Introduction to MegaETH

If a blockchain app took 10 seconds to react every time you clicked, you would quit instantly. You would not wait patiently for finality, you would not admire the decentralisation, and you would not read the documentation. You would simply close the tab and move on.

Well, that gap between what users expect and what blockchains deliver is exactly what MegaETH is trying to close. MegaETH positions itself as a high performance Ethereum execution layer designed to make onchain interactions feel real time. Instead of waiting for blocks to confirm, transactions are streamed continuously, allowing applications to respond almost immediately.

Considering how important user experience is for the success of a dApp or blockchain network, we decided that MegaETH deserves our attention. In this article we explain what MegaETH is, why it matters for Ethereum scaling, and how it fits into the broader Web3 infrastructure landscape. The goal is simple: help you understand why MegaETH is being discussed as one of the most ambitious performance focused Ethereum Layer 2 projects to date.

Let’s dive in!

What Is MegaETH?

In essence, MegaETH is an Ethereum Layer 2 designed specifically as a high performance execution layer. It inherits security from Ethereum while rethinking how transactions are executed, ordered, and validated. Rather than replacing Ethereum or competing with it, MegaETH is built to extend what Ethereum based applications can realistically do.

The project’s main focus is on execution speed and responsiveness. In practice this means that smart contracts are still written in Solidity while existing Ethereum tooling still works, therefore ensuring that composability with the Ethereum ecosystem is preserved. What changes is the execution environment, which is optimised to deliver extremely low latency and very high throughput.

Developed by Mega Labs, MegaETH is designed to sit within Ethereum’s scaling roadmap rather than diverge from it.

Why Ethereum Needs High Performance Solutions

It is fair to say that Ethereum has succeeded beyond expectations, but success brought quite a lot of congestion. As usage increased, block space became scarce, fees fluctuated, and confirmation times became unpredictable. Even if rollups improved scalability, many applications still feel slow from a user perspective.

Most Ethereum scaling solutions optimise for cost and throughput, but latency often remains an afterthought. Even on fast rollups, users still wait for blocks to be produced before applications update state. Although this may be acceptable for simple transfers, it breaks immersion for interactive use cases. Applications like high frequency trading, onchain games, live prediction markets, and real time financial instruments all suffer when latency is measured in seconds. Responsiveness itself should be a core feature, not a secondary optimisation.

If you are interested in another concrete example of how crypto infrastructure is moving toward real time experiences, Simply Staking recently explored the x402 payment protocol, which enables instant stablecoin payments directly over standard HTTP requests. It highlights the same underlying shift MegaETH is targeting: removing waiting, friction, and invisible delays that break user experience.

How MegaETH Works

MegaETH approaches scaling from the execution layer outward. Its architecture introduces several design choices that work together to remove bottlenecks while keeping verification accessible.

Execution Layer First

First of all, MegaETH does not introduce a new consensus system and Ethereum remains the security anchor. MegaETH focuses almost entirely on fast execution, ordering transactions through a sequencer and anchoring results back to Ethereum’s mainchain.

Therefore, this allows the project to optimise performance without redesigning Ethereum’s trust assumptions.

Mini Blocks and Continuous Execution

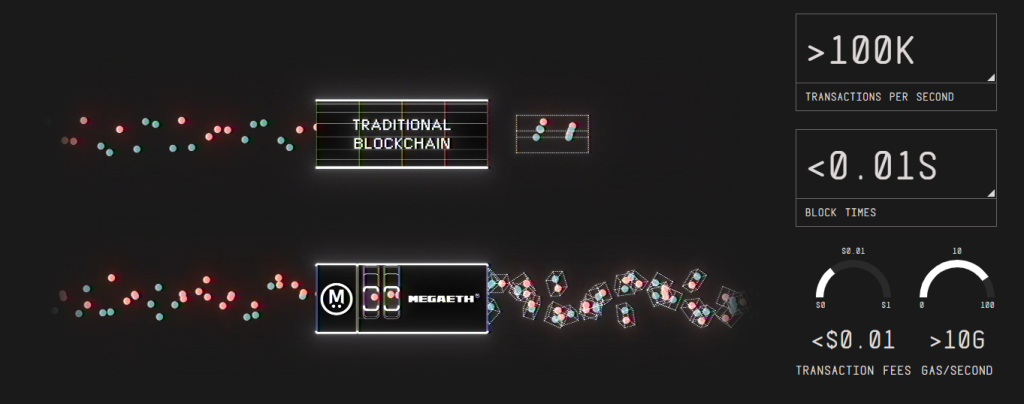

Instead of producing blocks at fixed intervals, MegaETH introduces mini blocks. These are small transaction batches that are executed continuously, with a cadence measured in milliseconds.

Each transaction appears in exactly one mini block and later in one full EVM equivalent block. The full block is produced on a slower schedule and is used for anchoring state to Ethereum. For applications, the key benefit is that execution happens immediately rather than at the end of a block interval.

Real Time JSON RPC

Execution speed is absolutely meaningless if applications cannot see state changes quickly. MegaETH extends the standard Ethereum JSON RPC so that queries can reflect the latest mini block state, rather than waiting for a full block to be produced. Additionally, wallets and applications can observe balance updates, logs, and contract state changes almost instantly. Subscriptions stream changes as they happen, creating a much tighter feedback loop between user actions and onchain responses.

This is also where low latency RPC infrastructure becomes critical. Real time execution only delivers its full benefit when applications are connected through reliable, high performance endpoints, such as those provided by Spectrum, which are designed to handle rapid state updates without introducing additional lag.

SALT and State Performance

In many Ethereum style systems, state access becomes the hidden performance bottleneck. It is important to note that updating the state structure often requires expensive disk operations that slow execution as the chain grows.Therefore, to address this, MegaETH introduces SALT, or Small Authentication Large Trie. The key idea is to keep the authentication structure entirely in memory, removing slow disk access from the execution path. All this allows state size to scale without significantly degrading performance.

In simpler terms, the keyl takeaway is that MegaETH is designed not to slow down as usage increases.

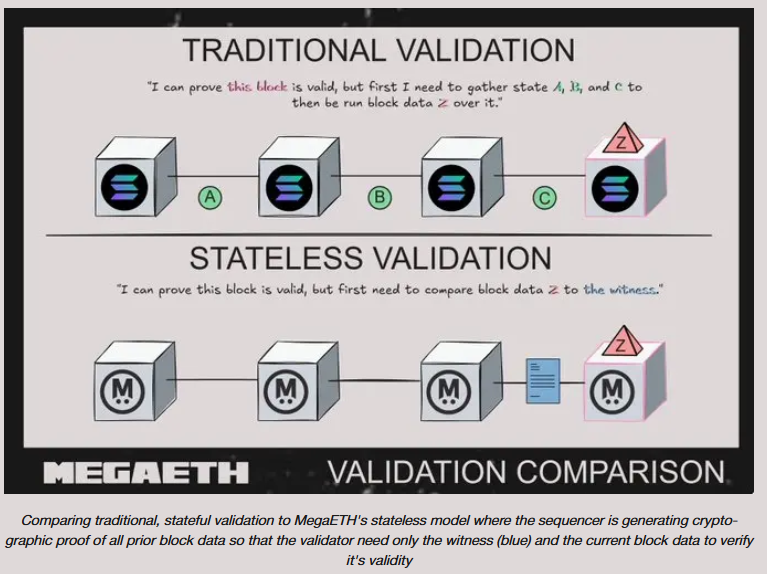

Stateless Validation

High throughput chains often require heavy node infrastructure but MegaETH completely avoids this by separating block production from block validation. Each block includes a witness, a compact package of state data required to verify correctness. Furthermore, validators do not need to store the full blockchain state, as they re-execute the block using the witness and check that the resulting state matches the sequencer’s claim.

This allows block production to be specialised and powerful while keeping verification lightweight and broadly accessible.

Key Features of MegaETH

At a glance, MegaETH offers:

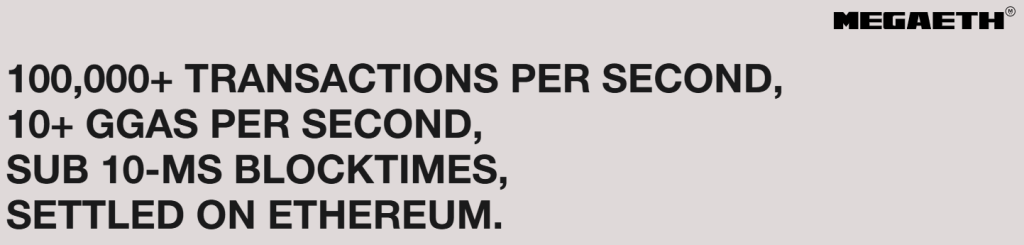

- High transaction throughput, with a design target of up to 100,000 transactions per second

- Ultra low latency through continuous mini block execution

- Full Ethereum compatibility, including Solidity and existing tooling

- An execution focused architecture anchored to Ethereum security

- Stateless validation that lowers the barrier to verification

- A real time JSON RPC designed for responsive applications

MegaETH vs Traditional Ethereum and Other L2s

Ethereum mainnet prioritises decentralisation and security, but it is fair to say that block times and throughput are inherently limited. MegaETH does not attempt to change this, but instead, it offloads execution to a specialised environment while anchoring results back to Ethereum.

Compared to optimistic rollups, MegaETH differs in how execution is surfaced to applications. Traditional rollups batch transactions and expose state updates only after blocks are produced. In contrast, MegaETH streams execution continuously and exposes state updates in near real time.

Furthermore, compared to ZK rollups, MegaETH does not currently rely on validity proofs for execution correctness. Instead, it uses stateless validation combined with Ethereum anchoring. This places MegaETH differently within the modular blockchain thesis, focusing on execution performance rather than proof compression.

MEGA Token and Network Incentives

MegaETH’s native token is MEGA, but unlike many other Layer 2 designs, MEGA is not positioned primarily as a gas token. Gas fees are handled separately and paid in ETH, with a clear emphasis on stability and predictability.

Therefore, what is MEGA used for? MEGA’s primary roles are governance and network incentives. Validators stake MEGA to participate in securing the network, and token holders are expected to play a role in governance decisions related to protocol upgrades and ecosystem development.

It is worth noting that a central concept in MegaETH’s incentive design is performance based rewards. Rather than distributing most of the supply upfront, MegaETH reserves a large portion of tokens for KPI based staking rewards that are released over time as the network grows and meets usage milestones.

Let’s now invest some time to clearly lay down MEGA’s Tokenomics.

MEGA Tokenomics Explained Simply

First of all, MEGA has a fixed total supply of 10,000,000,000 tokens, and the token’s distribution is best understood by grouping it into three broad categories.

The first category focuses on community and public ownership. 5% of the total supply was allocated to the public sale, giving non insiders direct access to the token at launch. This was complemented by earlier community driven allocations, including the Echo sale and the Fluffle NFT programme, which were specifically structured to attract long term participants rather than short term speculators. Together, these allocations were designed to make the community one of the largest collective stakeholders in the network from an early stage.

The second category includes builders, contributors, and long term stewards of the project. The team and advisors allocation represents 9.5% of total supply and is subject to a one year cliff followed by linear vesting over three years. An additional 7.5% is reserved for a foundation and ecosystem fund intended to support partnerships, grants, and long term sustainability. Furthermore, private investors also hold a defined portion of supply aligned with the project’s funding history.

The third and most significant category is long term network incentives. A total of 53.3% of the supply is reserved for KPI based staking rewards. These tokens are not immediately circulating. They are distributed gradually to validators and participants as the network grows and demonstrates real usage.

It should also be noted that there is also a bonus pool associated with lockup incentives during the public sale, designed to encourage longer term holding behaviour.

Overall, the key takeaway is that MEGA is designed to be earned over time through participation, rather than extracted quickly through fees or early emissions. If you wish to dive deeper, we encourage you to read MegaETH’s MiCA compliant white paper by clicking here.

The Future of MegaETH

MegaETH has already demonstrated its architecture through a public testnet featuring mini blocks, real time APIs, and high throughput execution.

The transition to mainnet marks the shift from experimentation to real economic activity. Initially, block production will remain centralised to ensure correctness and performance, but over time, staking and validator participation are expected to expand, increasing decentralisation at the validation layer.

Within Ethereum’s long term scaling vision, MegaETH fits as a specialised execution layer focused on responsiveness. It does not aim to replace rollups or Ethereum mainnet, but to extend what Ethereum based applications can deliver.

Final Thoughts

MegaETH is not trying to make Ethereum marginally faster. It is trying to make Ethereum feel alive. By streaming execution in real time, redesigning state performance, and keeping validation accessible, MegaETH challenges the assumption that blockchains must feel slow to remain decentralised. Whether this model becomes a blueprint for future execution layers remains to be seen, but the problem it targets is real and increasingly important. If you want to explore MegaETH further, follow its ecosystem development and watch how real applications behave as adoption grows.

To stay up to date with beginner friendly breakdowns of Ethereum scaling, Web3 infrastructure, and staking trends, follow Simply Staking on X.