Real World Assets (RWA) tokenisation is the process of representing the value and ownership of physical or financial asset through digital tokens on a blockchain. Each token represents a fraction or whole unit of the asset, allowing for easy transfer, trading, and fractional ownership. Asset tokenisation could potentially eliminate geographical barriers, reduce transaction costs, and enhance transparency, bringing significant advantages to both asset owners and investors.

As RWA tokenisation gains momentum, the MANTRA chain aims to lead the Interchain by becoming the first RWA blockchain within the Cosmos ecosystem.

What is MANTRA?

- Real World Asset Tokenisation (MANTRA ASSETS): MANTRA Chain is designed to facilitate the on-chain tokenisation of RWAs. Therefore capturing a solid piece of the RWA pie, which is predicted to reach USD 10 trillion by 2030.

- Security and Compliance (MANTRA COMPLIANCE): MANTRA Chain is a security-based platform with in-built functionalities to adhere to regulations and compliance frameworks like Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF). The aim is to address the current lack of compliance and fragmented liquidity in DeFi.

- Technical Architecture: Utilizing Cosmos Software Development Kit (SDK), MANTRA Chain offers a modular and scalable infrastructure for developers to build dApps and protocols, while being supported by the Inter-Blockchain Communication (IBC) Protocol for interoperability with other chains.

- Ecosystem and Governance: The platform integrates MANTRA Finance, MANTRA DAO, and MANTRA Chain into the Omniverse ecosystem to offer fundamental capabilities such as transactions, governance, and yield – all of this while emphasizing regulatory compliance.Due to the compliance-first approach, MANTRA becomes a permissionless blockchain for permissioned applications. To bring this vision to reality, MANTRA raised USD 11 million in venture capital led by Shorooq Partners, while other investors like Three Point Capital, Forte Securities, and GameFi Ventures joined as a syndicate.

Tokenisation

Asset tokenisation refers to the process of representing ownership of real-world assets in a digital token, through the process of issuing a token that digitally represents tradable assets. Any asset with real-world value such as art, commodities, or real estate can be easily traded and managed once it is converted into a digital representation in the form of a token. These tokens are issued through security token offerings (STOs) and can then be traded on a KYC/AML-guarded secondary market such as MANTRA Chain’s decentralised exchange (DEX). Tokenization of assets streamlines the transfer of ownership due to the benefits of blockchain technology. Because all RWA tokens exist on the blockchain much of the bureaucracy and manual processes associated with the transfer of these assets are automated and maintained by the ledger. Furthermore, each transaction that involves a token includes predetermined information such as the sender and receiver signatures, a timestamp, and an amount paid recorded in the blockchain’s transaction data that is completely transparent and immutable.Mantra Compliance

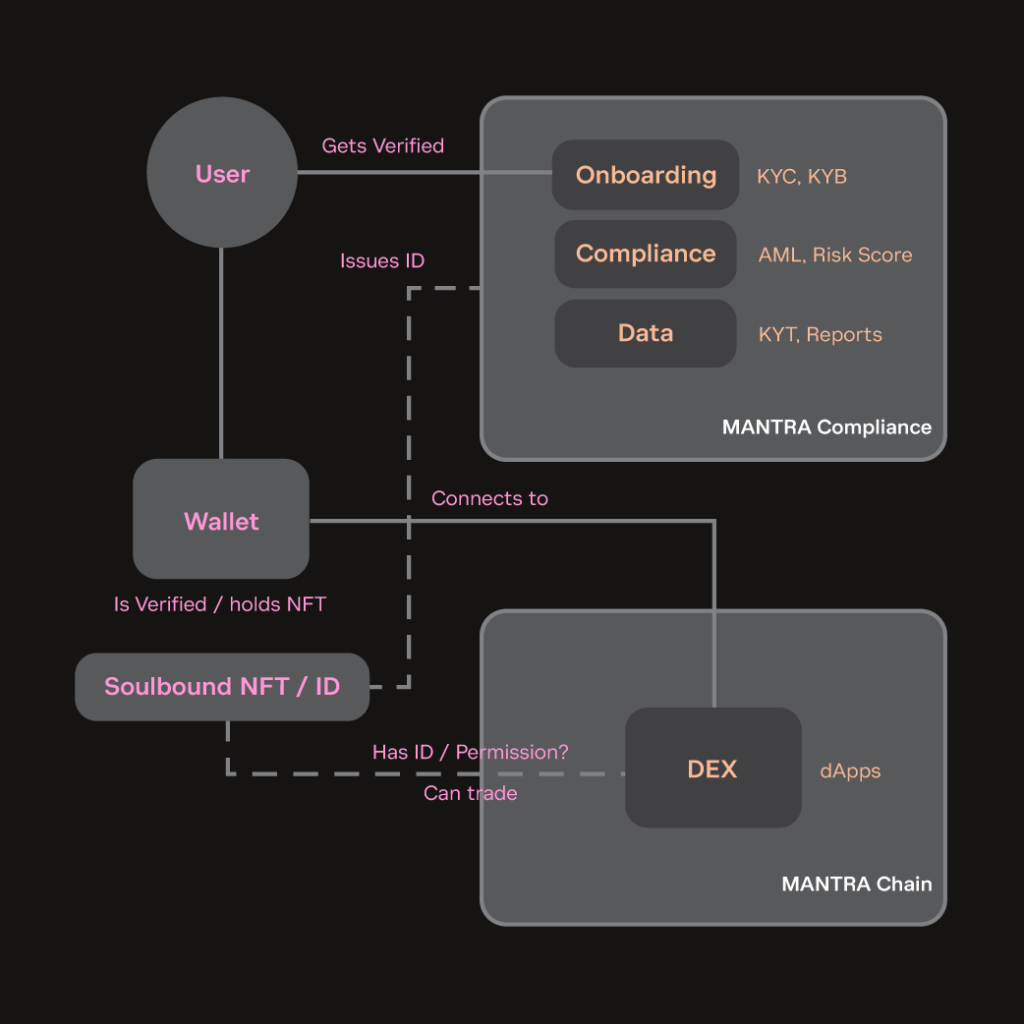

MANTRA Compliance offers a suite of tools and services designed to help Web3 platforms meet regulatory requirements for cryptocurrency transactions and other DeFi activities. Its goal is to streamline and automate regulatory compliance for Web3 businesses, allowing them to participate more safely and efficiently in the expanding cryptocurrency and blockchain economy. MANTRA Compliance includes a range of features and capabilities, including know-your-customer (KYC) and know-your-business (KYB) protocols, AML/sanctions screening, and transaction monitoring. It also offers tools for risk assessment and reporting, as well as allowing projects to manage and track regulatory changes. Since MANTRA compliance is built on top of MANTRA’s permissionless blockchain, transactions, and other financial activities are inherently transparent and can be openly tracked in real-time. This in turn facilitates effective detection and prevention of fraudulent or illicit activities, while also reducing the risk of regulatory non-compliance. Let’s recap some key features of MANTRA Compliance:- Onboarding: user identification and verification (KYC/ KYB), business verification (KYB), wallet address verification, sanction / adverse media list, AML screening, etc.

- Reusable KYC: Decentralised Identity Documentation (DID) / Soulbound NFT

- Ongoing user profile AML checks

- User Risk Scoring

- Transaction Monitoring: Know Your Transaction (KYT)

On-chain Decentralised ID

One of the key features of MANTRA Compliance is its on-chain Decentralized ID (DID) system, which provides a secure, efficient, and reusable method for verifying an individual’s identity for regulatory KYC/AML purposes. Once a user’s identity is verified, MANTRA Compliance issues a Soulbound NFT (also known as a DID). A Soulbound NFT / ID is a unique, non-fungible token linked to a specific user’s identity. This token serves as proof of the user’s personhood and can be used for various purposes, including KYC verification with third parties. By issuing a Soulbound NFT / ID, the platform ensures that the user’s personal information is not duplicated and their identity is only stored once. This process eliminates the need for users to undergo KYC verification multiple times, making sign-ups and account registrations more user-friendly and efficient. Initially, MANTRA Finance & SOMA.finance will be the only DID issuers on the platform, but more entities will be added as the project progresses over time. Additionally, each new entity that joins MANTRA compliance to issue Soulbound NFT / ID will go through a thorough due diligence process to make sure they comply with MANTRA’s guidelines and have a clean legal history behind them. Let us walk you through Bob’s (the user) experience of MANTRA Compliance:- Bob signs up to use MANTRA

- After signing up, Bob and his wallet complete compliance checks like KYC & Sanctions Screening

- Bob receives a Soulbound NFT as proof of compliance

- After compliance checks are completed, Mantra compliance permits Bob to use dApps that exist on MANTRA chain

- After permission is granted, Bob can interact with products like MANTRA DEX

MANTRA Token Service (MTS)

MANTRA Token Service (MTS) is an SDK allowing blockchain businesses to create, issue, distribute, and manage their own digital assets on the MANTRA network. A key advantage of MTS is its ability to help businesses create digital assets that comply with various regulatory frameworks, including those for fiat currencies, securities, commodities, and other financial instruments. Hence, MTS facilitates the creation and trading of regulated assets across different jurisdictions. MTS operates on a permissioned model, allowing only approved entities to create, manage, or transfer tokens on the platform, therefore ensuring the platform is used compliantly and in accordance with relevant laws and regulations. Key features of MTS include:

- Create, issue and manage fungible and non-fungible assets.

- Access control / Permissions layer: provides a simple role-based access control mechanism, including the ability to freeze, seize, destroy, and transfer tokens.

- Configurable yield and royalties.

- Predictable and low fees.

These configurable features can be combined in various ways to create asset characteristics that are found in different real-world asset classes and financial instruments like command and investment contracts respectively.

MANTRA Assets

MANTRA Assets is a simple dApp that leverages the previously discussed MTS SDK to enable entities to issue security tokens on MANTRA Chain. The idea behind MANTRA Assets is to provide a platform that makes it easy for businesses, organizations, and individuals to launch and represent real-world assets such as securities or other financial instruments. With MANTRA Assets, entities can specify the characteristics of their tokens, such as name, symbol, issuance quantity, and yield or royalty amounts. MANTRA Assets also provides various tools to manage security tokens, including tracking token ownership, granting or revoking permissions, and transferring tokens to others. Additionally, MANTRA Assets can automate processes like distributing dividends to token holders. Once these assets are configured and launched, they can be traded via MNATRA decentralised exchange (DEX) – a DeFi marketplace reviewed below.

MANTRA DEX

MANTRA DEX is a DeFi hub built on the Cosmos ecosystem to simplify and enhance real-world asset trading. The DEX offers investors a fast, secure, and efficient way to trade real-world assets that have been toeknised via MTS and MANTRA assets, capitalizing on growth opportunities in both TradFi and DeFi. Key features of MANTRA DEX include:

- Automated Market Making (AMM): MANTRA DEX utilizes AMM technology to automatically facilitate trading by pricing assets based on supply and demand, thus providing users with a fair and efficient market for trading real-world assets.

- Liquidity provision/Farming: MANTRA DEX incentivizes liquidity providers to keep the platform liquid, granting users deeper and more competitive order books

- Order Book: MANTRA DEX provides users with a transparent order book that allows for efficient price discovery and execution of trades.

- Cross-chain compatibility: MANTRA DEX leverages the interoperability standards of the Cosmos ecosystem to allow the trading of assets across multiple blockchain networks.

- High speed and low latency: Consistently seamless trading experience through rapid execution and minimal delays in transactions.

- Easy-to-use interface: A user-friendly interface that makes it easy for users to navigate and trade.

- Staking rewards: Users can earn rewards by participating in MANTRA DEX’s staking program.

- Asset tokenisation: MANTRA DEX integrates MTS to connect the user journey end-to-end, from tokenising to transacting the RWA.

- Dynamic fees: MANTRA DEX fees adjust based on market conditions to reduce trade costs, creating a more sustainable ecosystem for liquidity providers.

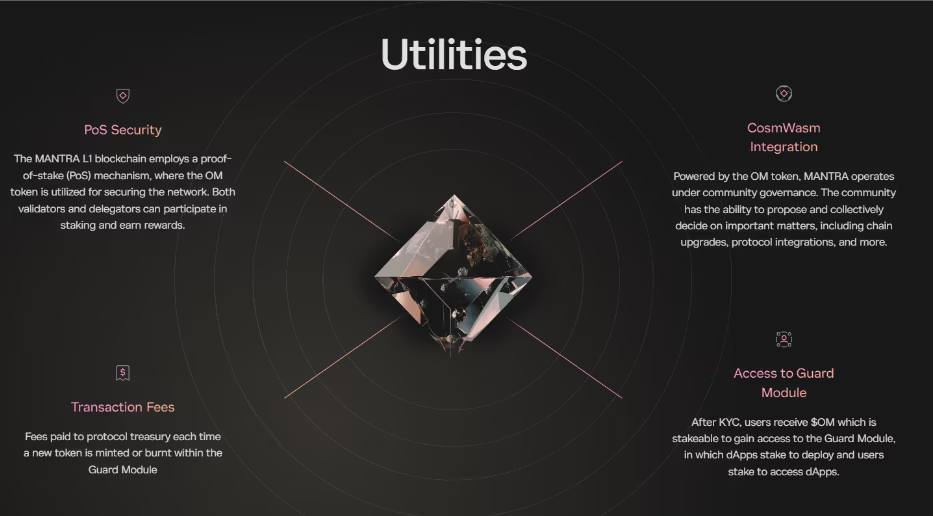

The OM Token

MANTRA Chain’s main token is the $OM, 50 million units of which are set aside for community airdrops, with a circulating supply of 888,888,888. Additionally, MANTRA plans to double its token supply for the upcoming mainnet launch and reward the participants of the Hongbai Incentivized Testnet via airdrops. OM’s main characteristics include: PoS Security: The MANTRA L1 blockchain uses a proof-of-stake (PoS) mechanism, with the OM token securing the network. Both validators and delegators can stake OM tokens to participate and earn rewards. You can delegate your OM to Simply Staking from our Networks Page. CosmWasm Integration: Powered by the OM token, MANTRA operates under community governance. The community can propose and collectively decide on important matters, including chain upgrades, protocol integrations, and more. Transaction Fees: Fees are paid to the protocol treasury each time a new token is minted or burnt. Access to Guard Module: After KYC, users receive $OM which is stakeable to gain access to the Guard Module. Within this module, dApps stake to deploy their code and users stake to access these dApps.

MANTRA’s Real World Application

MANTRA has recently launched its USDY vault, which allows users to access yield supported by short-term US Treasuries within the DeFi sector.

Powered by Ondo Finance’s USDY yieldcoin, the MANTRA USDY vault provides an alternative to traditional financial instruments, enabling participants to earn yields on their investments with the flexibility and convenience similar to stablecoins.

The USDY vault currently offers an APY of 5.3%. To encourage participation, the Ondo Foundation and MANTRA provide $ONDO and mainnet $OM rewards, which participants will receive upon the launch of the MANTRA mainnet.

Conclusion

Overall, MANTRA represents a pioneering effort in bridging traditional finance (TradFi) and decentralised finance (DeFi) through a compliance-first approach to real-world asset tokenisation. As the first RWA blockchain in the Cosmos ecosystem, MANTRA aims to leverage its security and regulatory adherence to facilitate the seamless integration of physical and financial assets into the blockchain space. By offering a robust technical architecture, comprehensive compliance tools, and a dynamic ecosystem for developers and institutions, MANTRA could become a significant player in the evolving landscape of asset tokenisation, promoting transparency, efficiency, and accessibility for all stakeholders involved.

Simply Stake and Secure your assets with the Ledger wallet.

Disclaimer: This article contains affiliate links. If you click on these links and make a purchase, we may receive a small commission at no additional cost to you. These commissions help support our work and allow us to continue providing valuable content. Thank you for your support!

This article is provided for informational purposes only and is not intended as investment advice. Investing in cryptocurrencies carries significant risks and is highly speculative. The opinions and analyses presented do not reflect the official stance of any company or entity. We strongly advise consulting with a qualified financial professional before making any investment decisions. The author and publisher assume no liability for any actions taken based on the content of this article. Always conduct your own due diligence before investing.