vulnerabilities in the Namada protocol. The foundation offers rewards based on the severity of the issue, with a maximum payout of CHF 100,000 for critical vulnerabilities. The program focuses on ensuring the security of the mainnet during and after its launch through community participation and cooperation.

Here’s a breakdown of the reward structure:

Overall, the launch of the security programme was yet another demonstration of Namada’s commitment to community-driven and security-first ecosystem development.

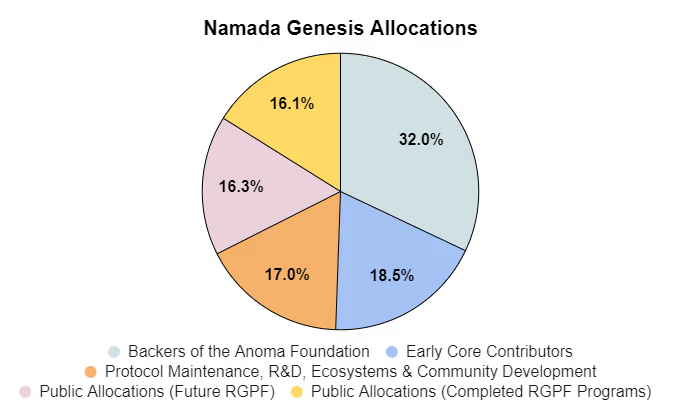

NAM Genesis Allocation

As a logical next step, Namada published the Genesis Allocation, which not surprisingly, was also subject to community approval. The Namada Genesis Allocation refers to how the total supply of NAM tokens will be distributed at the launch of the Namada blockchain.

- The Anoma Foundation is preparing the balances.toml file, which will detail how 1,000,000,000 NAM tokens will be allocated at the genesis

- These tokens will be available with no lockups, meaning they can be used immediately after the network goes live.

- The Namada community will discuss and review the allocations, parameters, and readiness before the launch, with the balances.toml file made public for transparency.

The goal is to ensure a fair and transparent distribution of tokens at the start of the network.

Below, we break down the 1,000,000,000 NAM allocation:

Releasing the Mainnet Plan

Namada has also published the Mainnet Launch plan, which you can see here. The mainnet plan is divided into 3 key phases:

- Pre-genesis plan: includes test launch of operations, stability testing on software and the merge of all valid transactions PRs

- Tet-launch plan: includes genesis dry-run where validators generate their genesis file set using the actual mainnet files and set initial IBC rate limits for each IBC asset

- Mainnent-launch plan: Same as test launch except ensure all integrations are notified and prepared (ie. exchanges, custodians, explorers eg. Cosmostation, wallets eg. Keplr)

Below, we focus on Pre-genesis stages 1 and 2, as these have recently been completed.

Pre-genesis Stage 1

Pre-Genesis Stage 1 was the initial phase for setting up validators in preparation for the Namada mainnet. During stage 1, users who wished to participate as validators on the mainnet were able to create and configure their mainnet validator nodes, making them ready for delegation in the next stage.

When it comes to validator creation, there was no special selection or pre-approved validator list, representing the permissionless nature of the network. Further, Validators submitted a pull request (PR) to the designated GitHub repository (namada-mainnet-genesis), where their mainnet validator setup was reviewed and merged.

Additionally, Validators were encouraged to create their validator setup even if they hadn’t fully decided to run a mainnet validator, ensuring proper setup and necessary tokens (NAM) were available for gas fees if they decided to participate later.

Last but not least, Validators were able to create their operator accounts even if they didn’t have any NAM tokens at this stage. Note that the tokens will be needed later for gas fees when the network advances to later stages, but setting up the validator now prepares them for future participation.

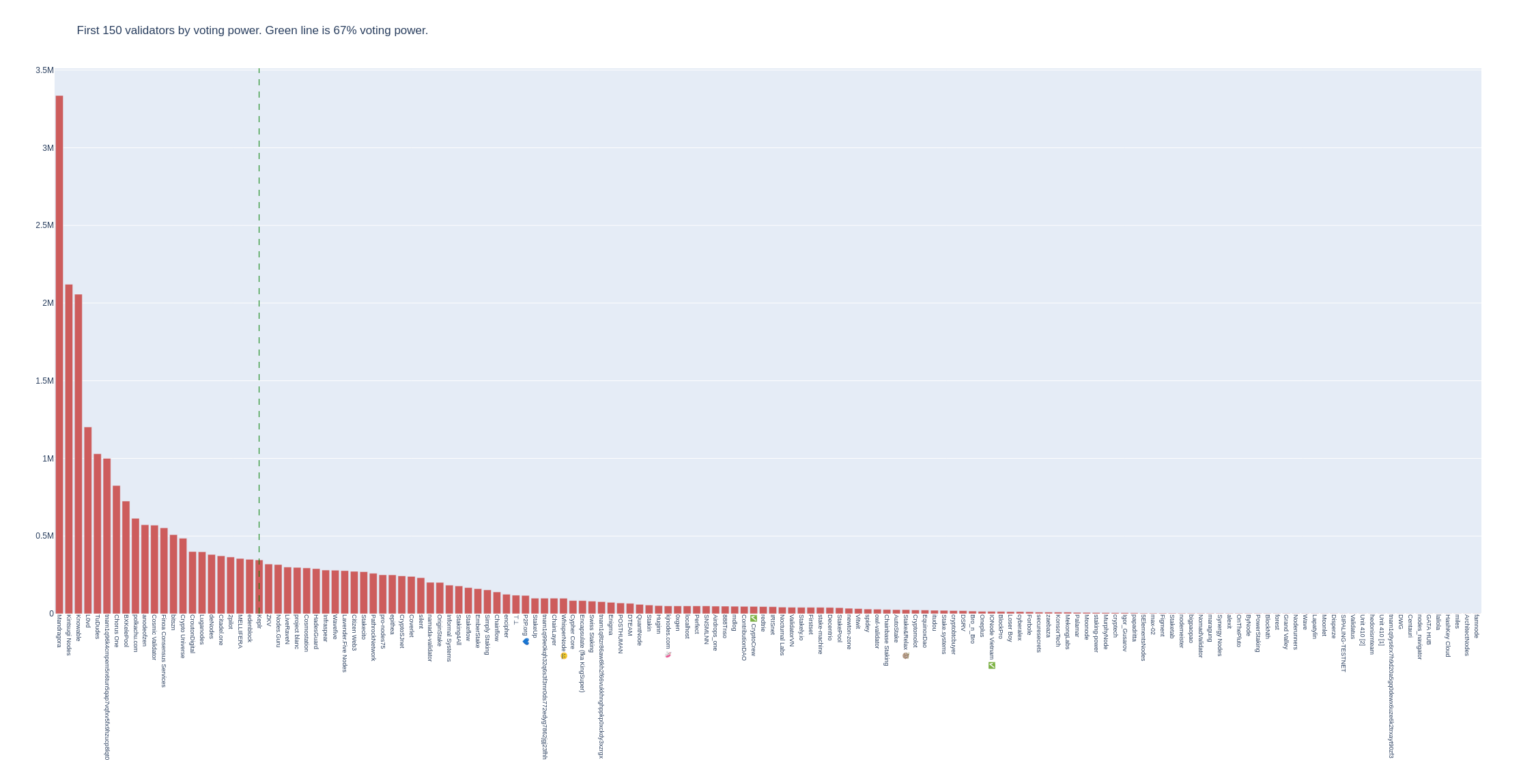

The diagram above showcases power distribution among Nanamda’s validators where 67% of all voting power is concentrated among the top 15 validators of the network. You can use Simply’s staking dashboard for secure, 1-click delegation!

After Pre-Genesis Stage 1 was successfully concluded, the network moved to Stage 2, where delegations unlock.

Pre-genesis Stage 2

The Namada pre-genesis stage 2, which opened on Sep 17, UTC 8:00, was a big step forward as it allowed users to delegate to validators. Anyone with NAM tokens was able to join Stage 2, and the Ledger Wallet users were able to stake directly from the device.

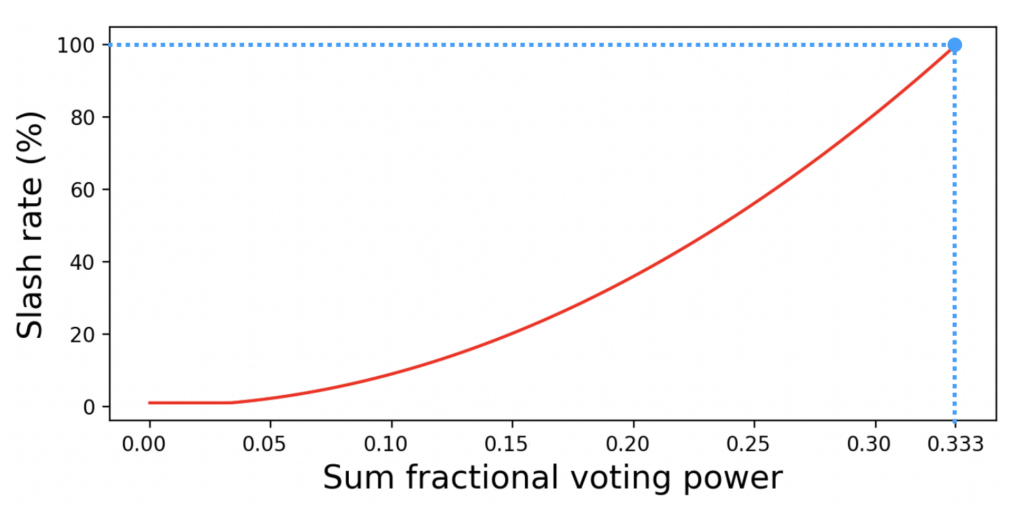

Stage 2 ran completely permissionlessly, with no validator prioritisation happening from the founding team. The minimum 5% fee was enforced and the Namada Cubic Slashing mechanism was activated, as shown in the diagram below.

Namada’s cubic slashing system is designed to penalise validators based on the severity and intent of their misbehaviour, with a special focus on coordinated attacks.

In the cubic system, the punishment is proportional to the cube of the validator’s voting power, meaning that the more voting power a validator has, the harsher the penalty becomes for deliberate misbehaviour. For instance, intentional, repeated attacks are punished more severely than accidental or non-malicious errors, fostering a balance between discouraging attacks and avoiding overly harsh penalties for innocent mistakes.

When a validator misbehaves, the protocol immediately jails them, preventing further participation in consensus or staking operations. The actual slashing, or reduction in staked tokens, is delayed until the epoch (period) after the infraction, which gives the network enough time (around 21 days) to thoroughly detect and confirm the offence. Once the unbonding period is passed, the cubic slashing formula is applied to determine the severity of the slash based on the validator’s voting power at the time of the infraction.

Namada X Anoma

Namda remains far from being a siloed ecosystem as it thrives to find synergies with complementary ecosystems and chains. The partnership between Namada and Anoma is no different – being centred on complementary roles within the blockchain space, this partnership has a particular focus on data protection and interoperability.

Despite architectural differences between Namada’s transaction-centric design and Anoma’s intent-centricity, the two protocols share significant development goals. The tooling for application development and ecosystem features overlap, including functionalities like FROST multisignatures, shielded multisigs, and private note retrieval. Many tools developed for Namada applications can also support Anoma applications, enhancing end-user experiences with privacy-focused features. For example, Namada’s web-based interface, Namadillo, can serve as a basis for intent-centric applications on Anoma, which also require private state handling.

Together, Namada and Anoma form one community that prioritises data protection, interoperability, and public goods funding. Namada’s unique approach to privacy and its supportive community has made it a hub for individuals and organisations from other ecosystems, such as Zcash, Cosmos, and Ethereum. As a key component of the Anoma ecosystem, Namada plays a vital role in fostering secure, private, and interoperable blockchain interactions.Through the above-discussed complementary partnerships, Namada and its community can flourish at the intersection of data protection, interoperability and utility-maximising public goods.

Namda Today

As we have demonstrated, Namada has come a long way, covering expeditions, protocol updates, resource allocation and partnerships. Yet, it still has a few stages left to cover, before it is fully decentralisation, including the Validator’s Dry Run and the test phases of the Mainnet Test launch.

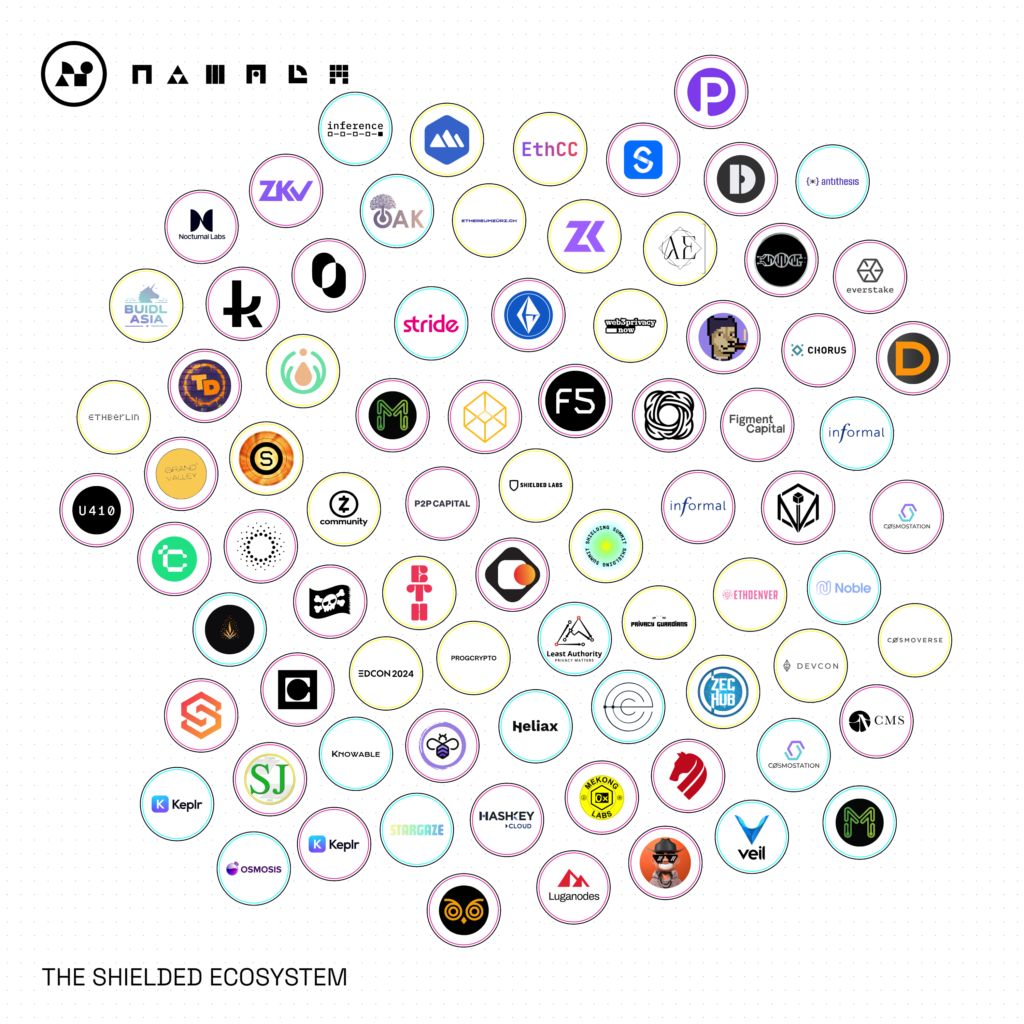

Namada was able to bootstrap liquidity, grow a strong community and onboard over 100 ecosystem partners (excluding validators). The bird’s eye view of Naamda’s ecosystem is shown below:

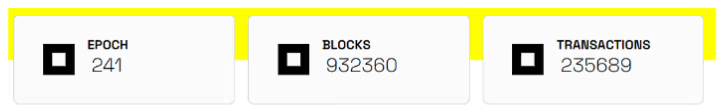

Furthermore, since its inception, Namada has been able to process nearly 1 million blocks, allowing it to finalise 241 epochs and over 230K transactions, showcasing early signs of the network’s robustness and processing capabilities.

You can monitor the network’s current state through this link: https://namada.info/

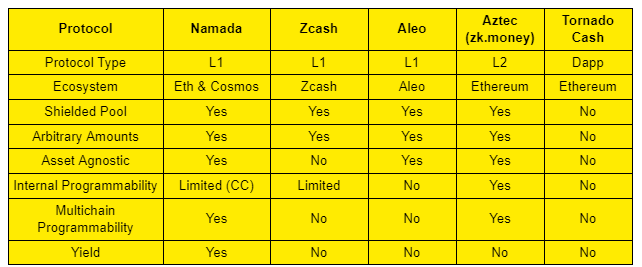

As the mainnet approaches, Namada is heading into the waters full of fierce competition, as showcased in the comparative table below:

Conclusion

Namada’s journey from the Shielded Expedition to the upcoming mainnet launch highlights its commitment to creating a robust, privacy-focused, and community-driven blockchain ecosystem. The Shielded Expedition testnet, with its incentivised participation and innovative governance features, successfully tested critical elements like Sybil resistance, on-chain governance, and incentive structures. Namada’s unique features—such as its multichain programmability, asset-agnostic shielded pool, and yield opportunities—position it as a competitive force in the privacy protocol landscape. The community’s ongoing involvement in configuring mainnet parameters, coupled with Namada’s partnerships and advancements in privacy technology, has laid a strong foundation for its mainnet launch.

With a strong community, diversified ecosystem, competitive tech stack and complementary partnerships, Namada is poised to become a solid player in the survival of the fittest game of the crypto-verse.

(Terms & Conditions Apply)

About Simply Staking

We are a Blockchain Services Provider who operates Validators and Nodes on over 30 Networks with over $1 Billion in Assets Staked. Our journey started in 2018, with Simply entering the Cosmos Hub Testnets, and now have expanded our operations to most major ecosystems including networks such as LIDO, Polygon, EigenLayer, Oasis Network, Cosmos Hub, Polkadot, and many more, all while being an Oracle Operator on Chainlink.

We offer additional services such as Nodes-As-A-Service (RPCs), Blockchain Development work, Tooling, Governance Services as well as Blockchain Consultancy Services.

More Information on our offerings can be found on our website.

Disclaimer: This article contains affiliate links. If you click on these links and make a purchase, we may receive a small commission at no additional cost to you. These commissions help support our work and allow us to continue providing valuable content. Thank you for your support!

Terms & Conditions apply on all partnership offers.

This article is provided for informational purposes only and is not intended as investment advice. Investing in cryptocurrencies carries significant risks and is highly speculative. The opinions and analyses presented do not reflect the official stance of any company or entity. We strongly advise consulting with a qualified financial professional before making any investment decisions. The author and publisher assume no liability for any actions taken based on the content of this article. Always conduct your own due diligence before investing.