Liquid Restaking: A Primer

The launch of EigenLayer brought the new innovative concept known as restaking to Ethereum, enabling its baselayer security to be extended to applications and services built on EigenLayer. Yet, restaking suffers from the same faith as native ETH staking on Ethereum: tokens remain bonded to the network and rendered illiquid, that is, unable to be moved or used elsewhere. Standard staking solved this issue through a feature known as liquid staking, which makes these illiquid staked tokens liquid by way of minting synthetic representations of the underlying asset. Evidently, it did not take long before restaking enjoyed the same liquidity innovation in the wake of the EigenLayer launch.

In this article, we’ll cover the basics of liquid restaking, explaining its benefits and risks. But before we do so, we’ll start with an overview of key concepts like staking and liquid staking for some necessary context, so even if you’re new to these ideas, you’ll gain a clear understanding.

From Staking to Restaking

Staking is the process of committing your cryptocurrency to support and secure a blockchain network that uses a proof-of-stake (PoS) consensus mechanism. In PoS networks, the blockchain is maintained by validator nodes, aka validators, who are responsible for validating transaction data, ensuring it follows the rules of the network, and then proposing new blocks to be added to the chain. Validators are chosen based on the amount of cryptocurrency they have staked. The more they stake, the higher their chances of being selected to validate transactions and create new blocks.

To become a validator, one must stake a significant amount of cryptocurrency, which acts as collateral and ensures that validators are financially invested in the network and have an incentive to act honestly, as they risk losing their staked assets if they engage in malicious activities. If you don’t meet the minimum staking requirements or don’t want to handle the technical aspects of running a validator node, you can delegate your stake to a validator. Validators earn rewards for their work, which are shared with their delegates. And so by staking your tokens you not only get to support these validators and contribute to the network’s security, but will likewise earn rewards for it. You can Simply Stake and Secure your assets with the Ledger wallet!

Liquid staking is a mechanism that allows users to stake their assets in a blockchain network while still retaining liquidity. Normally, when you stake assets, they are locked up and cannot be used for any other purpose. Liquid staking solves this by issuing a derivative token representing the staked assets, referred to as a liquid staking token (LST), which can be traded, used in other applications in decentralised finance (DeFi), or even (re)staked again. This means users can earn staking rewards and simultaneously utilise their assets across other protocols, enhancing the overall utility and efficiency of staked capital.

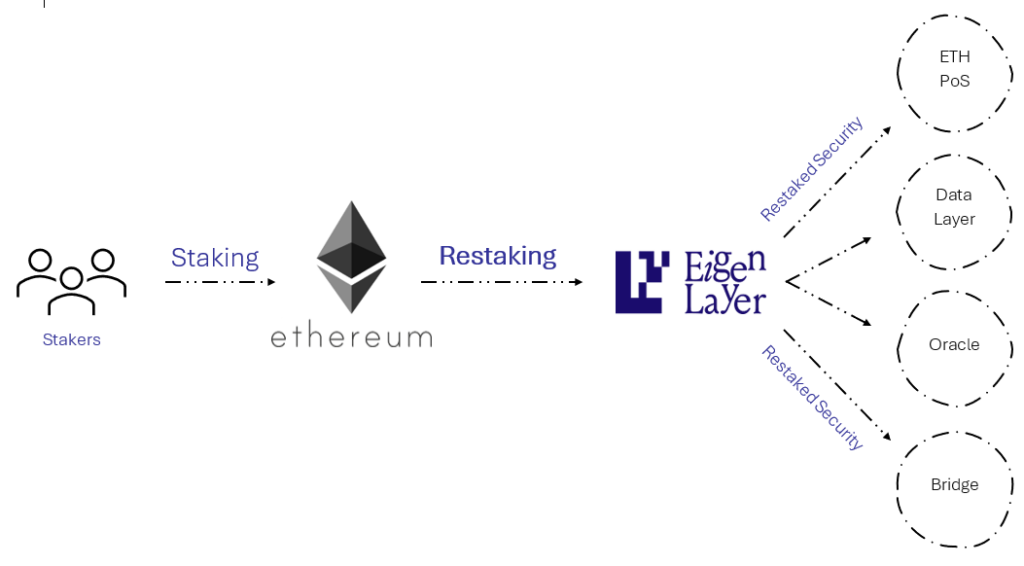

Restaking refers to the process of taking already staked assets and staking them again to secure a different protocol or for a different purpose. The concept was first popularised by EigenLayer, arguably becoming the hottest trend of 2024 so far; with both restaking competitors such as Karak and Symbiotic as well as other innovations emerging, like the liquid restaking that is the focus of this article. Through protocols like EigenLayer, validators can opt to restake their ETH, which allows them to extend their security commitments beyond the main Ethereum blockchain to other modules, such as data availability layers, oracles, and more; which not only enhances the security of these services but also provides validators with additional rewards for their extended participation and risk. Restaking can thus be said to aggregate security across ecosystems and to various applications to increase the robustness and reliability of the network while offering validators and restakers additional revenue streams.

What is Liquid Restaking?

Liquid restaking is a financial concept in decentralised finance (DeFi) that combines the principles of liquid staking with restaking to optimise the utility and yield of staked assets. Combining the two, liquid restaking follows the same general procedure as liquid staking described above and involves tokenising the staked ETH into a liquid restaking token (LRT) that retains the value of the original staked ETH while allowing it to be used across various DeFi applications. Essentially, liquid restaking decouples the staking rewards from the operational constraints of traditional staking, providing stakers with greater flexibility, improved capital efficiency, and enhanced reward opportunities.

Benefits of Liquid Restaking

Liquid restaking offers several advantages, making it an attractive option for both individual stakers and the broader blockchain ecosystem. Below we list some of the most prominent ones:

Improved Yield Potential

One of the primary benefits of liquid restaking is the potential for increased rewards. By allowing staked assets to participate in multiple protocols, liquid restaking enables stakers to earn rewards from various sources. In addition to the standard PoS rewards, stakers can receive restaking rewards from participating in protocols like Eigenlayer to enhance their overall yield.

For instance, when a user stakes ETH through an LRP like Puffer Finance, they earn the standard PoS rewards for securing the Ethereum network. Simultaneously, their staked ETH can be restaked within Eigenlayer, generating extra rewards from providing security and liquidity to other applications and services.

Greater Liquidity and Capital Efficiency

Most obviously, liquid restaking improves liquidity and thus capital efficiency by maximising the utility of staked assets. As explained earlier, standard restaking requires users to lock up their tokens, which limits their use in other financial activities. Liquid restaking, on the other hand, makes these staked assets liquid, able to be used simultaneously in multiple DeFi protocols and, as such, optimise their utility while promoting a more dynamic and efficient market with deeper liquidity.

For example, with liquid restaking, a user’s staked ETH can earn PoS rewards while also generating additional income through restaking activities; a dual functionality that reduces the need for additional capital investment, as the same staked assets can participate in multiple earning opportunities. Consequently, stakers can achieve higher returns on their investments without having to increase their capital outlay.

Enhanced Network Security

Liquid restaking contributes to the overall security and resilience of the Ethereum network and other supported protocols. By restaking their ETH, stakers provide additional security to various decentralised services, enhancing the robustness of the entire ecosystem while making it more challenging for malicious actors to compromise the network.

Moreover, liquid restaking promotes decentralisation by allowing a broader range of participants to engage in staking and restaking activities. This increased participation helps to distribute the security efforts across the network, reducing the risk of centralisation and enhancing the stability of the blockchain ecosystem.

Reduced Opportunity Cost and Extended DeFi Utility

As liquid tokens, LRTs can be used in various DeFi applications to provide extended utility for staked assets and can be traded, used as collateral, or invested in other DeFi protocols. Hence, they also reduce the opportunity cost associated with locking funds in a single protocol.

For instance, if you have staked ETH and received an LRT, you could use these tokens in lending protocols, providing liquidity on decentralised exchanges (DEXs), or as collateral for borrowing other assets. Hence, LRTs provide flexibility that enables you to leverage your staked assets in multiple ways to enhance their overall utility and potential returns.

Lower Entry Barriers

Liquid restaking protocols often lower the barriers to entry for staking by allowing users with smaller amounts of capital to participate in staking activities. As such, they can be said to democratise access to staking opportunities as they enable more users to contribute to and benefit from the network’s security and decentralisation efforts.

By making staking accessible to more users, liquid restaking fosters a more inclusive ecosystem where small-scale investors can pool their resources and gain exposure to staking rewards previously only available to those with significant capital. Importantly, this can help to decentralise the network further, and in turn, enhance its security and resilience.

Risks Associated with Liquid Restaking

While liquid restaking offers numerous benefits, it is not without risks. Understanding these risks is important for stakers to make informed decisions and manage their investments effectively. What follows is a general outline of the most common ones stakers should be aware about.

Smart Contract Risks

Smart contracts are the backbone of decentralised protocols, and any vulnerabilities or bugs within these contracts can lead to significant losses. Liquid restaking involves multiple layers of smart contracts, each of which needs to be secure and reliable. If a smart contract managing the restaking process has a flaw, it could be exploited by malicious actors, resulting in the loss of staked and restaked assets.

To mitigate this risk, it is essential for protocols to undergo thorough audits and continuous security evaluations. Ensuring the robustness of smart contracts involves regular updates and patches to address any discovered vulnerabilities. Stakers should also stay informed about the security practices and audit results of the protocols they are involved in.

Slashing Risks

Slashing is a penalty mechanism used in PoS networks to punish validators who act maliciously or fail to maintain required uptime. In the context of liquid restaking, the risk of slashing can extend to restaked assets and increase the potential for financial losses. Validators must maintain high performance and uptime to avoid slashing penalties. Some LRPs have implemented various anti-slashing mechanisms that could be worth considering.

For example, suppose a validator fails to produce blocks or signs conflicting transactions (double-signing). In that case, they can be slashed, resulting in the loss of their staked and restaked assets—a risk that underscores the importance of choosing reliable validators and implementing robust anti-slashing measures.

Liquidity Risks

One of the main risks associated with liquid restaking is liquidity risk. Some liquid restaking protocols may not have sufficient liquidity, making it difficult for users to withdraw their funds or trade their LRTs. In thinly traded markets, this could result in significant price drops for LRTs and lead to potential losses for stakers. Without naming any protocols, we have already seen this happen in the restaking market.

To manage this risk, it is essential to assess the liquidity of the protocol before committing your assets. Check the trading volumes and market depth of the LRTs on DEXs to ensure there is enough liquidity to support your transactions if they are of larger size. Being aware of market conditions and choosing protocols with higher liquidity can help mitigate these risks.

Overleveraging

The ability to restake assets multiple times can create leverage on the initial amount, which can amplify losses during market downturns or if the protocol experiences technical issues. There is also the strategy known as “looping”, whereby liquid-(re)staked tokens are used as collateral to borrow even more tokens to be restaked, over and over again, Overleveraging has been a problem in the crypto space before, leading to significant collapses like that of Luna Classic.

To avoid overleveraging, it is important to monitor your leverage levels and be cautious with recursive borrowing strategies. Ensure that you understand the risks involved and have strategies in place to manage potential losses. Diversifying your investments and avoiding excessive leverage can help protect your assets from the negative impacts of overleveraging.

Complex Management

The layered nature of liquid restaking adds to the operational complexity, making it challenging for stakers to manage their assets effectively across different protocols, which requires a decent level of knowledge and diligence. For newcomers, added complexity can lead to operational errors and inefficiencies.

Stakers may need to monitor multiple positions, track various reward streams, and so on, leading to increased operational overhead that can be difficult to manage, especially for individual stakers without the necessary technical knowledge. However, automated tools and dashboards can help mitigate this complexity by providing intuitive management interfaces.

Conclusion

In summary, liquid restaking enhances the restaking process by providing greater liquidity and flexibility for restaked assets. By converting restaked ETH into liquid restaking tokens (LRTs) through platforms like EigenLayer, stakers can use these tokens across various DeFi protocols, improving capital efficiency and allowing for additional earning opportunities. Liquid restaking also offers the advantage of promoting broader participation by lowering the barriers to entry, enabling smaller investors to engage in staking and benefit from network rewards.

In conclusion, liquid restaking enhances the restaking process by providing greater liquidity and flexibility for restaked assets. By converting restaked ETH into liquid restaking tokens (LRTs) through platforms like EigenLayer, stakers can use these tokens across various DeFi protocols, improving capital efficiency and allowing for additional earning opportunities. Liquid restaking also offers the advantage of promoting broader participation by lowering the barriers to entry, enabling smaller investors to engage in staking and benefit from network rewards.

However, liquid restaking is not without its challenges, including potential smart contract vulnerabilities, liquidity risks, and the complexity of asset management. Effective risk management strategies, protocol audits and due diligence are essential to mitigate these. As the restaking narrative continues to develop, its liquid staked form offers the promise of a more accessible, efficient, and secure staking environment for all participants—assuming risks are appropriately managed.

Disclaimer: This article contains affiliate links. If you click on these links and make a purchase, we may receive a small commission at no additional cost to you. These commissions help support our work and allow us to continue providing valuable content. Thank you for your support!

This article is provided for informational purposes only and is not intended as investment advice. Investing in cryptocurrencies carries significant risks and is highly speculative. The opinions and analyses presented do not reflect the official stance of any company or entity. We strongly advise consulting with a qualified financial professional before making any investment decisions. The author and publisher assume no liability for any actions taken based on the content of this article. Always conduct your own due diligence before investing.