Introduction to the Canton Network Blockchain

When people think of blockchain networks, the first thing that often comes to mind is transparency. Every transaction is open for anyone to see, and every detail is recorded on a public ledger. That design works well for open crypto communities, but it is a serious problem for banks, asset managers, and other financial institutions that deal with sensitive information every day.

Introducing the Canton Network! The blockchain that was created to solve this challenge. It offers the benefits of blockchain technology such as fast settlement, real-time coordination, and interoperability across markets, but with privacy and compliance built in. The promise is simple: institutions should not have to choose between openness and confidentiality. With Canton, they can have both.

Curious to explore further? Lets have a quick look at what makes the Canton Network unique, its architecture, its tokenomics and more!

Understanding the Canton Network

Canton is a permissionless blockchain purpose built for institutional use. Unlike most public blockchain networks where everyone shares a single ledger, Canton is designed as a network of networks. Each participant maintains its own ledger but can connect with others through Canton’s unique design.

A good way to imagine this is to think of secure rooms. Each bank or financial service provider has its own private room where it records activity. The Global Synchronizer acts like the corridor that links the rooms together. When two participants need to trade or share data, they can open their doors and connect, but no one else in the building can see inside.

This system is powered by a concept called selective visibility. Only the parties involved in a transaction can see the details, while the rest of the network participants remain unaware. This gives regulated institutions the confidence to transact on-chain without exposing their strategies or client data.

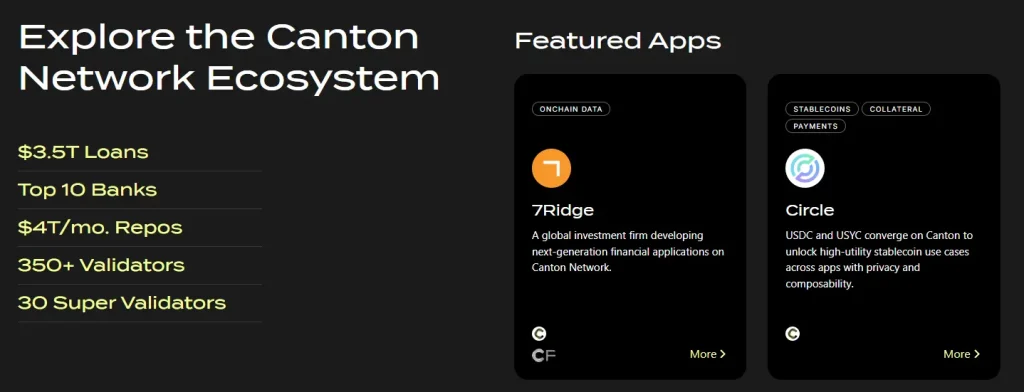

To keep everything secure, the network relies on validators that confirm and order activity. Some take on a larger role as super validators, providing additional resilience and coordination. This layered approach strengthens the Canton Network while spreading trust across many participants in the ecosystem.

Why Financial Institutions Need the Canton Network

Public blockchain networks such as Ethereum have shown how powerful decentralised systems can be. They allow people to interact without intermediaries, provide a single source of truth, and make digital assets easy to transfer. But their transparency is a problem for regulated institutions.

Financial institutions need confidentiality to comply with strict laws and to protect their competitive edge. At the same time, they want the benefits of blockchain: faster settlement, reduced risk, and the ability to connect markets on a shared digital infrastructure.

The Canton Network offers both. It combines TradFi and crypto by allowing regulated institutions to transact on-chain while respecting privacy requirements. It unlocks the efficiency of blockchain while meeting the regulatory demands of capital markets.

How the Canton Network Blockchain Achieves Interoperability and Synchronized Finance

Canton’s design is different from most public blockchains. Instead of a single shared ledger, it connects many distributed ledgers through the Global Synchronizer.

Think of the synchronizer as a post office for encrypted mail. Every transaction is placed in a sealed envelope. The post office sorts the envelopes, ensures they are delivered in the right order, and passes them to the right recipients. But, crucially, it cannot open or read them!

This design creates several advantages:

- Privacy by default: transactions are only visible to those who need to know.

- Atomic settlement: complex trades across applications either complete together or not at all.

- Horizontal scaling: new applications can join without overloading a single chain.

This combination of privacy, interoperability, and scalability is what makes Canton a blockchain infrastructure purpose built for institutional blockchain adoption. It is an example of what the project calls synchronized finance, where multiple systems work together in real time without giving up control.

Canton Coin and On-Chain Tokenization of Finance

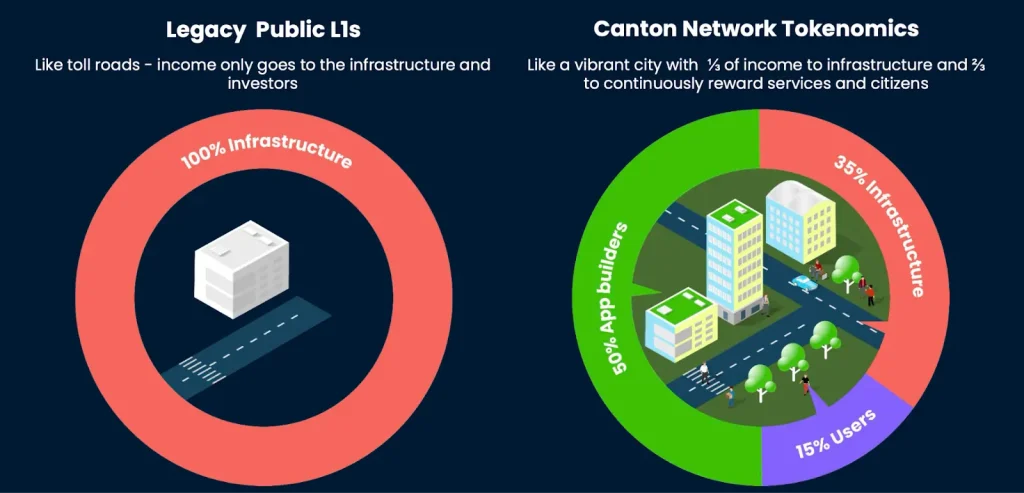

Every blockchain needs a token to keep the system running. For Canton, this is Canton Coin (CC).

CC is a utility token that pays for traffic through the Global Synchronizer. Every message that moves across the network has a fee, deterministically priced in US dollar terms by message size, and settled in CC. This avoids the volatility of gas markets and keeps costs predictable.

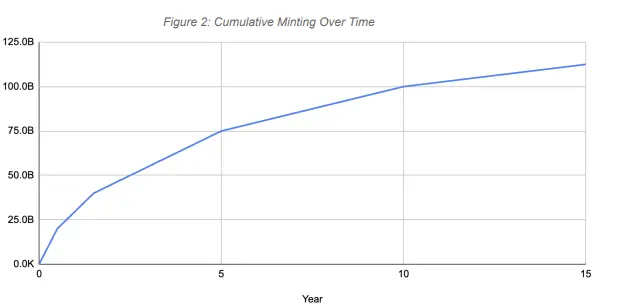

Canton uses a burn and mint equilibrium. Fees paid in CC are burned, reducing supply, while new CC is minted and distributed as rewards. The result is a system where supply grows or shrinks in line with real usage of the network.

Unlike many crypto projects, CC had no premine, no presale, and no early insider allocations. It can only be earned through real participation.

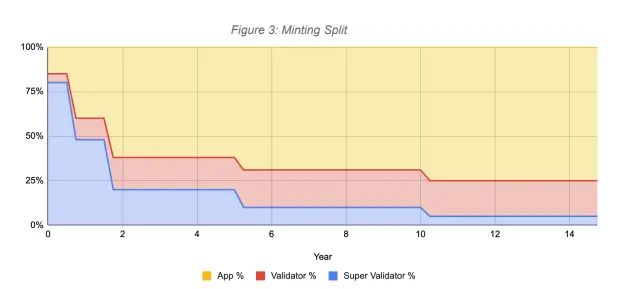

Rewards are distributed via coupons, which entitle holders to a proportional share of newly minted CC. Coupons are distributed to three groups:

- Application developers whose apps bring value to the ecosystem.

- Infrastructure providers who run synchronizer nodes and other services.

- Active users who generate real transaction flow.

The balance of distribution is overseen by the Global Synchronizer Foundation, a governance body that can adjust the model as the ecosystem grows.

Importantly, there are no vesting schedules or lockups, since no early grants were made. This means CC is entirely earned through network contribution. In short, it is a token designed to incentivise adoption, tokenisation of assets, and participation in the Canton Network ecosystem.

Markets on Canton: Real-Time Use Cases and Tokenized Assets

The Canton Network mainnet launched on 1 July 2024 with both the Global Synchronizer and Canton Coin in place. This was not just a pilot or a sandbox but a live release ready for institutional finance.

Real use cases quickly followed:

- Repo trading: Broadridge DLR processed trillions of dollars in tokenised repo trades each month through Canton. Repo markets are essential to capital markets, and this was proof that capital on Canton runs at real-world scale.

- US Treasury repo: the first ever United States Treasury repo trade financed with digital dollars on a weekend was settled through Canton.

- Syndicated loans: Versana used Canton to synchronise loan data between global banks, showing interoperability across asset classes.

- Stablecoins and money markets: assets on Canton now include the USDC stablecoin and a tokenised money market fund called USYC. These give institutions reliable stable value instruments for settlement.

These examples show that Canton is already unlocking real-time adoption of blockchain in traditional finance.

But, Canton is not the only network exploring tokenised assets. If you are interested in this space and want to explore another perspective, see our guide on MANTRA: Compliance First Chain for RWA Tokenisation. Like Canton, MANTRA highlights how compliance and regulation are critical for building trust in tokenisation.

The Canton Network Ecosystem and Global Synchronizer Foundation

Canton is supported by a broad ecosystem that includes major banks, market infrastructure providers, and crypto innovators. This wide participation is crucial, because adoption in finance depends on credibility.

The network is governed by the Global Synchronizer Foundation, which is modelled after the Linux Foundation. Its role is to provide neutral stewardship of the ecosystem.

On the technology side, the project has open sourced its core synchronisation technology under Hyperledger Labs with the name Splice. This lets developers explore, audit, and build upon Canton’s privacy architecture. Partners such as Chainlink Labs have also joined the Canton Foundation ecosystem, signalling the growing importance of interoperability.

Explore the Canton Network and Its Smart Contracts

If you want to dive deeper, the best place to start is the official Canton Network documentation and FAQs. Both of these dive deeper and explain how to build with the Daml smart contract language, how synchronizer nodes work, and what solutions are already available on Canton.

Developers can explore Daml smart contracts to model tokenised assets, while curious readers can browse the blog and FAQs for the latest network news and use cases. It is the best way to explore the Canton Network and see how it connects financial institutions and crypto infrastructure.

Final Thoughts

The Canton Network is one of the clearest examples of how blockchain can move beyond theory and into the heart of institutional finance. By combining privacy, interoperability, and tokenisation, it shows how real-world assets and digital dollars can move securely across distributed ledgers.

If you are building in finance, now is the time to explore the Canton Network. Check out the official resources, study Daml smart contracts, and learn how Canton enables tokenisation for regulated institutions.

And as always, stay tuned with Simply Staking for clear and beginner friendly guides on the projects shaping the future of blockchain. Follow us on X for real-time updates, insights, and network news.