Berachain Ecosystem

Berachain is a high-performance Layer 1 blockchain built with a unique Proof-of-Liquidity (PoL) consensus mechanism, enabling it to reward ecosystem liquidity for securing the network, fostering user growth, and ensuring price stability. Designed to be EVM-identical, Berachain supports the same execution environment as Ethereum, making it fully compatible with existing Ethereum tooling and infrastructure. EVM compatibility ensures rapid adaptability to the latest Ethereum upgrades, allowing developers to use familiar tools like Geth, Reth, and others to execute smart contracts seamlessly. Built atop BeaconKit—a modular EVM-focused consensus framework integrating CometBFT—Berachain provides single-slot finality and enhanced composability, ensuring efficient and scalable dApp development from day one. For a high-level overview of Berachain, see our recently published Introduction to Berachain. In case you would like further explore Berachain further, make sure to check out our Berachain Technical Deep Dive The rest of this article explores the overall Berachain ecosystem and dives into five projects that are currently on the Berachain “Project Spotlight” including:Ecosystem Overview

Berahcain hosts several unique, utility and yield-driven projects ranging from money markets to real-world assets and bridges. Highlights include projects like BurrBear, a one-stop Stablecoin and RWA shop for the Berachain, and GummiFi, a multi-asset money market protocol. Below is a snippet from an extensive Berachain ecosystem table we have created for you. You can access the complete table here.Bear-Themed Projects on Berachain 🐻

| Name 🐻 | Description 🐻 | Link 🐻 | Social 🐻 | Type 🐻 |

|---|---|---|---|---|

| GummiFi | Multi-asset money market | gummifi.fi | x.com/GummiFi | Spotlight |

| Kodiak | Berachain native liquidity hub | kodiak.finance | x.com/KodiakFi | Spotlight |

| Berabot | Telegram trading & sniper bot on Berachain | twitter.com/Berabot_ | twitter.com/Berabot_ | DeFi |

| BurrBear | One-stop Stablecoin + RWA shop for Berachain | burrbear.io | x.com/moneygoesburr | RWA |

| Beraborow | Interest-free loans backed by iBGT, issued in stablecoin | twitter.com/beraborrow | twitter.com/beraborrow | DeFi |

| Nitro | Cross-chain bridge by Router Protocol | nitro.routerprotocol.com | twitter.com/routerprotocol | Bridge |

Most of the Berachain projects can be interacted with on Testnet. But to do this, you would need to have testnet BERA tokens. We have a Berachain Faucet which allows you to drip tokens to your testnet wallet! See more information on how to use the faucet and access testnet BERA tokens for free here.

Spotlight Projects

BeraTone

BeraTone is a multiplayer life-simulation and role-playing game for PC and mobile. It offers an enchanting, ever-expanding world that you can explore anytime, anywhere.

BeraTone is a farming, RPG, and rhythm game that draws inspiration from classics like Harvest Moon, Stardew Valley, Animal Crossing, Final Fantasy XIV, and Friday Night Funkin.

Resource gathering, crafting, and customization are at its core, enhanced by an engaging rhythm mini-game that brings a fresh twist to the genre.

Set in a cosy and nostalgic online metaverse, BeraTone combines vibrant 3D visuals to create an immersive world for players to explore. As an online multiplayer experience, it invites players to make new friends, embark on adventures, craft unique items, personalize their homes, earn rare collectables, and trade with others.

Target user profiles

BeraTone targets a broad demographic, with 60% female and 40% male players across all ages, appealing to both casual and hardcore gamers. The community enjoys creative, interactive, and immersive games like Story of Seasons, Minecraft, and Genshin Impact.

Further, the go-to-market strategy focuses on premium and indie gamers, offering collectable NFTs to enhance in-game achievements, and supporting environmental charities. It is free-to-play, launching first on PC with plans to expand to other platforms, and self-published to maintain independence. Designed to attract non-crypto gamers, BeraTone aims to sustain itself through limited-edition in-game items, ensuring ongoing content updates and a high-quality experience.

Roadmap

BeraTone’s roadmap began at the end of 2023, aiming for the official website launch, a gameplay reveal trailer, and an auction for the Founder’s Sailcloth NFT. By Q2 2024, the Beratone project expanded the team to 20 members and delivered a playable game build. The Q1 and Q2 2024 have opened up beta access along with an NFT sale and release of the beta game build. Finally, in Q1 2025, BeraTone targets a global launch of the game.

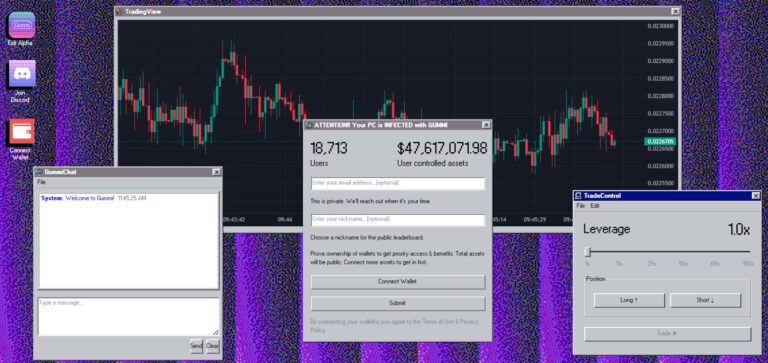

gummi.fi

Gummi.fi is an innovative money market built on the Berachain blockchain, designed to enhance liquidity across various assets and strategies. As liquidity is a fundamental component for the efficient functioning of DeFi, Gummi.fi is critical in facilitating trading, yield farming, payments, and other essential blockchain operations.

Key Features of Gummi.fi include:

Liquidity as a Core Focus: In the context of finance, liquidity refers to the ease with which assets can be converted to cash or used productively without affecting their price. Gummi.fi aims to unlock liquidity for every asset and strategy on Berachain, ensuring that users can access the funds they need to transact, even when they might not have sufficient balance on hand.

For example, Just like a credit card allows individuals to make purchases despite not having immediate cash, Gummi.fi allows users to borrow against their assets, effectively providing them with the liquidity needed for various financial activities.

Integration with Berachain’s Proof-of-Liquidity (PoL): Gummi.fi operates under Berachain’s PoL consensus model, which incentivizes liquidity provision rather than merely rewarding validators, as seen in traditional Proof-of-Stake (PoS) or Proof-of-Work (PoW) systems. This ensures that liquidity is prioritized, thus increasing the overall value of the blockchain’s native token.

Gummi aims to eventually support numerous independently developed applications within Berachain’s ecosystem, enhancing liquidity not just for Gummi but for all associated projects.

Permissionless and Flexible Money Market:

- Lending and Borrowing: Gummi.fi supports lending and borrowing for virtually any asset. Users can onboard new assets for these purposes with ease, similar to creating a liquidity pool on Uniswap.

- Leverage Trading: Gummi enables users to engage in leverage trading for various assets, regardless of their market cap or existing oracle support, hence democratizing access to leverage trading by allowing a broader range of assets to be utilized for trading strategies.

Yield Multiplication: When users deposit assets into liquidity pools (like those on Berachain’s DEX), they receive fungible tokens that can be further deposited into Gummi for additional borrowing. This creates an ecosystem where liquidity providers can enhance their yield by leveraging their positions while providing competitive rates for lenders.

Moreover, users can benefit from a range of rewards while trading or leveraging their assets. For example, if a trader borrows against liquid restaked Bitcoin (eBTC), they can earn rewards in multiple forms, including governance tokens and staking yields, which can influence their borrowing costs.

Enhancing Participation in Berachain’s Consensus: Gummi allows users who earn tokens (like iBGT through Berachain’s LST provider, Infrared) to borrow against these assets, enabling them to acquire more tokens and increase their stake in the network, thus enhancing their influence over governance decisions.

As a bonus utility, users can also leverage their governance tokens (like iRED) to gain greater control over the allocation of rewards within the Berachain ecosystem.

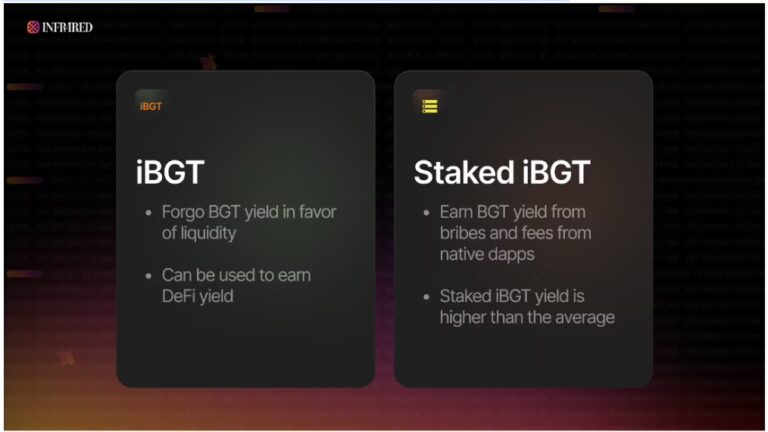

Infrared.finance

Infrared is dedicated to creating robust infrastructure centred around the Proof of Liquidity (PoL) mechanism developed by Berachain. The protocol’s primary goal is to enhance value capture by offering user-friendly liquid staking solutions for BGT and BERA tokens, as well as establishing reliable node infrastructure and PoL vaults. By focusing on developing tools and solutions that revolve around PoL, Infrared aims to improve the overall user experience and promote the growth of the Berachain ecosystem.

Infrared currently holds a pre-mainnet TVL of $38.08B and offers APY of up to 500%.

iBGT is a product of Infrared, which is a liquid wrapper for BGT tokens, maintaining a 1:1 backing with BGT, a relationship that is secured through Infrared’s smart contracts. While users cannot stake BGT to receive iBGT or convert iBGT back into BGT, holding iBGT still provides access to staking opportunities (through Infrared’s staking vault) and allows users to earn all associated BGT rewards without the need for direct ownership of BGT.

Additionally, just like Lido offers stETH, so does infrared issue iBERA – a token designed to offer users a liquid version of staked BERA, which is the native token of Berachain. Just like iBGT, iBERA is backed 1:1 by BERA, which is staked with Infrared’s validator set.

iBGT can be utilized across various DeFi applications, such as lending, borrowing, and trading. Given the high demand for staking BERA, iBERA serves to democratize access for users who wish to stake BERA but may lack the technical expertise or resources required to run a validator node, allowing them to actively participate in the Berachain ecosystem.

Kodiak

Kodiak is a key component of Berachain’s ecosystem, designed as a native liquidity hub. It integrates several layers to enhance liquidity provision and trading on the platform, making it user-friendly and efficient for traders and liquidity providers alike.

Currently, Kodiak has supported more than 13K Swaps, surpassing $5M in volume and $10M+ in TVL.

Effectively, Kodiak is the first vertically integrated liquidity hub on Berachain, combining multiple layers to enhance trading and liquidity provision within the ecosystem. Below, we offer an expanded explanation of each component:

Kodiak DEX

The Kodiak DEX offers a non-custodial trading experience, meaning that users maintain control of their funds throughout the trading process. It is designed to be highly capital-efficient, leveraging both concentrated and full-range Automated Market Makers (AMMs).

Koduiak’s Concentrated Liquidity allows liquidity providers to allocate their capital within specific price ranges rather than across the entire price spectrum. As a result, liquidity can be utilized more efficiently, enabling traders to experience lower slippage and better prices.

Additionally, Kodiak’s full-range AMMs allow liquidity to be spread across all possible price points, which can be beneficial for certain trading strategies or less volatile assets. Such dual AMM strategy gives traders and liquidity providers the flexibility to choose how they want to engage with the market based on their specific needs

Kodiak Islands

The Kodiak Islands feature automated liquidity management vaults designed to attract and retain liquidity from the average user. This component provides a “set-and-forget” approach to concentrated liquidity strategy vaults.

By liquid management automating the process, Kodiak Islands aims to encourage users to deposit their assets without requiring continuous oversight or management. This not only simplifies participation but also builds a more robust liquidity pool that benefits all participants.

Furthermore, the Island vaults allow liquidity providers to set their parameters and let the system manage their positions. As market conditions change, the vault can adjust its liquidity allocation to optimize returns, thereby enhancing the overall user experience.

Sweetened Islands

The Integrated Incentive Layer (Sweetened Islands) is a layer that leverages Berachain’s Proof-of-Liquidity (PoL) mechanism to sustainably incentivize liquidity provision within Kodiak Islands.

Unlike traditional incentive models that may require constant re-evaluation, Sweetened Islands aims to create long-term incentives for liquidity providers. By aligning rewards with PoL, Kodiak ensures that participants are motivated to maintain their liquidity over time.

The integration of an incentive layer not only boosts the liquidity available on the DEX but also encourages more users to participate actively in the ecosystem, fostering a vibrant community and marketplace

Panda Factory

No-Code Token Deployer Factory (Panda Factory) enables users to deploy new tokens and their initial liquidity seamlessly and without requiring technical expertise.

The Factroy allows creators to launch new tokens, including highly speculative assets like meme coins, quickly and efficiently. Users can provide initial liquidity on the Kodiak full-range AMM, making it easier for new projects to enter the market.

The ability to deploy new tokens in a permissionless manner helps accommodate assets with unpredictable price behaviours, being particularly useful for emerging projects that may not have established market characteristics.

Shogun

Shogun is a telegram trading bot designed to enhance trading efficiency across multiple blockchain networks, providing a unified experience for users and traders. Its primary goal is to address liquidity fragmentation, which occurs when users and assets are confined to specific Layer 1 chains (like Ethereum) or Layer 2 solutions.

Shogun was created to solve four main problems:

- Liquidity Fragmentation: Users often face challenges when trying to access liquidity across different chains, which can result in isolated assets and hinder trading opportunities.

- Transaction Delays: Bridging assets between chains can be time-consuming, with users waiting 20 to 30 minutes for transactions to process.

- Gas Token Limitations: Users might find themselves lacking the necessary gas tokens when attempting to bridge to another chain.

- Trust Issues with New Systems: Many existing solutions lack decentralization and reliability, forcing users to place trust in systems that may not be fully trustworthy.

Although it is still early days for Shogun, its primary goal of allowing users to trade any token on any chain, instils an expectation of the fragmented blockchain world being united, hence granting Shogun a place on the crypto enthusiast watchlist.

Conclusion

This review of the Berachain ecosystem highlights its innovative approach to DeFi, showcasing a unique blend of utility, community engagement, and technological advancements. Berachain supports a diverse array of projects, from games like BeraTone, which offers immersive life-simulation and role-playing experiences, to finance-focused protocols such as Gummi.fi and Infrared.finance, which enhance liquidity and staking functionalities. Other projects, including Kodiak and Shogun, address key issues in DeFi, like liquidity fragmentation and transaction efficiency across blockchains. Through its spotlight projects, Berachain exemplifies a well-rounded ecosystem aimed at fostering a vibrant, interactive, and financially inclusive DeFi landscape, reinforced by its commitment to environmental responsibility and accessibility.

(Terms & Conditions Apply)

About Simply Staking

We are a Blockchain Services Provider who operates Validators and Nodes on over 30 Networks with over $1 Billion in Assets Staked. Our journey started in 2018, with Simply entering the Cosmos Hub Testnets, and now have expanded our operations to most major ecosystems including networks such as LIDO, Polygon, EigenLayer, Oasis Network, Cosmos Hub, Polkadot, and many more, all while being an Oracle Operator on Chainlink.

We offer additional services such as Nodes-As-A-Service (RPCs), Blockchain Development work, Tooling, Governance Services as well as Blockchain Consultancy Services.

More Information on our offerings can be found on our website.

Disclaimer: This article contains affiliate links. If you click on these links and make a purchase, we may receive a small commission at no additional cost to you. These commissions help support our work and allow us to continue providing valuable content. Thank you for your support!

Terms & Conditions apply on all partnership offers.

This article is provided for informational purposes only and is not intended as investment advice. Investing in cryptocurrencies carries significant risks and is highly speculative. The opinions and analyses presented do not reflect the official stance of any company or entity. We strongly advise consulting with a qualified financial professional before making any investment decisions. The author and publisher assume no liability for any actions taken based on the content of this article. Always conduct your own due diligence before investing.