Crypto Perp DEXs in 2025 Beyond Hyperliquid, Aster and Lighter

Trading Without CEXs Trust: The Rise of Perp Decentralized Exchanges

In the early days of crypto, traders had no other option but to depend on centralised exchanges like Binance or OKX to speculate on prices. It was simply the only way to trade in a convenient manner, but although many did make use of these centralised products, the crypto community was always very aware of their shortcomings. These platforms controlled user funds, managed trades, and decided who could participate and who could not, until Decentralised Finance (DeFi) came along, a movement built on transparency and code.

Now the same thing is happening all over again but this time with Perp DEXs, or perpetual decentralized exchanges which are leading the next wave of crypto innovation. Perp DEXs bring perpetual futures trading fully onchain, blending the precision of traditional derivatives markets with the open, permissionless spirit of decentralised finance.

In this article, we will explore what Perp DEXs are, how they work, and why they are shaping the 1 trillion dollar derivatives market cap that could define crypto in 2025 and beyond, but first, it would be best to first understand what perpetual futures are as they are central to this conversation.

Understanding Perpetual Futures in Crypto Trading

Before exploring Perp DEXs, it helps to understand the financial instrument they are built on, the perpetual future, often called a perpetual contract or simply a perp.

A perpetual future is an agreement between traders that lets them speculate on the future price of an asset such as Bitcoin or Ether without ever owning it. Imagine two people making a friendly wager. One believes that Bitcoin will rise, the other believes it will fall. Both of them deposit collateral on a crypto trading platform, and as the price of the underlying asset changes, their profits or losses change in real time.

In traditional finance, futures contracts come with expiry dates. Traders must close or settle their positions when that date arrives. For instance, a gold future might end at the close of the month, forcing both sides to settle. Crypto traders wanted something more flexible: a market that never closes and contracts that never expire. That idea gave birth to the perpetual futures market, now one of the most active parts of decentralized finance.

The key mechanism that makes perpetual contracts work is known as the funding rate. Picture the price of a Bitcoin perpetual contract moving higher than Bitcoin’s actual spot price. This happens when more traders go long than short. To restore balance, the protocol automatically makes long traders pay a small fee to short traders. When the opposite happens, short traders pay the longs.

This system functions like a seesaw that constantly adjusts to stay even. The funding rate acts as the balancing point, keeping perpetual prices close to the real market value. These payments are usually small but occur frequently, often every hour, ensuring that the perpetual futures market always reflects the true price of the asset it tracks.

Platforms such as Coinbase, MEXC, and Hyperliquid use similar principles to keep their onchain perpetuals stable and liquid. The model has proven so effective that it has become a cornerstone of modern crypto trading.

Now consider leverage, another key feature of perpetuals. Perp traders can amplify their exposure by borrowing against their collateral. With ten times leverage, a trader can control a position ten times larger than their deposit. This can multiply profits when the market moves in their favour but also increases losses just as quickly.

In simple terms, perpetual futures are continuous, self-correcting contracts that never expire. They were designed to give traders complete freedom to stay in the market as long as they choose, without the restrictions of traditional derivatives. This ongoing tug of war between buyers and sellers is what fuels the Perp DEX ecosystem and underpins the growing onchain derivatives market across today’s blockchain-based decentralized exchanges.

What Is a Perp DEX in DeFi and How It Differs from Protocols Like Uniswap and Aave?

Essentially, a Perp DEX is a decentralized exchange designed specifically for trading perpetual futures directly on the blockchain. Unlike centralised exchanges (CEXs) that hold user funds, Perp DEXs are non-custodial, meaning traders always have full control of their assets.

You may think of it as a blend between a derivatives market and a DeFi protocol. Platforms such as dYdX, GMX, Aster, Avantis, and Hyperliquid allow users to open leveraged positions, trade perpetuals, and manage margin accounts all through smart contracts. Every single trade, liquidation, and funding rate adjustment happens transparently onchain, therefore making Perp DEXs a vital part of the decentralized finance movement.

Massive DeFi protocols such as Uniswap or Aave specialise in spot swaps and lending, while Perp DEXs are specifically built for derivatives. They let traders hedge exposure, speculate on market movements, and tap into deep onchain liquidity with low fees and no middlemen.

Decentralized Trading: How Perp DEXs Work on the Blockchain

The power of Perp DEXs comes from how they replicate the infrastructure of traditional futures markets entirely through code. Traders start by depositing collateral, most of the time stablecoins such as USDT, into a smart contract as a security buffer for leveraged positions. The protocol continuously checks each trader’s margin, ensuring solvency and triggering automatic liquidations if balances fall too low.

Pricing is determined by oracles such as Chainlink, which feed live data from spot markets into the Perp DEX, and therefore ensuring that each trade reflects fair market conditions and also prevents price manipulation. Additionally, the funding rate plays its part too, maintaining the balance between long and short positions and keeping perpetual prices close to spot prices. The true beauty of all of this is that everything is executed onchain, powered by smart contracts and governed by code rather than companies, creating a fully decentralized trading experience with transparency, security, and accessibility at its core.

Top Perp DEXs Trading Platforms in 2025:

The Perp DEX ecosystem has grown rapidly, with several platforms leading innovation in performance, liquidity, and decentralization.

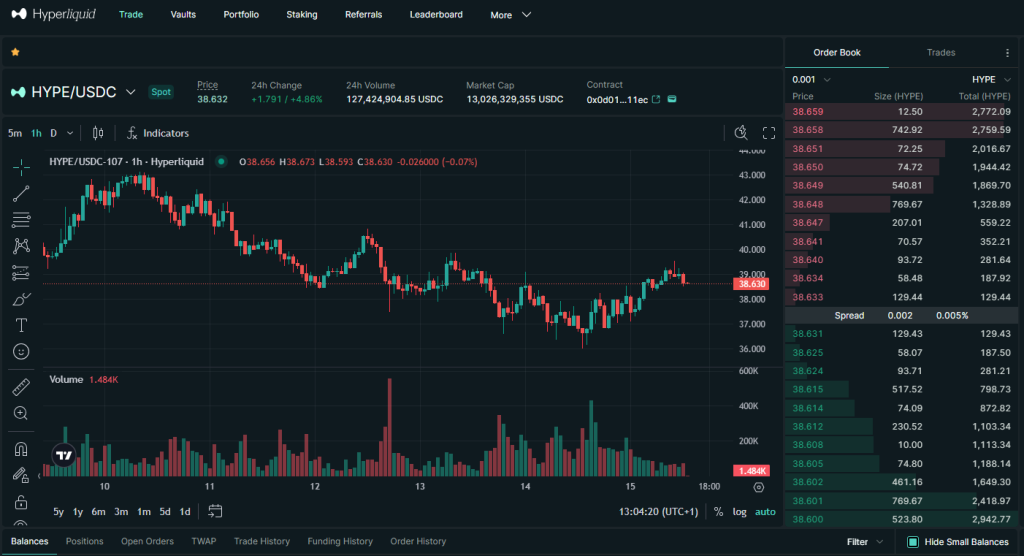

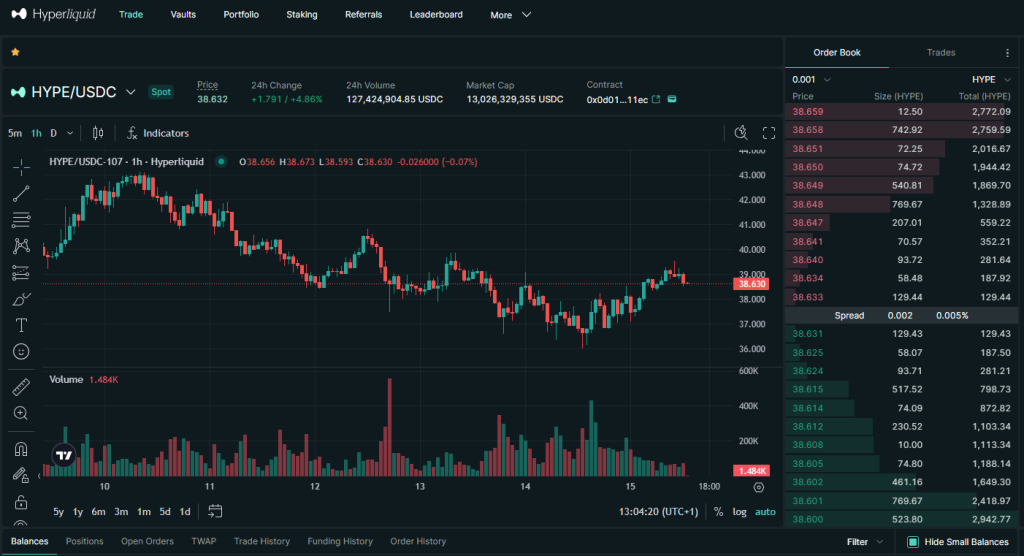

Hyperliquid: Fully Onchain High-Performance Trading

Hyperliquid is one of the most advanced Perp DEXs in crypto. It operates on its own custom Layer 1 blockchain and uses a consensus mechanism known as HyperBFT, designed for instant finality and low gas fees. Unlike most projects, Hyperliquid is fully community-owned, which means no venture capital and no private sales, aligning perfectly with the ethos of decentralised ownership.

To explore its unique tokenomics, trading engine, and liquidity design, check out our full article What Is Hyperliquid?

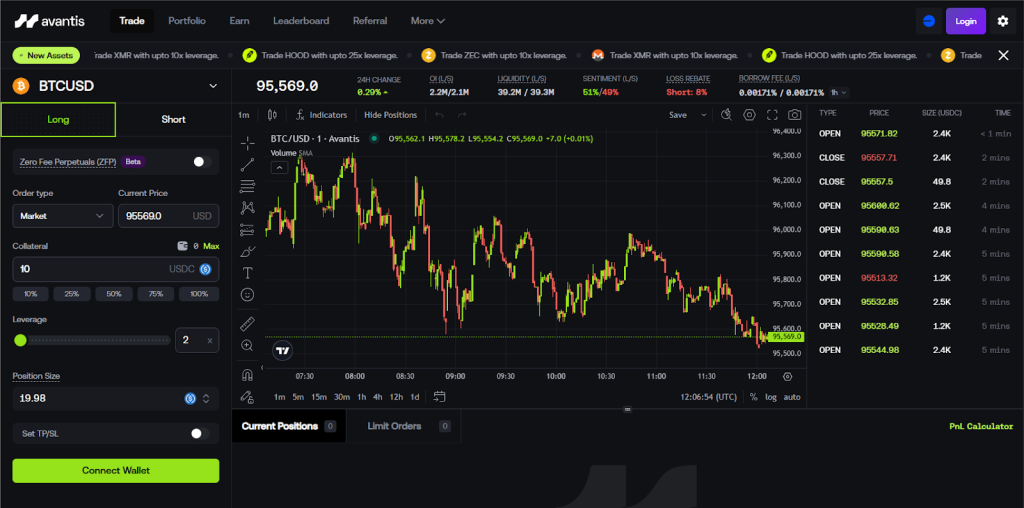

Avantis: Efficient and User-Friendly Derivatives Trading

Avantis focuses on capital efficiency and accessibility. Its pricing system minimises slippage and supports cross-margin accounts for traders managing multiple positions. Designed for professionals yet simple enough for beginners, Avantis combines low fees with deep liquidity to create a seamless trading platform.

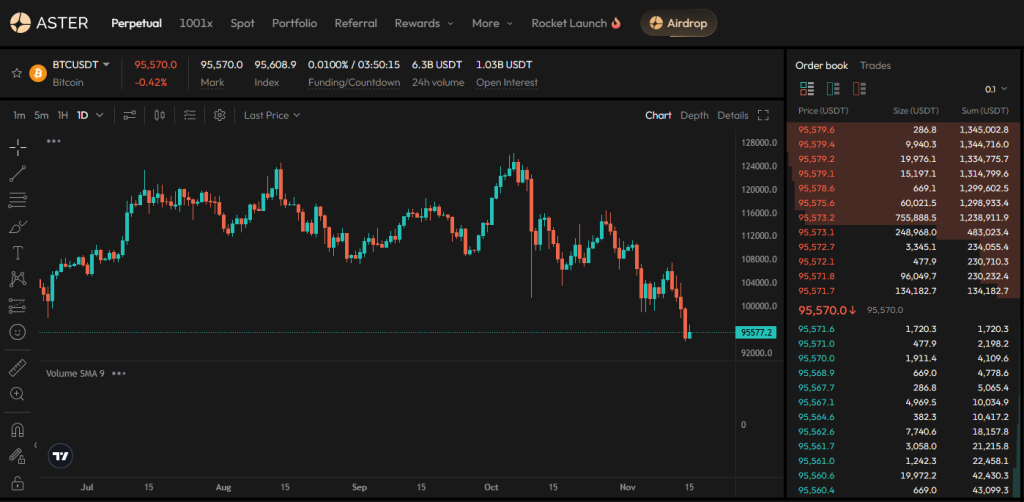

Aster: Building the Future of DeFi Composability

Aster stands out for its emphasis on composability and open architecture. It allows developers to build on top of its trading infrastructure, connecting perpetual trading to other DeFi applications like Aave or Uniswap. Aster’s permissionless model makes it one of the most promising onchain derivatives platforms in the multi-chain DeFi world.

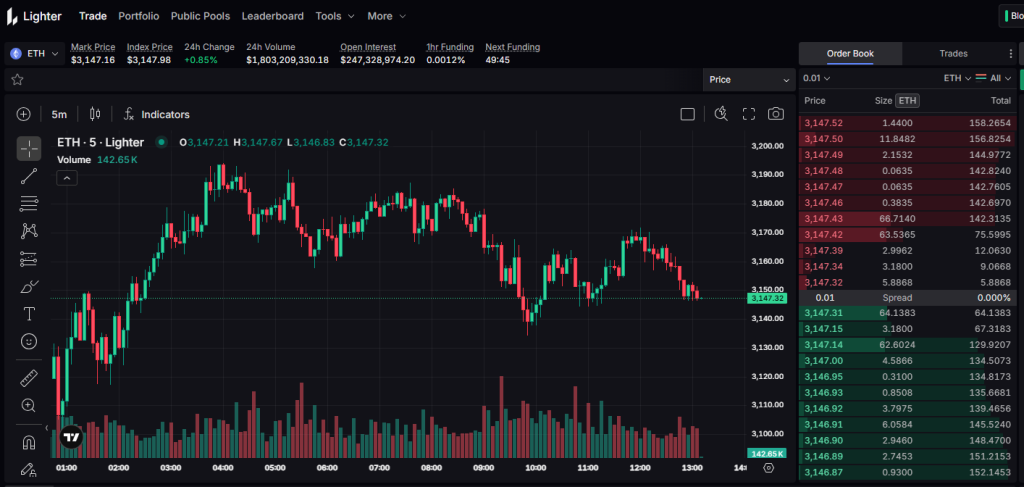

Lighter: Speed and Simplicity for Everyday Traders

Lighter delivers an intuitive and lightning-fast trading experience. With zero gas fees on executions and an interface built for simplicity, it bridges the gap between the performance of centralised exchanges and the transparency of decentralised trading.

Together, Aster, Avantis, Lighter, and Hyperliquid represent the cutting edge of onchain perpetual trading, driving growth across the 600 million dollar daily DEX volume segment tracked by DefiLlama.

Looking Ahead: A New Layer of Perpetual Protocols?

Hyperliquid, Avantis, Aster, and Lighter are the core Perp DEXs. They are the trading engines that power the perpetual markets themselves. These protocols handle everything from order execution to risk management, funding payments, pricing, leverage, and liquidity. Effectively, they may considered as the foundations of onchain perpetual trading, but what if we can build on of these protocols? What if instead of having new emerging projects directly complete with these Perp DEXs, they would sit above them and change how traders interact with those markets by improving improve interface design, simplify onboarding, provide analytics, introduce automation tools, or blend multiple ecosystems into one environment. Well, that is exactly what is going on as we speak, and considering the potential, we decided to create a quick overview of such projects, compare them to each other and rate them according to their features.

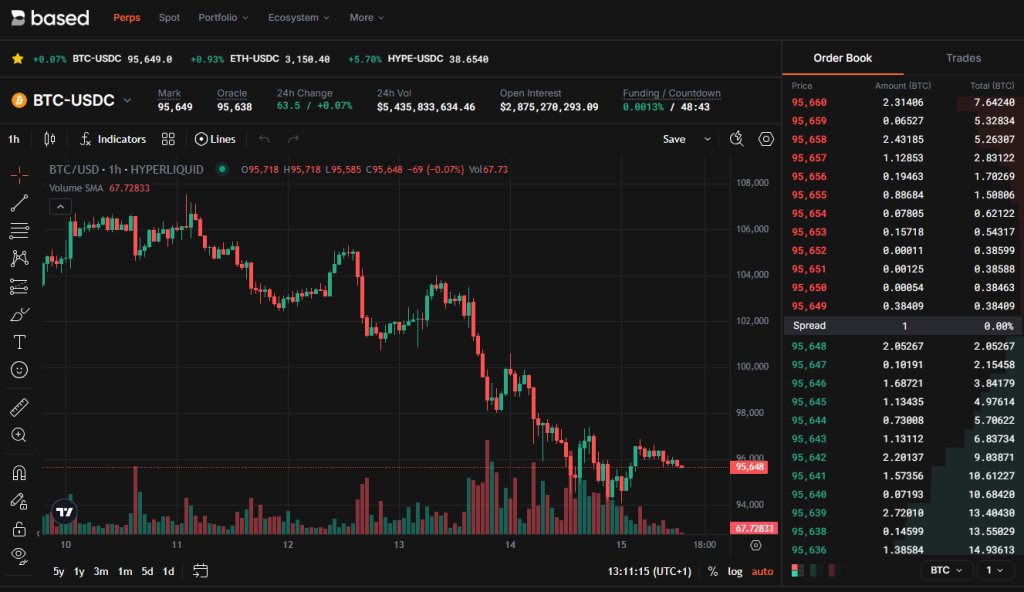

BasedApp

We consider BasedApp as the smooth beginner friendly gateway into Hyperliquid. It focuses on simplicity and reliability, giving users a clean interface and the benefit of Hyperliquid’s deep liquidity and fast execution. It is ideal for traders who want a CEX style experience without giving up self custody. In our opinion, the main drawback is that for the most part, it is essentially a polished Hyperliquid frontend rather than a source of a lot of new features. It does perform extremely well, but it does not try to reinvent the wheel.

Insilico Terminal

Insilico Terminal is a professional grade terminal designed for serious traders. With multi account support, custom layouts, advanced order handling, and a long history across multiple venues, Insilico feels closer to a traditional trading desk. New users may find it complex, but experienced traders will appreciate the control and precision it offers. It is a power tool, and it behaves like one.

Axiom

In our view, Axiom is a very ambitions platform as it combines multi chain spot trading, Hyperliquid perps, memecoin discovery, wallet tracking, analytics, sniping tools, alerts, and powerful automation features. Axiom is a full trading ecosystem designed for high intensity traders who thrive on speed and information and its high cumulative fees reflect real usage. The only downsides are its complexity and its higher cost structure, which might be too much for casual users.

Mass

This project is a mobile first DeFi app that makes perpetual trading accessible to almost anyone. With social logins, built in gas abstraction, and fiat on and off ramps, Mass removes the common friction points of DeFi. It currently relies on Synthetix perps and is still very early in adoption, but it does offers one of the friendliest experiences available. It is perfect for users who want a simple, fintech style gateway into decentralised perps.

Lit.Trade

Lit.Trade offers spot and perp trading through Hyperliquid and includes advanced order types and a customisable interface. However, adoption remains low, and it has yet to develop a clear identity in a competitive market. The potential is there, especially for traders who enjoy building their own layouts, but Lit still needs to attract a broader user base.

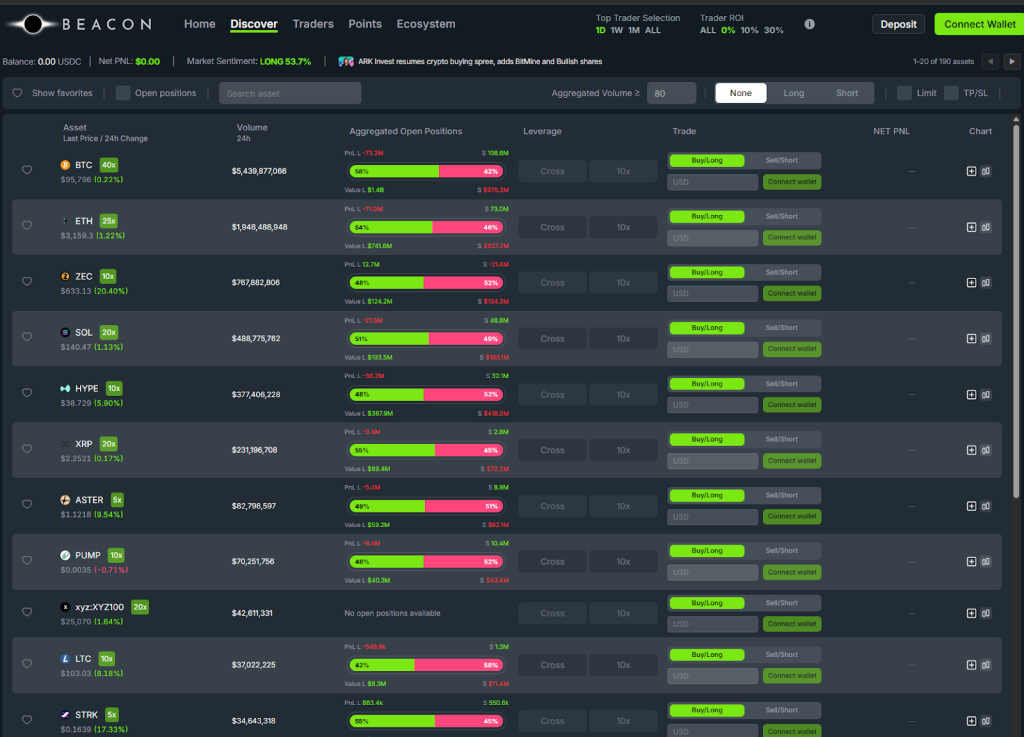

Beacon

The platform transforms raw onchain data into clear insights that help traders make better decisions. Its Global Feed offers a real time view of market wide activity such as whale movements, liquidity shifts, unusual funding behaviour, and major changes in market structure. The Personalised Feed adapts to each trader’s habits and highlights only the signals that match their preferred assets and strategies. This creates an experience similar to having an analyst sitting beside you, guiding your decisions with the most accurate and timely data in the ecosystem. For traders who believe that information is the true competitive edge, Beacon is the standout choice.

To offer an even better overview, have a look at the table below!

| Platform | Best For | Core Strengths | Limitations |

| BasedApp | Everyday traders who want a simple, fast interface | Very smooth UI, strong traction, deep liquidity through Hyperliquid, ideal for newcomers | Limited advanced tools, essentially a polished Hyperliquid frontend |

| Insilico Terminal | Professional traders and high volume users | Advanced order handling, multi account support, custom layouts, long track record | Complex for beginners, heavy focus on desktop style workflows |

| Axiom | Multi chain power users and active traders | Integrated spot and perps, analytics, social tracking, alerts, automation, large user base and strong volumes | Can feel overwhelming, higher fees, learning curve for casual traders |

| Mass | New users and mobile first traders | Social login, gas abstraction, fiat on and off ramps, friendly UX, accessible in many regions | Low volume so far, early stage product, limited advanced features |

| Lit.Trade | Traders who want custom layouts and combined spot plus perps | Modular interface, advanced order types, both spot and perps in one place | Very low adoption so far, unclear identity, limited community traction |

| Beacon | Traders who value intelligence, signals, and market insight | Real time feeds, whale tracking, liquidity insights, market structure tools, personalised alerts, clean trading layer | Focused entirely on Hyperliquid markets, not multi chain |

What about Perp DEXs on Ethereum? Scaling Perp DEXs with Layer 2 and Rollups

As Perp DEXs grow in popularity, one challenge becomes unavoidable, especially on Ethereum. Perpetual futures generate a huge amount of onchain activity as every funding payment, every liquidation, and every update to a trader’s position needs to be processed quickly and at a low cost. On Ethereum’s mainnet this would be far too slow and far too expensive, which is why many Perp DEXs have moved to Layer 2 networks or zk rollups.

Layer 2s transform the trading experience by providing speed and affordability without giving up the security of the base chain. They allow perpetual traders to react to the market instantly, something that is essential for derivatives.

One of the most active environments for perpetual trading is Optimism as it offers low fees and high throughput, which suits traders who open and close positions frequently. Major perpetual platforms such as Synthetix Perps and Kwenta use Optimism to deliver smooth execution and deep liquidity. If you are interested in learning more about how Optimism works, read our guide What Is Optimism Protocol.

Another major scaling approach is Starknet, a network that uses zero knowledge proofs to compress transactions and verify them efficiently. This allows perpetual trading to operate at lower cost while staying secure. Our article Introduction to Starknet explains how this technology supports high frequency DeFi trading and strengthens the broader ecosystem.

Why Perp DEXs Matter for Decentralized Finance

Perp DEXs are not just another type of trading platform. They became a cornerstone of the decentralized finance ecosystem as they allow traders to access derivatives markets worth over 1 trillion dollars in open interest, without relying on centralised intermediaries.

Therefore, Perp DEXs bring deep liquidity, low trading fees, and permissionless access to the onchain derivatives market, empowering both retail and institutional traders while also contribute to price discovery and strengthen DeFi’s long-term stability. In a world where transparency and autonomy matter, Perp DEXs prove that crypto trading can be fast, fair, and decentralised.

Challenges in the Perp DEX Industry

Despite their progress, Perp DEXs still face several challenges. Performance and liquidity can lag behind centralised exchanges during periods of extreme volatility. Furthermore, oracles must remain accurate and resilient, while liquidity fragmentation across chains limits market efficiency.

It is also worth noting that regulatory uncertainty also persists as governments continue to define the legal status of decentralised derivatives. Additionally, user education is another major hurdle as many traders still find concepts like margin, leverage, and liquidation complex. However, these challenges may also be viewed as opportunities. as every limitation is pushing innovation in tokenomics, liquidity pooling, and multi-chain interoperability.

Conclusion

Perp DEXs are transforming crypto trading by merging perpetual futures with decentralised finance. They embody transparency, autonomy, and efficiency, creating markets that never close and systems that never rely on trust.

By removing intermediaries and replacing them with code, Perp DEXs are redefining what it means to trade in the world of crypto. If you are interested in crypto perpetual future trading. We highly encourage you to explore the discussed protocols discussed in this article, especially our top choice: Beacon!

Furthermore, if you enjoyed this content make sure to follow Simply Staking on X for the latest insights, protocol reviews, and updates on the rapidly growing world of onchain perpetual trading and decentralised finance.